- RBA is expected to hold rates in December after hiking last month

- But will it signal future hikes or will it turn more cautious?

- After soft CPI, RBA’s decision on Tuesday, 3:30 GMT, poses a risk for the aussie

New governor has been beating the hawkish drum

The Australian economy has been gradually losing steam all year and GDP data due on December 6 is likely to show that growth slowed further in the third quarter. Rising borrowing costs for households and businesses, combined with the patchy recovery in China, were a major factor why former RBA Governor Philip Lowe was more comfortable to stand pat than his successor Michele Bullock.

Under Bullock’s leadership, which began in mid-September, there’s been a very notable hawkish tilt in RBA policy even though the economic data has been mixed. It’s fair to say that the recent uptick in the consumer price index as well as the acceleration in wage growth have been at the forefront of policymakers’ minds.

Is the surprise drop in CPI a game-changer?

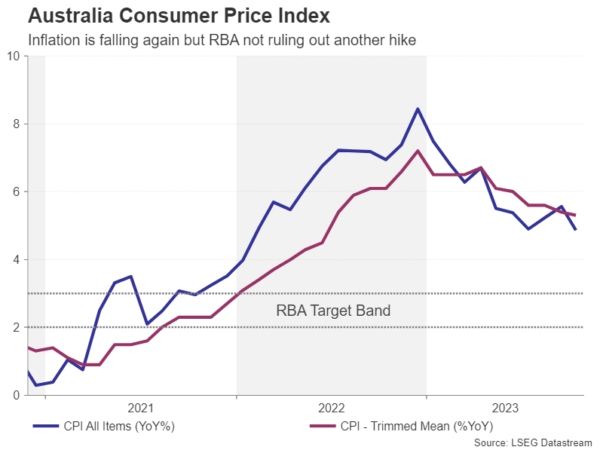

But inflation appears to be heading lower again. Monthly CPI edged down to 4.9% y/y in October after rising by 5.6% in September. The October picture isn’t entirely positive, however, as one of the core metrics – trimmed mean CPI – fell only modestly to 5.3%. In addition, the labour market remains very tight. The jobless rate has stayed below 4.0% since April 2022, while wages are rising at the fastest pace since 2009, hitting 4.0% y/y in the third quarter.

Until there is clearer evidence that inflation is resuming a downward course or that wage pressures are cooling, it’s unlikely that there will be much change in the language coming from the Reserve Bank of Australia on Tuesday. However, if the statement makes reference to the softer-than-anticipated CPI read, that would suggest an increased caution against further hikes.

Markets not fully convinced by RBA’s hawkish shift

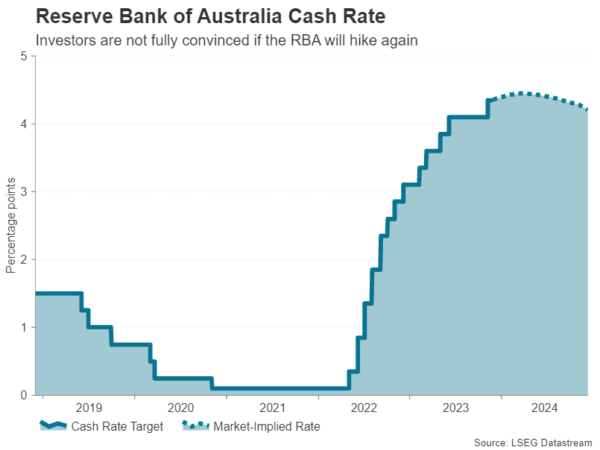

Investors see a less than 5% probability of a rate increase in December, which rises to around 40% by March. But that’s sharply lower than the more than 60% probability priced in before the latest CPI numbers came out.

When looking at Bullock’s comments more closely, however, another rate hike cannot be ruled out, even after the bigger-than-expected drop in CPI. Although higher rates have started to bite for consumers and it’s too soon for Australian exporters to turn optimistic again on China, the slowdown in the economy hasn’t been as bad as initially feared and there’s also the strong housing market to consider.

Yet, most investors seem to be betting on inflation falling further by the time the RBA next meets in February 2024 and unless CPI were to turn higher again, fresh hawkish remarks by Bullock will likely do little in boosting rate hike odds.

Aussie propped up by soft US dollar

For the Australian dollar, however, the CPI-induced losses didn’t last long as the US dollar is under even more pressure from a weakening inflation landscape. Traders think a dovish pivot by the Fed is just around the corner and that looks set to keep a lid on any gains for the greenback.

As things stand, the monetary policy divergence would still favour the aussie even if the RBA doesn’t have to raise rates again. The aussie has currently found support around the 38.2% Fibonacci retracement of the February-October downleg at just above the $0.6600 level. A renewed push upwards could see the 50% Fibonacci of 0.6713 being tested before making an attempt for the double top near $0.6900 from June and July.

But in the event that investors turn bearish on the aussie, the $0.6500 level will be a crucial support to watch before attention turns to the 50-day moving average at $0.6426.