- The OCR remained at 5.5% as Westpac and the market had expected.

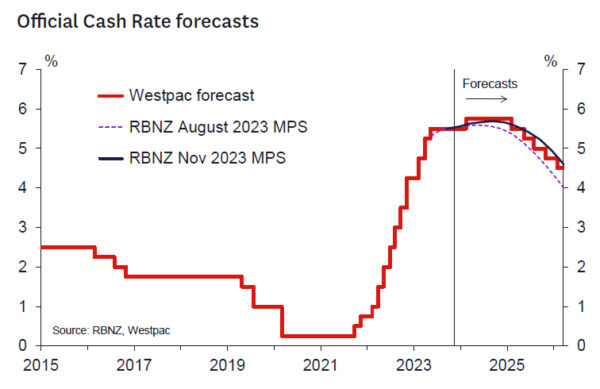

- The RBNZ’s projections for the OCR were revised 10bp higher to a peak of 5.69% in September 2024, implying around a 75% chance of a further 25bp rate hike. The projections imply a gradual easing of policy from the first half of 2025. The long-run neutral OCR was also adjusted up 25bp to 2.5%.

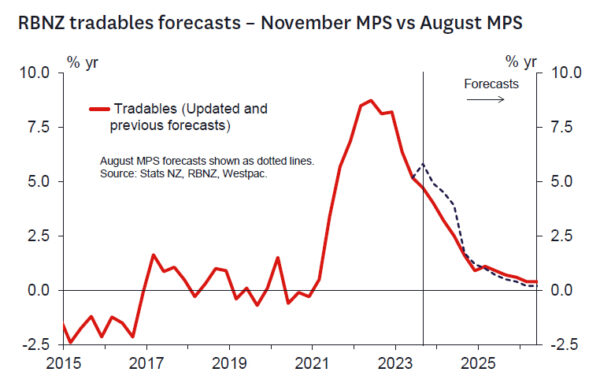

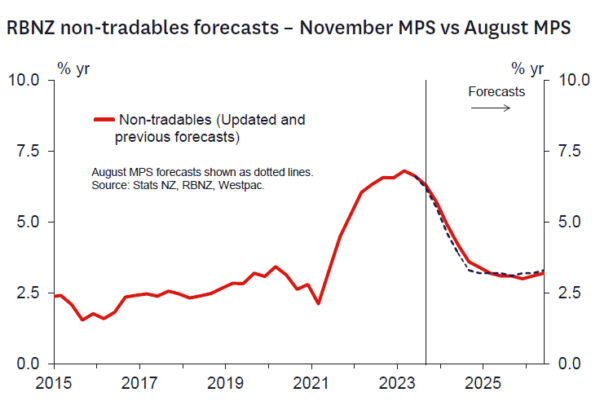

- The RBNZ’s short term CPI forecasts have been revised down slightly in the near term. However, the forecast for inflation from mid- 2024 is slightly higher despite the upwards revision to the projection for the OCR. That reflects a concern that migration driven population growth will add to demand and the housing market. CPI inflation still gets back inside the range in Q3 2024, but the RBNZ sees upside risks here.

- The RBNZ’s views of the inflation risks now align more closely with our own. We maintain our call for a 25bp hike in the OCR to 5.75% at the February 2024 Monetary Policy Statement.

As widely expected, the RBNZ left the OCR at 5.5% at its final policy review for this year. Of much greater interest to markets was what the Bank had to say about the outlook for the OCR next year and beyond.

The updated projections in the accompanying Monetary Policy Statement (MPS) contained significant revisions from those published back in August. A key change is that the RBNZ’s projections reflect a heightened risk that a further 25bp OCR hike will be required in 2024. The probability of a further 25bp hike in 2024 is now estimated at around 75% compared with 36% previously (the peak OCR increased to 5.69% from 5.59% previously). Thereafter, the RBNZ’s projections imply a modest easing cycle from mid-2025 – much later than implied by current market pricing. The RBNZ’s revised OCR track now closely resembles our own – albeit with the tightening coming around 6 months later.

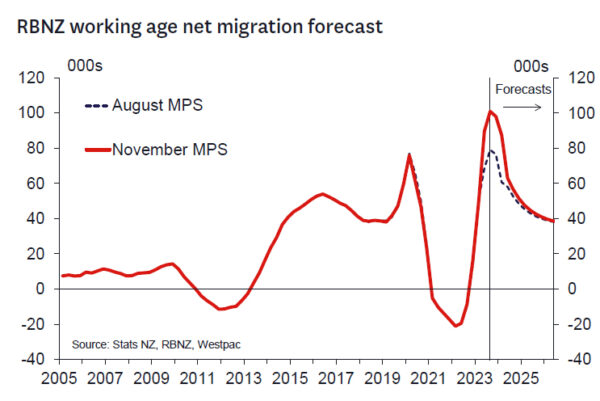

The key drivers of the more heightened perceptions of inflation risk stem from a reassessment of the mediumterm impact of very strong migration driven population growth. In addition, the RBNZ has become more cautious on the pace to which they expect core inflation pressures to moderate. That reassessment is reflected in a stronger housing market (and rents) profile, stronger near-term growth, and lower unemployment forecasts and a higher profile for government investment in the infrastructure required to support a growing population.

The bottom line is an upwards revision to the RBNZ’s medium term inflation forecasts (from mid-2024 onwards and despite a lower short term inflation profile due to recent weaker than expected tradables inflation data) even with higher interest rates. On top of this, the RBNZ notes an asymmetric risk profile around medium-term inflation outcomes – with upside risks there.

The RBNZ seems more focused on ensuring that inflation hits the middle of the target range in the next 18 months to 2 years. Hence, given still persistent core inflation, strong population growth and an upwardly revised long-run neutral OCR (increased a further 25bp to 2.5%) the clear message is the balance of risks has shifted towards a need for further tightening. And certainly, there is reduced tolerance for upside surprises to inflation – which is also consistent with the new government’s objectives when the new Monetary Policy Committee Remit (and perhaps new RBNZ Act) is promulgated.

We retain our view that the OCR will be increased by 25bps at the February MPS.

The RBNZ’s message and core concerns now map more closely to our own. The relatively high probability of a hike in Q3 2024 indicates that all meetings from now should be considered “live”. The Governor noted, the RBNZ is now “willing” to act if needed. That said, there is still plenty of water to flow under the bridge ahead of that meeting and so it’s possible a hike in the OCR comes later than February (or not at all). The RBNZ MPC seems more focused on seeing inflation in the middle of the 1-3% target range and will not tolerate upside surprises. The RBNZ has not yet incorporated the new Remit or revised Act formally into their decision making and we should remember the composition of the MPC will change next year as two new members join the MPC. And these members will presumably reflect the desire of the Minister to see the RBNZ meeting the inflation target expeditiously.

Today’s commentary sends a clear steer to the market that policy easings are very unlikely for the foreseeable future. All else equal, if the market heeds this message and financial conditions firm somewhat or at least don’t significantly ease, then there might be a reduced likelihood of the RBNZ needing to lift the OCR further. Easings are going to need to be motivated by a much weaker run of data on future core inflation pressures, and housing market trends. Our recent analysis still seems very relevant here.

The other clear message is to the new Government: if delivered, the fiscal stance embodied in the forthcoming Pre-Election Economic and Fiscal Update (PREFU) forecasts would add inflation pressure (compared to the Budget forecasts). So, the Government will need to deliver a materially tighter fiscal policy stance in the forthcoming Half-Year Economic and Fiscal Update (HYEFU) if it wishes to help avert the need for a higher OCR.

What we will be watching.

As we look ahead to the RBNZ’s February meeting, we will be watching the following key data and events:

- The Q3 GDP report on 14 December. Regarding the data flow, ahead of next week’s key partial indicators, we currently think that the Q3 GDP report will reveal weaker growth than the 0.3% factored by the RBNZ, while revisions to historical data foreshadowed in the recently released annual national accounts point to a modest downward revision to the level of real GDP compared to that published previously.

- The Q4 labour market surveys on 7 February. The RBNZ seemed to take little comfort from the slightly weaker than expected Q3 labour market outcomes. Our current forecasts for Q4 are not materially different to those of the RBNZ.

- The Q4 CPI report on 24 January and monthly updates ahead of that time. We currently think that both headline and non-tradables inflation will print slightly below the RBNZ’s updated forecast, but indicators over coming months could lead to a change in that view.

- Migration data and all housing-related data. Given the RBNZ’s obvious concern about the impact of migrant inflows on domestic demand, including via the housing market, we will be closely monitoring both the size of future inflows (relative to RBNZ forecasts) and how they are impacting housing turnover, house prices and dwelling rentals over coming months.

- The HYEFU. When it compiles its next forecast update in February, the RBNZ will factor the new Government’s fiscal stance, at least to the extent that this is built into the projection in the HYEFU. Therefore, we will be very interested in updated estimates of the “fiscal impulse” from the government’s activities, and any other analysis of the economic impact of the new Government’s policies.

The detail.

The RBNZ’s economic projections.

The RBNZ has revised up its forecasts for GDP growth. A big part of the reason for that is the strength of net migration, which has risen much higher than the RBNZ had expected. That’s offsetting a weak outlook for percapita spending and means that the RBNZ no longer expects a recession. Strong migration is adding to the outlook for demand and is also expected to provide a boost to the housing market (including rents). Migration also adds to the economy’s productive capacity, but at least in the near term the RBNZ expects that the boost to domestic demand – and inflation – will be the bigger impact on economic conditions.

The RBNZ has revised down the near-term outlook for inflation. That’s due to imported inflation (aka. tradables) which has been weaker than the RBNZ and other forecasters expected, including ourselves. However, even with that change, the RBNZ is still concerned about the upside risks for inflation more generally. In fact, the RBNZ’s forecasts for inflation from mid-2024 have been revised slightly higher. That’s despite an upward revision to the path for the OCR. Underpinning that higher outlook for the CPI, domestic inflation (aka non-tradables) has remained elevated. That’s very important for the RBNZ as domestic inflation should have a strong relationship with monetary policy, but in most cases, we haven’t seen inflation on this front easing two years after the RBNZ first hiked the OCR. In part, the RBNZ has ascribed this resilience in domestic price pressures to the strength in migration, which is adding to demand and the prices for services like housing rent. Both net migration and nontradables inflation will be important areas to watch ahead of the RBNZ’s upcoming policy meetings.

Reflecting the stronger picture for domestic demand, and a forecast of a slightly less negative “output gap” than projected in August, the RBNZ also forecasts slight less deterioration in the labour market. The unemployment rate is now forecast to peak at 5.2% in Q2 2025, rather than the previous forecast of a peak of 5.3% in Q4 2024. Curiously, despite that revision, the RBNZ is now slightly more optimistic regarding a slowing in wage growth, with the private sector Labour Cost Index now expected to rise 3.5% in 2024 and 3.4% in 2025 – down from 3.8% per year in the August projection.

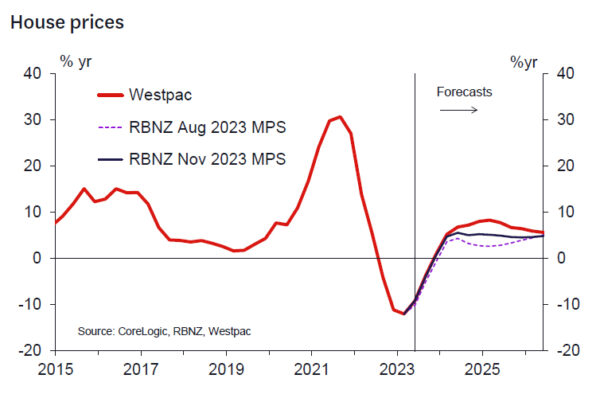

A notable adjustment to the RBNZ’s projections was in their forward view of house prices which were revised up and are now closer to our own projections. The RBNZ now sees house price growth next year around 5% (our forecast is 8%). This adjustment principally reflects a changed assessment of the impact of historically strong migration induced population growth on the housing market and with the 12-month lag typically seen historically. We still see upside risks to the RBNZ’s projections and will learn more in the next few months as the peak housing activity period is upon us. It’s interesting that the RBNZ has made this adjustment now given the October Monetary Policy Review discussion suggested the RBNZ was not ready to reassess its housing market view until later in the summer. This perhaps suggests an elevated level of concern on the risks coming to medium term inflation from this area.

The MPS noted that the policies of the newly formed Government were unknown at the time of publication, so the fiscal projections were based on the PREFU. On this basis, the RBNZ noted that government investment looks set to be stronger (in line with PREFU), adding to medium term demand concerns. However, we expect that ultimately the new government’s policies will be marginally more contractionary than assumed at PREFU. The HYEFU will hopefully provide more detail on the magnitude of any fiscal contraction as well as the nature of the proposed policies. The HYEFU is due ahead of Christmas and is likely to be a key focus for markets.