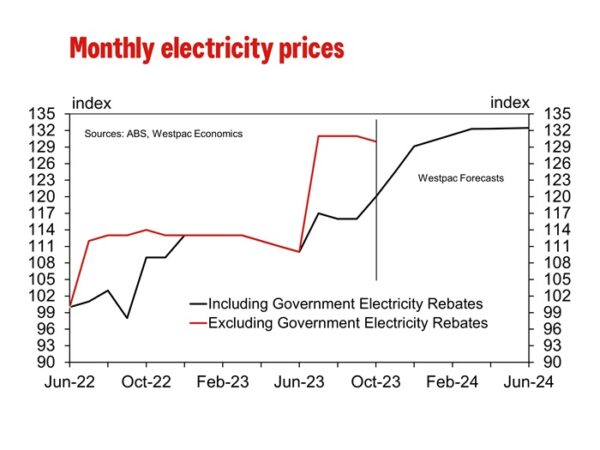

Government policies are holding down inflation but electricity prices are starting to rise as rebates come to an end.

The Monthly CPI Indicator rose 4.9% in the year to October, down from 5.6%yr in September and the recent peak of 8.4%yr at December 2022. This was meaningfully less than Westpac’s forecast of 5.3%yr, and the market median forecast of 5.2%yr.

As we noted in the preview, the first month of the quarter is heavy with the quarterly surveys of many household durable goods and given the global deflation in durable goods, we had been expecting a softer monthly print.

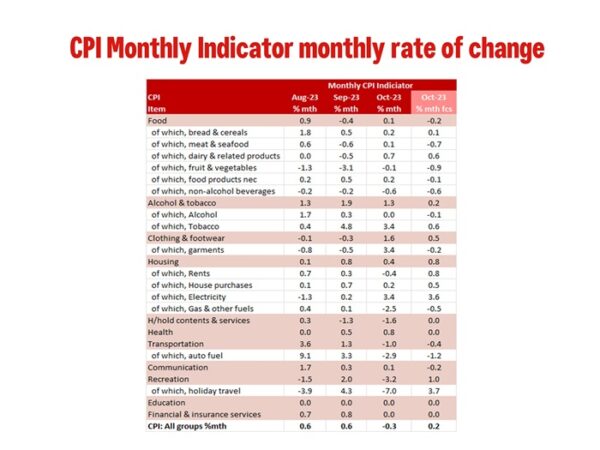

In the month, the CPI was down –0.3% compared to our forecast of 0.2%. Household contents were softer than expected (–1.6% vs flat forecast) but garments were stronger (+3.4% vs –0.2% forecast). The real surprise was the fall in rents (–0.4% vs +0.8% forecast), softer dwelling purchase prices (+0.2% vs +0.5% forecast) and a larger than expected fall in gas prices (–2.5% vs –0.5% forecast). Electricity prices rose as expected. Also of note was a large fall in holiday travel (–7.0% vs +3.7% forecast).

On the stronger side was food (0.1% vs –0.2% forecast), alcohol & tobacco (+1.3% vs +0.2% forecast) and as noted above clothing and footwear. It would be tempting to blame the softer-than-expected headline result on greater goods deflation, but goods were only down –0.1% in the month while services fell –0.7%. Note that the services that are surveyed monthly includes rents (–0.4%) and holiday travel (–7.0%).

The fall in rents was due to the impact of changes to Commonwealth Rent Assistance. From 20 September, the maximum rate available for rent assistance increased by 15% and as it was applied in late September, only part of the assistance was used in September and the remainder was used in October. The ABS noted that excluding the changes to rent assistance, rents would have risen 0.7% in October for an annual pace of 8.3%yr. Taking the difference between 8.3%yr and the 6.6%yr CPI estimate, and subtracting the non-assistance rent increase from the published increase in October (+0.7% vs. –0.4%) we estimate that non-assisted rents rose 0.9% in September, matching the 0.9% increase in June which was the largest monthly increase in monthly rental series.

Without the increase in the assistance from June to October, the monthly increases would have been 0.9%, 0.7%, 0.7%, 0.9% and 0.7% – no sign of a moderation from a monthly average increase of around 0.8%.

This increase in rental assistance shaved 0.07ppt off the Monthly CPI in October and 0.10ppt through September and October.

We are now starting to see the unwinding of the effect of the energy rebates. Energy Bill Relief Fund rebates introduced from July 2023 reduced electricity bills for concession households in Sydney, Melbourne, Adelaide, Hobart, Darwin and Canberra and for all households in Brisbane and Perth. From October 2023, newly eligible households received Energy Bill Relief Fund rebates in Sydney, Adelaide, Hobart, Darwin and Canberra. For Melbourne, rebates for newly eligible households will be reflected from November 2023. But the ABS data makes it clear the overall impact of the rebates is fading. In October, electricity prices rose 3.4% in the Monthly CPI but the ABS reports that electricity prices before the rebates fell –0.8%. As you can see in the chart below, as the effect of rebates fades, the level of electricity prices reported in the CPI rise to match the price without rebates.

It is also worth noting that the Monthly Indicator Trimmed Mean printed 5.3%yr, down from 5.4%yr in September and well down from the recent peak of 7.2% in December 2022. The quarterly Trimmed Mean printed 5.2%yr in September and our current forecast for the December quarter is 4.4%yr.

We are updating the full data set to see what any implications there are for our December quarter forecast.