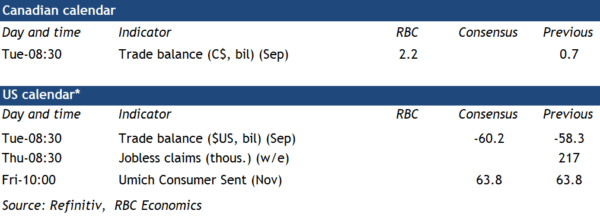

The week ahead will be a lighter one for data releases after signs of decelerating Canadian GDP growth, a higher unemployment rate in both the U.S. and Canada , and the U.S. Federal Reserve foregoing an interest rate hike for a second consecutive meeting in the week past.

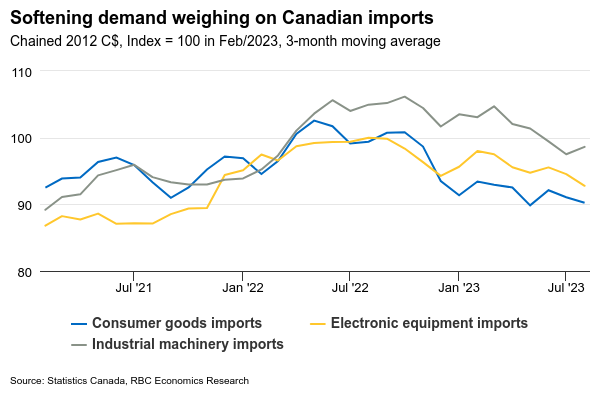

We expect Canada’s international goods trade surplus will widen with a 10% increase in oil prices boosting the value of net energy exports. Excluding price impacts, net trade is on track to add to GDP growth in Q3, but only as a result of an offsetting faltering in domestic demand. Lower imports of both consumer goods and equipment in the third quarter to-date are adding to signs that consumer spending and business investment are slowing. Canadian exports surged 5.7% in August, but largely due to a jump in gold shipments and higher oil prices. Excluding price impacts, exports of merchandise are tracking little changed in Q3 to-date.

As the economy loses steam, attention will also be on government finances with Quebec’s Economic and Fiscal Update set for release on November 7th. Canada’s provinces emerged from the pandemic in better fiscal positions than feared , thanks to rapidly rebounding economic growth. But provinces have yet to scale back expenditures even with pandemic support programs ended. Weaker economic growth, rising operating costs, and higher debt-servicing costs will continue to challenge provinces’ fiscal positions. Ontario’s Fall Economic Statement last week showed a larger $5.6 billion deficit for the current year, compared to the $1.3 billion deficit projected in the spring.

Week ahead data watch

The U.S. trade deficit is expected to widen to -$59.3 billion in September from $58.3 billion in August, driven by a $1.1 billion deterioration in the advance estimate of the goods trade balance. Merchandise exports jumped 2.9% in the advance estimate, led by higher food (+10%) and consumer goods (+7%) shipments. Merchandise imports rose 2.4% on broadly-based gains.