Summary

- As widely expected, the FOMC decided to keep rates on hold at today’s policy meeting. The decision to maintain the target range for the federal funds rate at its current level was unanimously supported by all 12 voting members of the Committee.

- The FOMC also maintained its current pace of quantitative tightening.

- The post-meeting statement continued to characterize inflation as “elevated.” Additionally, the Committee maintained that “additional policy firming” may be “appropriate.” In short, the FOMC is keeping open the door to hiking rates again if economic and financial developments warrant.

- This is the third time in the past four policy meetings that the FOMC has decided to maintain its target range for the federal funds rate at its current level rather than lift it further.

- It seems to us that the FOMC is now in “hold” mode, albeit in a hawkish way, rather than simply on “pause.” That is, we think the bar to further rate increases is higher now than it was a few months ago.

- We forecast that the FOMC will remain on hold through most of Q2-2024, which is more or less consistent with market pricing. But the stance of monetary policy, as measured by the real fed funds rate, likely will become more restrictive in coming months as inflation slowly recedes back toward target but as the FOMC keep the nominal fed funds rate on hold.

FOMC Moves to “Hawkish Hold

As universally expected, the Federal Open Market Committee (FOMC) unanimously decided today to keep its target range for the federal funds rate unchanged at 5.25%-5.50%. Additionally, the FOMC voted to maintain the current pace at which Treasury securities and mortgage-backed securities (MBS) are rolling off of the central bank’s balance sheet (i.e., quantitative tightening). The post-meeting statement acknowledged the strength in third quarter GDP growth—real GDP grew at an annualized pace of 4.9% in Q3 relative to the previous quarter— by noting that “economic activity expanded at a strong pace in the third quarter.” Yet it also gave a nod to some recent tightening in financial conditions. Otherwise, there were no material changes to the statement.

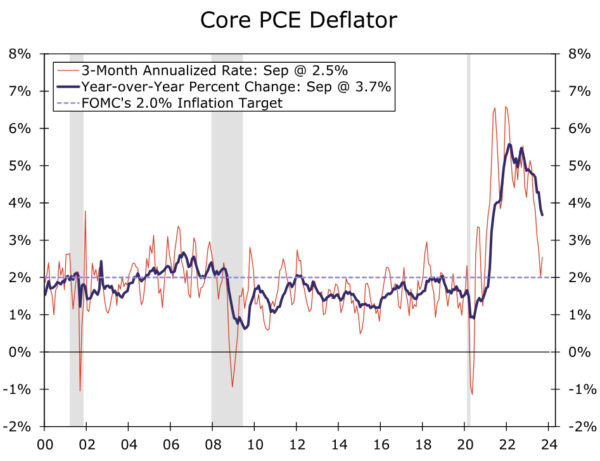

Notably, however, the FOMC continued to characterize inflation as “elevated.” Indeed, the year-over-year rate of core PCE inflation, which Fed officials believe is the best measure of the underlying rate of consumer price inflation, printed at 3.7% in September, although the annualized rate of change over the past three months was 2.5% (Figure 1). The Committee kept the door open to another hike by reiterating that it will monitor economic and financial developments when “determining the extent of additional policy firming that may be appropriate.” (The FOMC used this phrase in the past four statements.) This is the third time in the past four meetings that the Committee has decided to maintain its target range for the federal funds rate at its current level rather than lift it further. It seems to us that the FOMC is now in “hold” mode, albeit in a hawkish way, rather than simply on “pause.” That is, we think the bar to further rate increases is higher now than it was a few months ago.

Policy Will Become More Restrictive on a “Passive” Basis in Coming Months

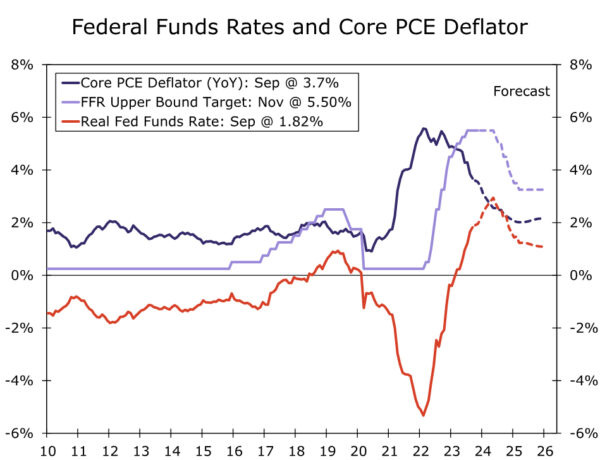

As shown in Figure 2, the real fed funds rate (i.e., the nominal rate of 5.50% less the year-over-year rate of core PCE inflation) is closing in on 2%, its highest level in more than a decade. In other words, the stance of monetary policy is more restrictive today than it has been for some time, even as the FOMC has held the fed funds rate target steady the past two meetings. Additionally, the effects of previous tightening is still feeding through the pipeline due to the inherent lags by which monetary policy tightening works, and the recent back-up in long-term interest rates will also exert headwinds on the economy.

There is no indication in today’s policy statement or in recent comments by Fed officials that the FOMC is about to cut rates. We forecast that the FOMC will remain on hold through most of Q2-2024, which is more or less consistent with market pricing. Consequently, the stance of monetary policy, as measured by the real fed funds rate, likely will become more restrictive in coming months as inflation slowly recedes back toward target while the FOMC keeps the nominal fed funds rate on hold. We think this “passive” tightening of monetary policy will lead to a period of economic weakness, if not outright contraction in real GDP, next year that will eventually induce the Committee to ease policy. As detailed in our most recent U.S. Economic Outlook, we then look for the FOMC to cut rates by 225 bps by early 2025, which is more than the market and Fed officials currently project.