- US employment growth expected to slow down in October

- Dollar retreats ahead of the event but outlook remains bright

- Nonfarm payrolls to be released at 12:30 GMT Friday

US outperforms

It’s been a strong year for the United States. Despite a sharp slowdown in manufacturing and sky-high interest rates limiting access to credit, the US economy accelerated over the summer, with GDP growth clocking in at an annualized pace of 4.9% in the third quarter.

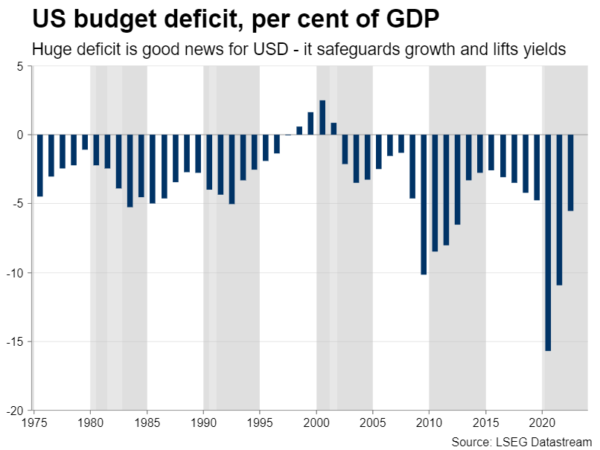

Heavy government spending has been the driving force behind this strength. The Biden administration is running an enormous budget deficit, which has shielded economic growth and helped prevent a recession.

But this gaping deficit has also propelled US borrowing costs higher. Yields on government bonds hit 5% in October, as the markets had difficulty absorbing all the debt supply that the Treasury unleashed to fund its spending spree.

Both developments have helped the dollar become a more attractive investment destination, as the US currently boasts the strongest growth among the major economies and offers the highest interest rates on its debt.

Employment growth set to cool

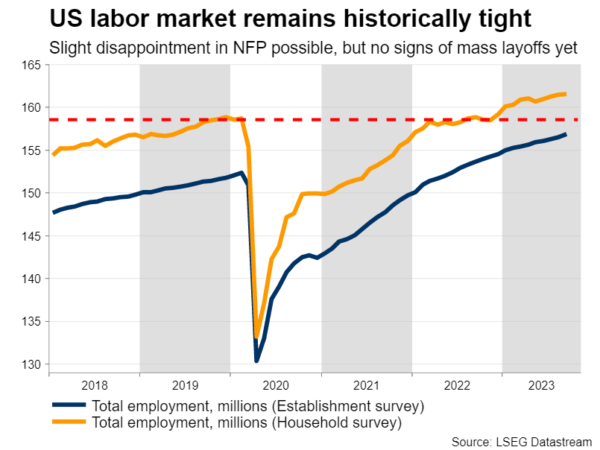

The upcoming jobs data will shed some light on the health of the labor market, which has remained exceptionally tight so far. Nonfarm payrolls are projected to have risen by 170k in October, nearly half the 336k recorded last month, but still a solid number overall.

Meanwhile, the unemployment rate is expected unchanged at 3.8%, while wage growth is seen slowing down in annual terms, falling to 4.0% from 4.2% previously.

As for any surprises, most early indicators point towards a slight disappointment in this employment report. Business surveys from S&P Global showed that the rate of employment growth slowed sharply in October.

Similarly, the strikes at car manufacturing plants will subtract around 25k – 30k from payrolls growth, because workers who did not receive a salary during the period when the jobs data were collected are treated as unemployed.

That said, there weren’t any signs of mass layoffs either in the US, as applications for unemployment benefits remained historically low in October. In other words, employment growth is gradually losing steam, but companies are not firing workers yet. It seems that the labor market has started to plateau.

Note that one of the most important early indicators of jobs growth, the ISM non-manufacturing survey, won’t be released until after the official employment data on Friday. Hence, investors have one less data point than usual to predict nonfarm payrolls with.

Can the dollar resume its rally?

An employment report that falls short of forecasts could inflict some damage on the dollar, but is unlikely to change the broader positive trend. Both growth fundamentals and interest rate differentials favor the US dollar at this stage, especially when compared with currencies such as the euro or the Japanese yen.

The euro has been haunted by recession concerns as growth in Europe has rolled over, the yen has been devastated by the Bank of Japan’s refusal to raise interest rates, while the instability in China could keep commodity-linked currencies under pressure.

Therefore, there’s no appealing alternative to the dollar at this stage. Bond investors can earn an annual return of almost 5% in the United States, which is the highest of the major economies once inflation is accounted for. With bond supply set to remain ample in the coming quarters and the economy looking solid, US yields could stay elevated, adding support to the dollar.

Looking at the charts, euro/dollar has been in a sustained decline since mid-July, and despite the latest bounce, the pair has been rejected twice from its 50-day moving average this month. In case of further losses, the 1.0520 zone could come into play. On the other hand, buyers would need to pierce above the 50-day average at 1.0640 and then challenge 1.0690 to improve their chances for a trend reversal.