- Tokyo inflation details will be released on Thursday 23.30 GMT

- Market prepares for the next BoJ gathering as geopolitics affect sentiment

- A strong set of data could offer some short-term respite to the yen

Market prepares for the next BoJ meeting

With only a few days left until the next Bank of Japan meeting, the market is trying to evaluate the impact of geopolitical developments. An escalation in the Middle East would most likely unsettle global markets and cause another rally in oil and gas prices, similar to the 2022 episode that fueled the elevated inflation rates.

To be fair, the BoJ might not strongly complain about another inflation surge, provided it does not hamper Japan’s growth outlook. This looks quite difficult to achieve considering the amount of oil imported annually and the associated cost. However, an inflation jump would most likely result in stronger wage increases going forward, like the ones agreed during the 2023 negotiation round; this is key for most BoJ members in order to finally support the gradual reduction of the current accommodation provided by the BoJ.

Rumours for another YCC tweak

There have been rumours lately that the BoJ is considering another tweak in its yield curve control (YCC) programme. The Japanese 10-year yield is trading around 0.85%, the highest level since the distant 2013, mostly due to the upside pressure from surging US yields. While there does not appear to be strong support for such a YCC change, a tweak announcement could be used as a signal that the BoJ is aiming for a tighter monetary policy stance.

Wages are critical but the Tokyo inflation release is coming up next

Until the 2024 wages discussion gets underway, the BoJ members will have to be content with the inflation reports and earnings prints. The latest figures for the latter, in the form of the labour cash earnings, have not been exciting so the burden falls on inflation data for some positive news for the BoJ. In this context, the Tokyo print for October will be pushed on Thursday evening (23.30 GMT).

Tokyo’s headline CPI has dipped below the 3% threshold over the past two months with the national headline figure mimicking this move. More importantly, the core CPI indicator – excluding food and energy – remains elevated, pleasing certain BoJ members. Looking ahead to Thursday’s release, a small pickup in inflation rates, on the back of higher oil prices feeding through the system over the past month, would make sense.

Yen at multi-year highs across the board

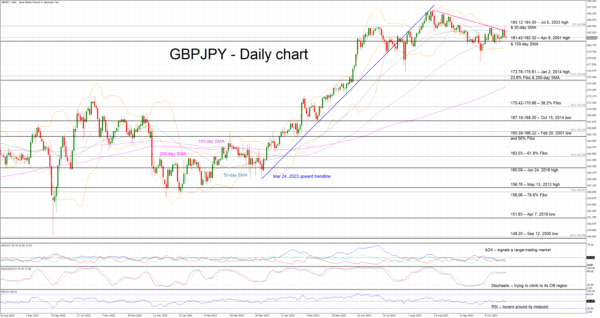

It has been a brutal year for yen bulls as the underperformance against the key global currencies has reached double digits. However, there have been some muted signs of life from the yen lately, for example the pound-yen pair. This is mostly the result of intervention threats, but the divergent rhetoric of the two respective central banks has probably been a factor as well.

Having said that, an upside surprise in Thursday’s data could result in a small downleg below the 181.42-182.32 area, but this move would most likely prove to be short-lived. On the flip side, a weak inflation report would cause a smaller market reaction higher as the intervention threat remains at large.