U.S. Highlights

- Treasury yields continued their steep ascent this week, amidst a heavy week for Fed speakers. FOMC members broadly agreed that positive progress had been made on inflation, although few were willing to take the prospect of further policy tightening off the table.

- Previous increases in mortgage rates weighed heavily on the housing market in September, although new home construction rebounded from its August decline.

- The consumer appeared undeterred by higher borrowing costs in September, with retail sales growth doubling expectations.

Canadian Highlights

- Canada’s inflation moved back in the right direction in the month of September, which should give the Bank of Canada confidence in holding the policy rate at 5.00% next week.

- Markets have largely removed bets for further interest rate hikes in coming meetings, previously expecting at least one more hike by early next year. We also expect the policy rate to remain on hold until the middle of next year.

- The Bank of Canada’s quarterly business and consumer surveys pointed to downbeat sentiment on the state of the economy, while higher interest rates have consumers pressing the spending brakes.

U.S. – Treasury Yields Flirt with Multidecade Highs

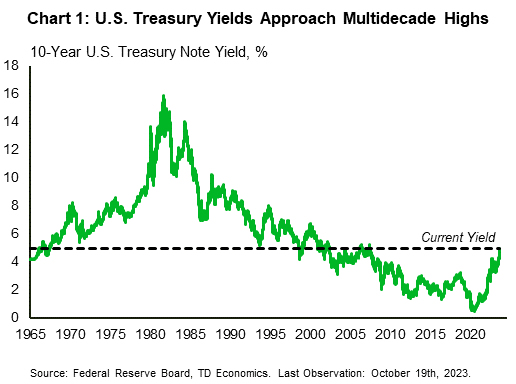

The steep ascent of U.S. Treasury yields continued unabated this week, as markets revised their expectations for yields, particularly over the longer term. The persistent political dysfunction in Congress amid rising deficits and heightened geopolitical tensions is likely playing a role in the increase in the term premium, which has recently contributed to the higher 10-Year yield. The term premium reflects the added compensation investors require for the unknowns associated with holding longer-term government debt. The 10-Year Treasury yield is now just under 5%, its highest level since before the Global Financial Crisis (Chart 1). Equities in turn fell this week, with the S&P 500 down 1.8% as of the time of writing.

Outside of financial markets, the real economy has seen divergent trends between economic sectors depending on their sensitivity to interest rates. The housing market softened further in September to reach a 13 year low, reflecting the strain of higher mortgage rates (see here). While existing home inventory levels improved on the month, supply remains low, which continued to place upward pressure on housing prices. Low resale listings have in turn increased the demand for new units, but elevated rates remain a headwind to homebuilding activity as well. While housing starts rose in September, they remain well below year-ago levels, primarily resulting from weakness in the more rate-sensitive multi-family segment.

Despite higher interest rates, the health of the American consumer has remained robust (see here). Retail sales growth in September more than doubled expectations. Somewhat surprisingly, the most rate-sensitive segment of retail sales (Automobile & other motor vehicle dealers) saw its strongest growth in four months. However pent-up demand from the extended shortage of vehicles in previous years continues to be a factor. But, even excluding the more volatile categories, the retaChart 2: The chart shows the market pricing implied probability for the federal funds rate in November and December, lining up with the FOMC meeting dates. Markets broadly expect the Fed to maintain interest rates at their current level into the end of 2023. Implied odds for the Fed holding in November are nearly 100%, while odds for a hold in December are slightly lower at 80% as of the time of publication.il sales “control group” was very strong on the month. All in all, the resilience of the consumer has been a key growth contributor in 2023.

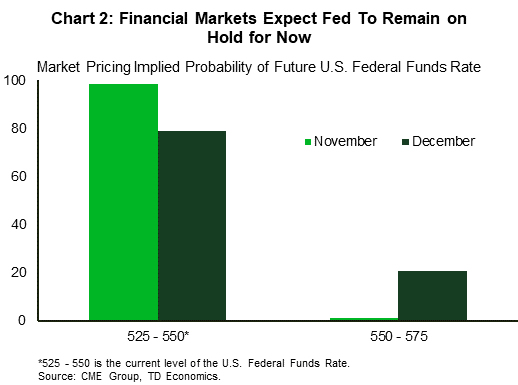

In terms of what this means for interest rate moves, we heard remarks from nearly every member of the FOMC this week, including Chair Powell. The balance of opinion was skewed towards maintaining a wait and see approach given the positive progress that has been made on inflation thus far, which pushed market pricing for a hold at the next meeting on November 1st to a virtual certainty (Chart 2). However, Powell also noted that additional evidence of persistently above trend growth or tightening labor market conditions could put inflation progress at risk and warrant further policy tightening. We currently expect that the resilience of the U.S. economy will lead to one last interest rate hike, but the recent tightening in financial conditions makes it a close call.

Next week we will see the advance estimate for third quarter GDP growth, which is expected to show eye-popping growth. Perhaps more importantly, the September consumer spending data will show how momentum is looking heading into the fourth quarter, along with the Fed’s preferred inflation metric. A moderation in both metrics would be welcome news for the Fed.

Canada – Inflation Deflates Bets for Interest Rate Hikes

The Bank of Canada’s (BoC) October 25th interest rate decision is right around the corner, and markets have increased the odds for a stand pat deicsion. September’s softer-than-expected inflation reading helped on that score, and likely gives Tiff Macklem & Co. some comfort to hold the policy rate at 5.00% next week. Next week’s decision will be accompanied by a fresh set of forecasts in the Monetary Policy Report (MPR), which will be closely watched for the Bank’s assesssment of how their recent rate hikes are affecting the economy. Canadian yields were taken on rollercoaster this week, with two-year yields finishing flat and the 10-year yield up around 12 basis points (bps). Although a lot of this week’s curve move was influenced more by strong economic data stateside than developments in Canada.

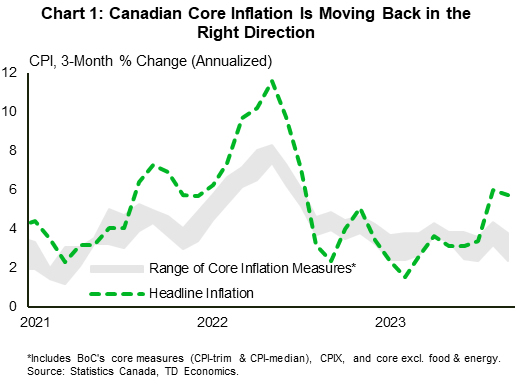

Canada’s inflation data moved in the right direction in September, coming in below consensus estimates. More importantly, the BoC’s preferred measures of core inflation also cooled. More encouragingly, the slowdown was also broad-based. Sticky inflation has been a thorn in the BoC’s side, and a large driver of the additional interest rate hikes delivered back in June and July. Chart 1 shows that the range of various core measures are back inside the 3.5–4.0% range from the first half of 2023, still too high, but moving in the right direction. Of note, food inflation decelerated the most of all major categories. The price of gasoline is still higher relative to a year ago, but did moderate on a month-on-month basis. Services inflation was flat on the month while core goods prices continue to cool. Base-effects alone could see headline inflation in October push down to just north of 3% y/y.

Consumer and business sentiment is another mark in the cooling column. The BoC’s companion business and consumer outlook surveys showed weakening sentiment in the third quarter this year. Businesses expect sales to slow over the coming year, which is weighing on plans for investment and employment. Inflation expectations amongst businesses and consumers alike have edged down but remain at elevated levels. On wage expectations, businesses report wage pressures have peaked but remain high. However, consumers’ wage expectations are at the highest point since the inception of the survey. From the BoC’s perspective, there is evidence in these surveys to suggest that economic conditions are cooling, which should help them achieve their inflation target.

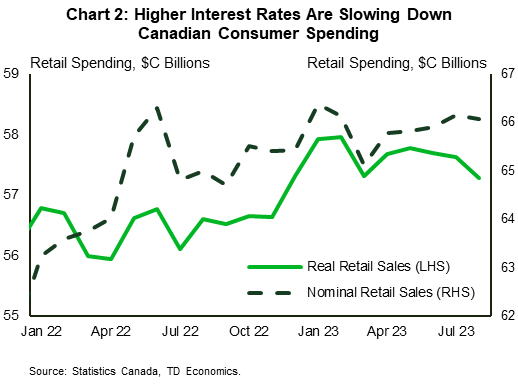

The hard data is bearing this out, as spending fatigue looks to be setting in for Canadian consumers. August retail sales dropped by 0.1% m/m, with volumes dropping by a larger magnitude (Chart 2). Declines were broad-based across industries. Given weak goods prices in September and early estimates of flat nominal spending, September sales volumes might register positive. That said, third quarter real spending is set to slow, with the outlook for the consumer weakening in coming quarters.