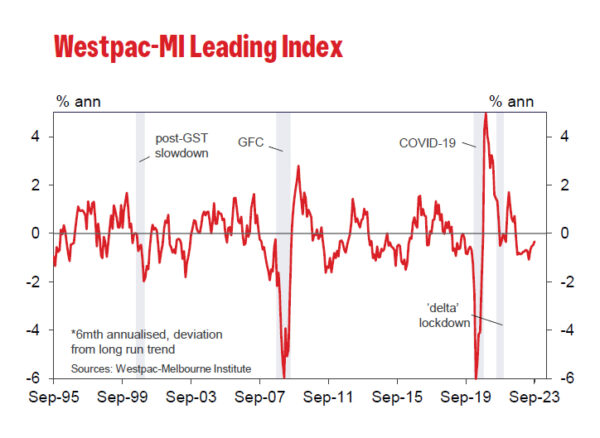

Australia’s economic outlook remains subdued as indicated by the Westpac Leading Index, which, though it rose slightly from -0.48% to -0.34% in September, continues to signal prolonged weak conditions. Fourteen successive months of subzero readings on the headline index growth rate project that the anaemic sub-trend growth momentum is anticipated to linger into 2024.

Westpac anticipates the nation’s GDP growth to decelerate to 1.2% in 2023, maintaining this tepid pace into the initial half of 2024, with an annualized growth rate pegged at 1.1%. This projection is notably beneath the expected population growth, which is projected to hover around 2.3%.

The recent minutes from RBA’s October meeting shed light on the central bank’s discomfort with the current inflationary environment, revealing its “low tolerance” towards unexpected inflationary spikes.

As the market casts its gaze towards the upcoming RBA meeting slated for November 7, Westpac anticipates revisions in the near-term forecasts for headline inflation. However, adjustments to the central bank’s medium-term view, a critical determinant for any further rate hike, are not expected.

However, this anticipation hinges significantly on the unveiling of the September quarter CPI, scheduled for release on October 25. Any significant surprises in this data could recalibrate expectations and potentially prompt the RBA to rethink its stance.