Key Highlights

- Gold price struggled to settle above $1300 against the US Dollar and moved down.

- There is a major bullish trend line forming with support at $1270 on the daily chart of XAU/USD.

- The US Manufacturing PMI in Oct 2017 (Prelim) posted a rise from the last reading of 53.1 to 54.5.

- Today, the US New Home Sales for Sep 2017 will be released, which is forecasted to decrease by 0.9% (MoM).

Gold Price Technical Analysis

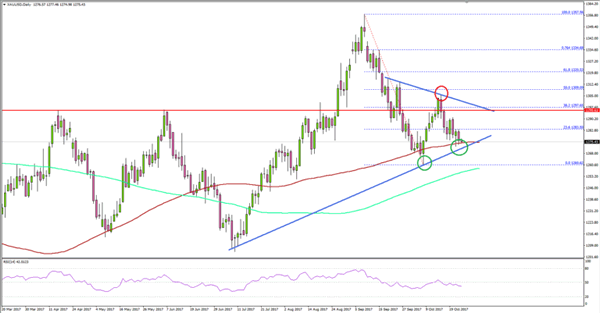

This week was mostly bearish for Gold price below $1290 against the US Dollar. The price is currently struggling and trading near a major support area at $1275-70.

Looking at the daily chart of XAU/USD, there is a major bullish trend line forming with support at $1270. The trend line support is also close to the 100-day simple moving average (red) at $1272.

Therefore, the $1272-70 support area holds a lot of importance. A close below $1270 might ignite more losses towards the $1255 level and the 200-day simple moving average (green).

On the upside, there is a connecting bearish trend line on the same chart with resistance at $1295. As long as the price is below the $1295-1300 levels, it remains at risk of a downside break.

US Manufacturing PMI

Recently in the US, the preliminary Manufacturing Purchasing Managers Index (PMI) for Oct 2017 was released by the Markit Economics. The forecast was lined up for a rise from the last reading of 53.1 to 53.5.

The actual result was above the forecast as there was a rise in the PMI to 54.5. The Services PMI is also expected to post an increase from 55.3 to 55.9 in Oct 2017, whereas the market was looking for 53.5.

Commenting on the report, the Associate Director at HIS, Tim Moore, stated:

The US economy seems to have made a strong start to the final quarter of 2017. Resilient service sector growth and an encouraging rebound in manufacturing production combined to generate one of the sharpest rises in private sector output for two-and-a-half years during October.

Overall, the result was positive and increased bearish pressure on Gold below $1290, putting it at risk of more declines.

Economic Releases to Watch Today

UK GDP for Q3 2017 (Preliminary) (QoQ) – Forecast +0.3% versus +0.3% previous.

US New Home Sales for Sep 2017 (MoM) – Forecast -0.9% versus -3.4% previous.

US Durable Goods Orders for Sep 2017 – Forecast +1% versus +2% previous.

BoC Interest Rate Decision – Forecast 1%, versus 1% previous.