Market Picture

From above, Bitcoin was subjected to a sell-off on the rise to its 200-week average and 200-day average but received new buyers on a dip to its 50-day average last week. Now, all eyes are on the ability to develop gains on rallies above $28K. Bitcoin seems to be sandwiched between two important moving averages. Our eyes are now on its momentum near those curves, and we are closely watching the behaviour near $28K.

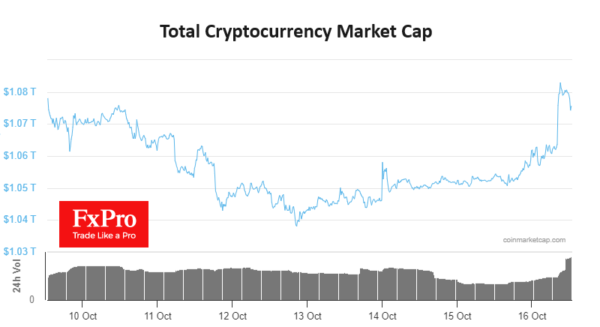

An additional bullish signal is that the crypto market’s volumes are growing along with the price, i.e., significant purchases are taking place. As a rule, such purchases confirmed by volumes can often be followed by a continuation of growth.

News background

The U.S. Securities and Exchange Commission (SEC) will not appeal the court ruling that found the SEC’s refusal to convert Grayscale Bitcoin Trust (GBTC) into a spot bitcoin-ETF unlawful. The appeals court ordered the SEC to reconsider its decision.

G20 countries agreed and approved a roadmap to regulate the crypto industry at the representatives meeting in Marrakesh, Marocco. The goal is to mitigate macroeconomic and financial stability risks associated with digital assets.

CFTC spokeswoman Christine Johnson criticised crypto broker Voyager Digital, which is going through bankruptcy proceedings, for making mistakes that led to the loss of billions of dollars in customer funds.

The New York Times reported that US-based Chinese mining companies have raised national security concerns, citing US government officials.

Italian sports car maker Ferrari has started accepting cryptocurrency payments from US customers and is ready to provide the same service to European customers.