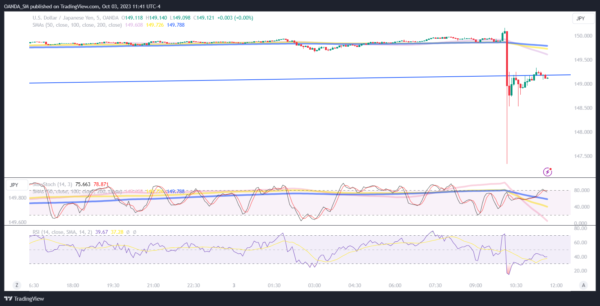

- USD/JPY fell 275 pips immediately after the JOLTS report sent price action above the 150 level

- Japan MOF Official: No comment on in Japan intervened with the yen

- JOLTS: August job openings rose from an upwardly revised 8.920 million to 9.610 million

The FX market was dealt a surprise after Japanese officials likely intervened after a hot JOLTS report sent dollar-yen above the 150 level. The other scenario, albeit unlikely, is that the dollar rally triggered a massive stop.

The two big levels that every FX trader had their eyes on were USD/JPY at 150 and 155. With NFP payrolls around the corner, some traders thought intervention would most likely wait until later in the week. The timing of this intervention will unlikely be confirmed in the NY session as it is very late in Tokyo.

The Ministry of Finance releases official intervention data at the end of the month, but we should not be surprised if they have a press event or if a key official comes out with a comment early in Asia. The Ministry of Finance will want to confirm the action and send a strong signal that they are not done with their intervention efforts.

USD/JPY Five-minute chart

USD/JPY pared losses after a Ministry of Finance official said no comment on whether Japan intervened.

Stocks

US stocks tumbled after Treasury yields surged after a hot JOLTS report signaled the labor market is not breaking. A cooling labor market was expected to emerge, but the August job openings data showed a large pickup with vacancies. Openings were strong in professional and business services, finance, insurance, education, and non-durables goods manufacturing. Unless, the NFP report comes in lower than expected, Wall Street will likely start to fully price in at least one more Fed rate hike before the end of the year.

Oil

Crude prices are lower on global economic fears and as the dollar continues to rally given the surge in Treasury yields. Energy traders are still not ready to buy the dip as the oil market starts to lose some of its tightness. The latest headlines are supporting further softness for oil. Russia’s seaborne crude flows reached a 3-month high. Nigeria’s oil minister said they could produce 2 million barrels per day next quarter, which would be almost twice of what they did in July.

Today’s weakness however is somewhat minimal as press reports are suggesting that OPEC+ won’t change their policy at the committee’s meeting on Wednesday.

A likely Japanese currency intervention may have also put a top in place for the dollar, which is providing oil some support.

Gold

Gold prices have found some support after plunging to a 7-month low. Treasury yields are still rising so gold’s respect of the $1830 level could become major support. The rally in yields could continue but we should see some exhaustion as Wall Street awaits the NFP report and ahead of a long weekend.