Summary

Manufacturing activity contracted at the slowest pace in nearly a year according to the September ISM. Recent data signal some relief in the sector, while higher oil prices point to potential upside risk ahead.

Some Reprieve in Manufacturing

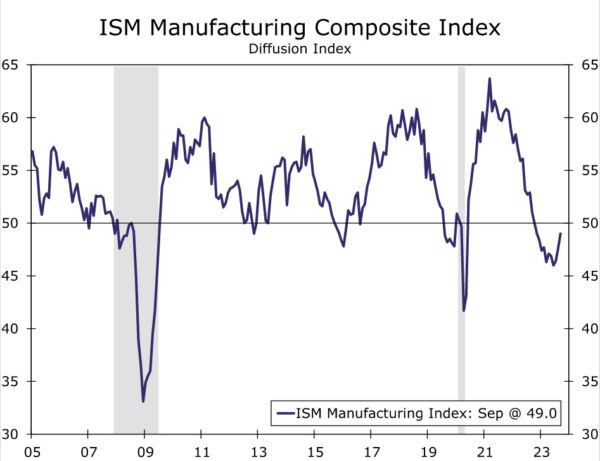

The recent read on the manufacturing sector is that activity is seeing somewhat of a reprieve though it remains weak. This is the message from today’s ISM. The overall manufacturing index rose for the third straight month, but at 49.0 in September still signals activity is contracting—even if it’s at a slower pace (chart). That said, even though 50 marks the traditional threshold for economic expansion, for manufacturing any reading above 48.7 is typically associated with expansion.

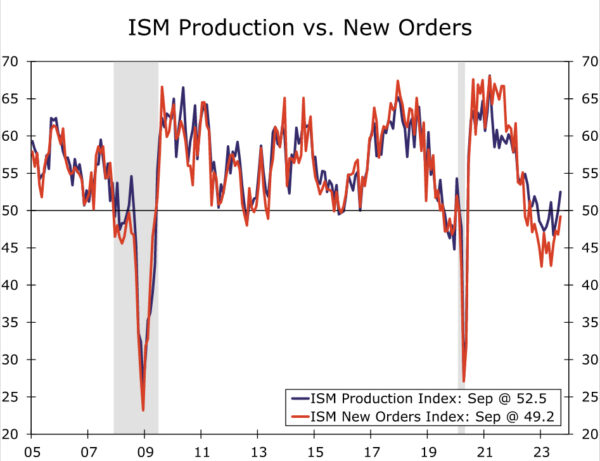

Most of the underlying measures moved in the right direction. Production and new orders pushed higher, with current production in expansion territory (52.5) for the second consecutive month (chart). New orders remained in contraction, but at 49.2 the index reached the highest in just over a year. Manufacturers also expanded head count last month. The employment index rose to 51.2 in September after contracting for three months. While labor prospects look to have improved last month, the release noted continued slowdown. Specifically the release referenced, “In September, attrition remained the primary source of head-count reductions, but hiring freezes were more prevalent”. When the full Employment Situation report is released on Friday, we expect to see a continued slowdown in hiring. Order backlog slipped further into contraction and prices paid fell by the most of any component, dropping 4.6 points to 43.8.

The Undeniable Impact of Oil Prices

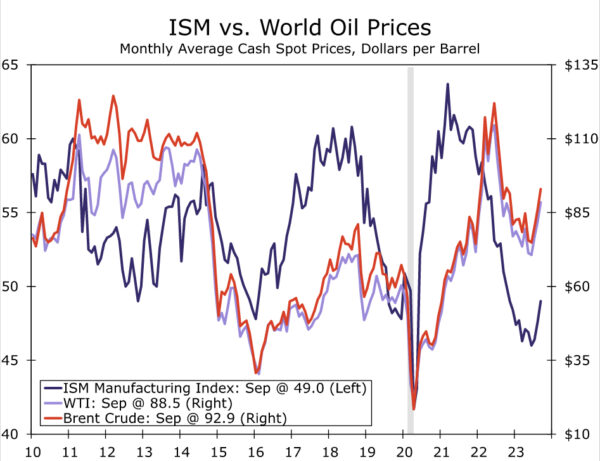

Last month we highlighted the gap between the Manufacturing and the Services ISM. One of the main factors that can contribute to a divergence between these measures is the price of a barrel of oil (chart). There was a period in the midst of the prior expansion that highlighted this relationship. Between 2014 and 2016, oil prices went through a slow-motion collapse going from north of $100/barrel in the summer of 2014 to a low of about $26/barrel in February 2016. In the same period, the ISM manufacturing index went from readings of north of 55 in the summer of 2014 to a mid-cycle low of 47.6 in January 2016.

High oil prices may present headwinds for some parts of the economy and not every manufacturer celebrates higher prices for crude, but on balance high oil prices are associated with brisk activity in manufacturing. Of the larger industries covered in the ISM, only two were in expansion in September: food, beverage & tobacco products and petroleum & coal products. Yet, higher oil prices tend to bring increased investment and activity to places beyond the petroleum industry. Activity in the energy business requires pipes, machinery and metal products, and when we look at the industries that reported order growth in September, the fingerprints of these industries were all over place: miscellaneous manufacturing, primary metals, fabricated metal products and nonmetallic mineral products all reported a growing order book in September