The EUR (€1.1764) continues to be trading somewhat unaffected by political uncertainty in Catalonia. Instead, all investor eyes are on the prospect of the European Central Bank (ECB) announcing plans to scale back its bond-buying program on Thursday.

The negative effect of events in Spain are muted, despite the rising tensions ahead of the potential vote in Senate on Friday on constitutional powers such as removing Catalan President Puigdemont.

The EUR’s downside remains shallow ahead of the ECB meet. Central bank officials are expected to outline their asset purchase reduction plan. Market guesstimates expect the ECB to begin to taper its current €60B monthly asset purchases in January 2018 with consecutive €10B monthly reductions. This means the ECB would cease balance sheet expansion by the end of Q2 2018.

Elsewhere, investors are waiting for more news on the Fed leadership succession and the U.S budget.

This week will also see rate decisions from the Bank of Canada (Wednesday 10 am EDT), Norges Bank and Riksbank (Oct 26).

1. Stocks mixed results

In Japan, the Nikkei share average extended its record-winning streak to 16-days overnight, supported by buying of large-cap stocks. The index, which was down part of the day, rose +0.5 %, while the broader Topix index rose +0.7%.

Down-under, Australia’s S&P ASX 200 benchmark ended fractionally higher, rallying +0.1%.

In Hong Kong, stocks fell amid signs of tighter liquidity. The Hang Seng index fell -0.5%, while the China Enterprises Index lost -0.7%.

In China, blue-chip stocks reached a 26-month high, led by infrastructure and property shares, as investors cheered robust earnings growth and felt comfortable with economic policy as the Communist Party’s congress concluded. The blue-chip CSI300 index rose +0.7%, while the Shanghai Composite Index added +0.2%.

In Europe, regional indices trade little changed in a lackluster session, despite stronger than expected manufacturing PMI’s readings out of Germany and France.

U.S stocks are set to open unchanged.

Indices: Stoxx600 -0.1% at 390.4, FTSE flat at 7521, DAX +0.2% at 13027, CAC-40 +0.2% at 5395, IBEX-35 +0.2% at 10184, FTSE MIB +0.4% at 22456, SMI -0.3% at 9222, S&P 500 Futures flat

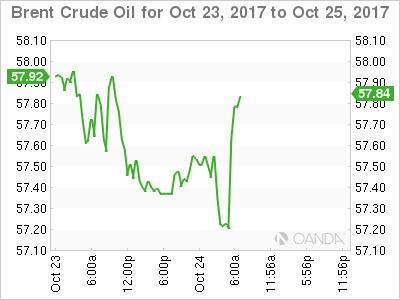

2. Oil prices inch up, support from drop in Iraq exports, gold unchanged

Oil prices have inched higher, finding support from a decline in oil exports from OPEC’s second-biggest producer Iraq and a projected extended fall in U.S commercial oil stocks.

Brent crude for December delivery is up +10c at +$57.47 a barrel, while U.S light crude (WTI) is up +6c at +$51.96.

Iraqi oil exports have fallen more than 200,000 barrels per day (bpd) so far this month, as shipments from both the north and the south of the country declined.

The drop in supplies comes as OPEC, Russia and other producers are cutting output by about -1.8m bpd until March 2018 in an effort to drain a glut and support prices.

Investors will take their cues from this week’s API and EIA industry data.

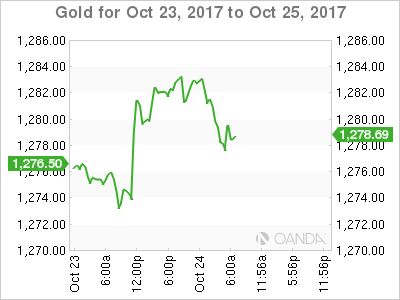

Gold is trading sideways ahead of the U.S open, with investors bracing for the possibility of an early announcement on the next U.S Fed Chief. Spot gold has slipped -0.1% to +$1,280.80 an ounce.

3. Yields – wait and see

The European Central Bank (ECB) meeting Thursday is giving investors a strong reason to sit back and wait. The absence of significant data to alter perceptions about the strength of the U.S economy and uncertainty about the details of President’s Trumps tax overhaul plan are also encouraging ‘little movement’ in the bond market.

Investors are also looking for clarity about whom President Donald Trump will nominate to lead the Federal Reserve. Potential nominees John Taylor, a Stanford economics professor, and Kevin Warsh, a former Fed governor, are seen by investors as likely to favour raising interest rates at a faster pace than the central bank has suggested it will take. While current Fed Chairwoman Janet Yellen and central bank Governor Jerome Powell are seen as more likely to maintain the status quo, in which the Fed projected three rate increases in 2018.

Note: President Trump has said he would like to name his pick before his Nov. 3 trip to Asia.

The yield on 10-year Treasuries have climbed +2 bps to +2.38%. In Germany, the 10-year Bund yield has advanced +2 bps to +0.45%, while in the U.K, 10-year Gilt yield has gained +1 bps to +1.321%.

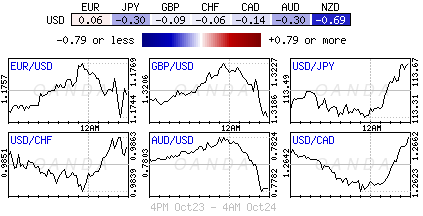

4. Dollar little changed

The FX markets remain subdued in quiet trading ahead of a plethora of central bank meetings this week. Even this morning’s various European PMI’s and confidence data (see below) failed to inspire any volatility.

The ECB would likely be keen to make sure its potential QE tapering announcement Thursday does not cause another market tantrum.

Note: In 2015 after the ECB announced QE, Bund yields rallied aggressively from +0% to almost +1% in just seven-weeks.

EUR/USD is a tad higher, trading just above €1.1765, the pound is at £1.3185, while yen is a tad weaker trading atop of ¥113.67.

Elsewhere, weighing on the NZD (N$0.6929) overnight was news that the new Labour/NZ First coalition government outlined some of its priorities, which include a higher minimum wage, review of the Reserve Bank of New Zealand’s (RBNZ) mandate and a ban on the purchase of existing homes by foreigners

5. Eurozone economy appear to slow

Data this morning indicates that the eurozone economy appears to have slowed slightly as it enters Q4 of what has been a strong year.

IHS Markit data this morning said its composite PMI for the eurozone fell to 55.9 in October from 56.7 in September.

Digging deeper, the decline was driven by services companies, which rely more heavily on domestic demand than their manufacturing counterparts.

On the plus side, the survey recorded the fastest growth in employment in over a decade, which keeps alive hopes that regional wages will accelerate and help generate the sustained pickup in inflation sought by the ECB.

Also, the measure of activity in the eurozone’s factories rallied to its highest level in six-and-a-half years, an indication that the EUR’s appreciation year-o-date has yet to weaken exports.