U.S. Highlights

- The Federal Reserve held rates unchanged at its September meeting, but updated projections showed that the median FOMC member expects rates to remain above 5% through 2024, reinforcing the higher for longer message.

- The economy is likely to feel some drag from the UAW strike, which announced additional action at 38 parts and distribution facilities across 20 states, as contract negotiations continue to progress slowly.

- The theme of “higher-for-longer” had pushed mortgage rates higher, which weighed on both homebuilding activity and existing home sales in August.

Canadian Highlights

- The economic data headline this week was a faster than expected acceleration in inflation in August. Markets are now positioned for another Bank of Canada (BoC) interest rate hike in the next six months.

- The BoC is at a crossroads as nascent signs of renewed inflation pressures collide with an economy that is losing its heat. We see enough bending in the Canadian economy to allow the BoC to hold the policy rate at 5.00% in October.

- Retail spending is one example of cooling demand. While sales rebounded modestly in July, they fell in real terms, a trend expected to continue into August. Overall, the consumer is showing signs of losing steam.

U.S. – Higher for Longer

Over the past eighteen months the Federal Reserve has raised interest rates eleven times, bringing the policy rate 5¼ percentage points (ppts) higher. On Wednesday, the FOMC opted to hold rates steady for the second time in the past three meetings, as it fine-tunes its approach to the level it deems sufficiently restrictive to return price stability to the economy. The Fed adopted the same policy decision it implemented in June – a hawkish pause if you will – indicating their expectation that one further rate hike is in the cards for 2023. In response, Treasury yields jumped to their highest level since 2007, with the ten-year yield rising by 12 basis points (bps) on the week to 4.4%, while equities fell with the S&P 500 down 2.3% as of the time of writing.

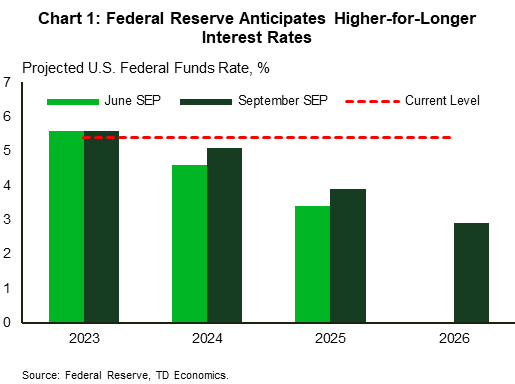

Accompanying the FOMC decision on Wednesday, the updated summary of economic projections (SEP) showed that the median FOMC member is projecting a de-facto soft landing for the U.S. economy. The median member expects the unemployment rate to rise only 0.3ppts by the end of next year. For reference, the U.S. unemployment rate just rose by 0.3ppts in August alone. The Fed’s expectation that inflation will be at 2.5% by the end of 2024 remained unchanged. However, the number of rate cuts for next year was pulled in, with the median FOMC member expecting the policy rate to be only 25bps below the current level at the end of 2024 – 50 basis points higher than in the June SEP (Chart 1). While these projections are decidedly hawkish, Chair Powell continued to emphasize that the Fed’s future decisions will depend on incoming data and its implications for the trajectory of inflation.

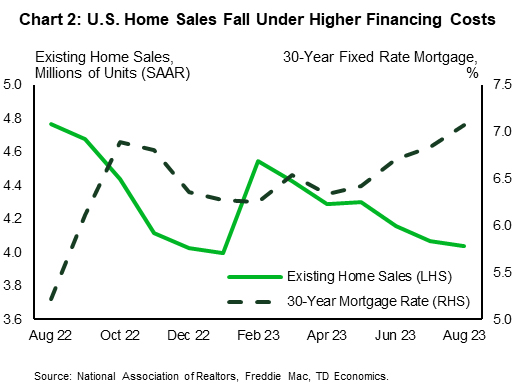

On that front, we saw in the housing data released this week that the interest rate sensitive sector continues to feel the strain of higher rates, as homebuilding activity faltered in August on slowing demand for new homes. With mortgage rates back above 7%, a similar curtailment of demand was seen in existing home sales in August, which declined for a third consecutive month (Chart 2). Price growth, however, has continued to push higher, as the highest mortgage rates in 22 years has left many would-be sellers locked-in to their lower rates, limiting resale supply. This dynamic is being monitored by the Fed but is unlikely to influence monetary policy discussions due to the lagged and proxied measurement of shelter costs in the CPI and PCE indexes.

Looking ahead, there is no shortage of upcoming events that will be on the Federal Reserve’s radar. This includes the UAW strike, which was extended to an additional 38 parts and distribution facilities this morning as negotiations continue to progress slowly. In the most recent round of strike action, the UAW has targeted General Motors and Stellantis, citing negotiation progress with Ford as the reason for the company’s exclusion. This is expected to create additional disruptions on top of the roughly 7.5% hit to U.S. production stemming from the first round of strike action. Also on the horizon is a looming shutdown of the federal government, with only a few days left before the October 1st deadline. Adding to the impacts expected from the end of the moratorium on student debt repayment, it is clear that the Federal Reserve’s data-dependency approach is set to become more challenging over the near-term.

Canada – Inflation Testing the Bank of Canada’s Hand

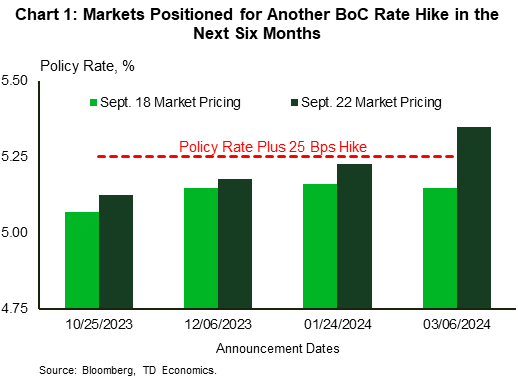

Summer may be coming to an end, but Canada’s inflation report just offered up some unwelcome heat. Headline CPI accelerated for a second straight month in August reaching 4.0% year-on-year (y/y). On top of that, core inflation measures increased, which surely rang some alarm bells at the Bank of Canada (BoC). Whether the inflation data is hot or just uncomfortably warm is up for debate, but markets have raised their bets for another interest rate hike down the road. Prior to Tuesday’s inflation release, markets were pricing a roughly 20% chance of another quarter-point hike at the October 25th policy meeting. Those odds swiftly increased to 50% post-data, with a full quarter-point hike fully priced by the first quarter of next year (Chart 1). As interest rate expectations rise, the 5-year Government of Canada yield rose to 4.25%, its highest level in 16 years.

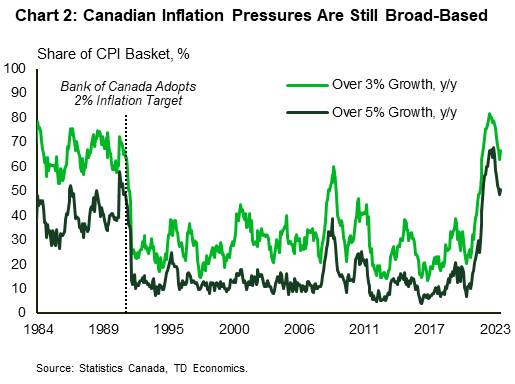

Soaring energy prices over the month of August were expected to drive an increase to headline inflation. But it was more than this, as shelter costs accelerated for both renters and homeowners facing higher mortgage payments. There was finally some relief on food prices, which fell for the first time in two years, but still sport the highest year-on-year increase across major CPI categories. On core readings, the average of the BoC’s CPI-Trim and CPI-Median measures has moved back to 4.0%, the highest reading since April this year. Any way you slice it, inflation pressures remain broad-based. As shown in Chart 2, the share of components in the CPI basket running at higher than 3% and 5% y/y are considerably higher than pre-pandemic levels, and the highest since the pre-inflation targeting days of the BoC.

The BoC faces a difficult road ahead, as nascent signs of renewed inflation pressures collide with an economy that is losing its heat. Our base case is for the BoC to keep the overnight rate on hold at 5.00% next meeting. However, the BoC will need to see evidence of further slowing in upcoming data to feel comfortable staying on the sidelines. The first such data point was today’s pulse check on the consumer. Retail sales for July (+0.3% m/m) came in a touch weaker than Statistics Canada’s advance estimate, and broadly in line with our own internal spending data which pointed to a rebound. However, controlling for price effects, retail spending edged down, with further deceleration expected in August. This aligns with our view that the resiliency of the consumer is beginning to fade and will continue to do so into next year.

We see enough bending in the Canadian economy to support a cooling in inflation pressures ahead, with enough time to allow the lagged impacts of monetary policy to continue working through the system. The Bank does have over a month to see how the data unfolds before it’s next announcement in late October. The data to watch the most closely include another inflation report, plus data on jobs and wages and the BoC’s surveys of consumers and businesses including measures of inflation expectations. Stay tuned.