- We expect the Bank of England (BoE) to hike the Bank Rate by 25bp on 21 September, although august inflation released the day before marks a joker.

- We expect a peak in the Bank Rate of 5.50%. We see current market pricing of a peak in the policy rate of 5.60% as broadly fair.

- EUR/GBP is set to end the day higher on dovish commentary.

BoE call. We expect the Bank of England (BoE) to hike the Bank Rate (key policy rate) by 25bp on 21 September, bringing it to 5.50%. We expect the vote split to be 8-1 favouring a 25bp hike over keeping the Bank Rate unchanged. Markets are currently pricing around 18bp for the meeting this week. Note, there will be no updated projections at this meeting nor a press conference following the announcement.

While forward guidance is likely to be limited, we expect the MPC to strike a dovish tone indicating that a peak in the Bank Rate is near if not already reached by Thursday. Likewise, we expect the MPC to repeat that “current monetary policy stance is restrictive” and that they “will ensure that Bank Rate is sufficiently restrictive for sufficiently long“. The final point has recently been reiterated by several MPC members, with prominently BoE’s chief economist Pill recently stating that he prefers a “table mountain” approach, where rates are held steady for longer.

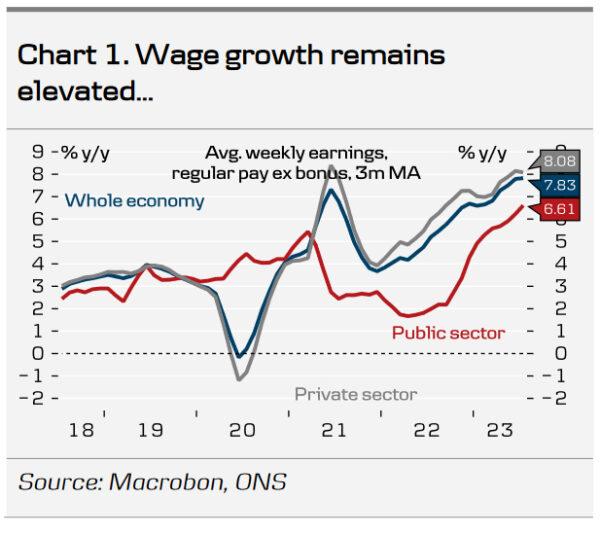

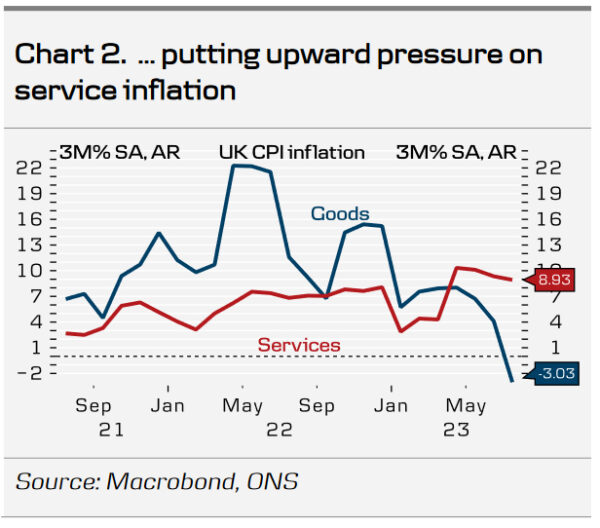

Since the last monetary policy decision in August, data releases have been mixed. The unemployment rate increased to 4.3% in July and unfilled vacancies continued to decline indicating some rising slack in the labour market. Likewise, the REC/KPMG report showed the steepest decline in permanent placements in over three years. PMIs for August surprised to the downside and pointed to growth weakening further in the months ahead with both composite and service indices falling below 50 at 48.6 and 49.5, respectively. That said, wage growth remains elevated with wage growth excl. bonuses at 7.8% 3M/YoY. Pay growth in the private sector slowed marginally suggesting a peak might be near. With wages being the largest input cost factor in the service sector and therefore highly determining for service inflation, the continued high wage growth favours another increase in the Bank Rate. Although inflation figures for August will not be published until the day before the rate announcement, the July figures exceeded expectations for both headline and core inflation with most notably service inflation reaccelerating (see chart 2).

We maintain our call that a 25bp hike at the upcoming meeting will mark the final hike of this hiking cycle and see the Bank Rate peaking at 5.50%. This is broadly in line with current market pricing. We expect no rate cuts until 2024. As pre-warned in the August monetary policy report the MPC will present a target for gilt stock reduction over the coming 12-month period.

FX. In our base case of a 25bp hike, we expect EUR/GBP to end the day higher on dovish commentary. We anticipate the statement to strike a dovish tone, noting that monetary policy is restrictive while reiterating the BoE’s data dependent approach. We expect the BoE to highlight that elevated wage growth and service inflation remain the upside risks. We continue to forecast EUR/GBP to move modestly higher the coming year to 0.88 on the UK economy performing relatively worse than the euro area.