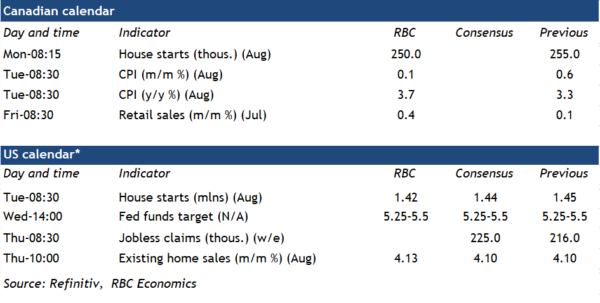

The U.S. Federal Reserve is widely expected to hold the Fed funds rate at the 5.25-5.5% range next week. U.S. economic growth data remains exceptionally strong with GDP growth tracking a 3%+ rate in Q3 and employment is rising solidly. Still, job openings and quit rates have continued to trend lower, suggesting labour demand is continuing to soften under the surface. Indeed, the unemployment rate ticked up to 3.8% in August. More important, interest rates are now at levels ‘restrictive’ enough to cool the economy and inflation pressures have moderated significantly. The Fed remains firmly focused on the data and won’t hesitate to lift the interest rate again if necessary (particularly if inflation shows signs of reaccelerating). But not next week.

The Bank of Canada is also watching inflation closely with August CPI data to be released next week. As in the U.S., higher energy prices will push headline price growth higher. We expect a 3.7% year-over-year rate in August, up from 3.3% in July. Grocery prices will remain high, but the pace of growth has been edging lower. And mortgage interest costs will continue to drive a disproportionate share of overall price growth (this accounted for over a quarter of total year-over-year price growth in July by our count.)

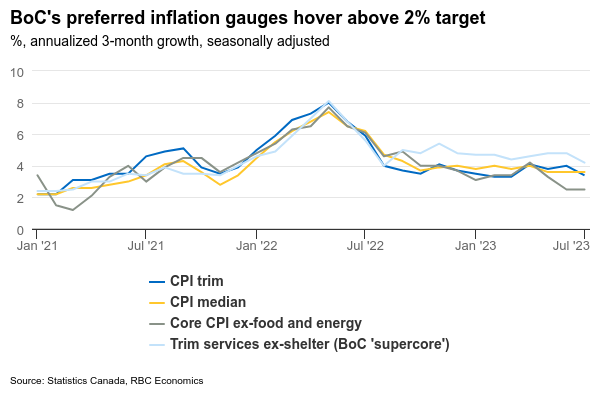

The BoC is more concerned about where price growth is going rather than where it’s been. And more recent broader measures of inflation pressure are a better indicator of that. The BoC’s preferred core measures may tick higher on a year-over-year basis due to soft year-ago ‘base-effects’ (the month-over-month increase in those measures a year ago was relatively small). But it’ll be more focused on the recent 3-month average growth rate for the ‘median’, ‘trim’, and trim services ex-shelter (sometimes called ‘super core’) measures. All of these are still ‘sticky’ at rates above the top-end of the BoC’s inflation target. But we continue to expect signs of softening in the economy to spill over into softer price growth over the remainder of the year—preventing additional BoC interest rate hikes.

Week ahead data watch

We expect July Canadian retail sales to show minimal change from the prior month, in line with Statistics Canada’s preliminary estimate of +0.4%. By our count, auto sales declined on a seasonally-adjusted basis in each of July and August, suggesting some downside risk to near-term retail sales.