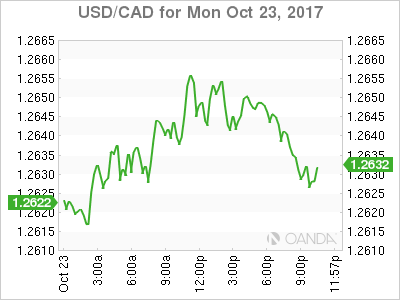

The Canadian dollar is softer on Monday after last week’s events boosted the USD against the loonie. Tax reform optimism and a message from the Trump administration that a Fed Chair candidate will be announced shortly put US yields higher. The three people short-list includes: Federal Reserve Governor Jerome Powell, economist John Taylor and current Fed Chair Janet Yellen

The Canadian economy is showing further signs of a slowdown from the impressive growth pace of the first half of the year. Wholesale sales were 0.5 percent. Last month the leading indicator of consumer spending had risen by 1.5 percent (revised today to 1.7 percent). The disappointing data echoed the retail sales data released on Friday which caused the CAD to break through the 1.25 price level.

The Bank of Canada (BoC) will announce its benchmark short term interest on Wednesday, October 25 at 10:00 am EDT. The central bank is anticipated to keep rates unchanged after an earlier unexpected rate hike in September that put the benchmark rate at 1.00 percent. A press conference by Governor Stephen Poloz will take place at 11:15 am EDT.

Meetings between Canada, Mexico and the United States continue as legislators from the three nations will meet in Mexico and Washington. JPMorgan is advising its clients to short Mexican stocks as the chances of a no deal scenario have increased. Mexico and the US were pushing initially for the renegotiation of the trade deal to be done before 2018 to avoid the political cycle ahead of Presidential elections in Mexico and the primaries in the US. The demands by the Trump administration have derailed that timeline and now the deal is in jeopardy as it appears the deal will be negotiated with a highly politicized background in 2018 making its future even more uncertain.

The USD/CAD rose 0.18 percent on Monday. The currency pair is trading at 1.2645 after the USD got an early boost against the loonie with the release of Canadian wholesale sales. Total sales at the wholesale level came in lower than expected at 0.5 percent putting more downside pressure to the Canadian currency as more signs of an economic slowdown accumulate.

On Friday retail sales fell –0.3%. Market expectations were looking for a strong +0.5% gain. The miss in retail sales was a big blow to the loonie. After the surprise rate hike in September by the Bank of Canada (BoC) and various calls for a GDP slowdown the currency is more sensitive to underperforming indicators.

Stronger headline numbers would have improved the odds of the Bank of Canada (BoC) raising rates before the end of 2017. Retail and wholesale sales data could take the BoC out of the rate hike equation for the time being. The BoC meet next Wednesday, October 25 at 10:00 am EDT.

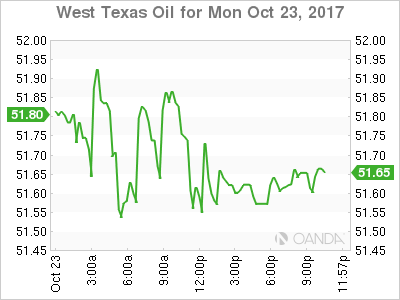

The price of West Texas Intermediate is trading near 5.162 in the last 24 hours. Crude price levels have been stable as threats for disruption of supplies in Iraq and a drop in US drilling. Iraq is the largest producer in the Organization of the Petroleum Exporting Countries (OPEC), but an independence referendum by the oil producing Kurdish region prompted the central government to dispatch the military to intervene. Exports from the Kirkuk fields are starting to pick up and are now in 288,000 barrels per day in the Turkish pipeline, this is down from 600,000 before the conflict.

Market events to watch this week:

Tuesday, October 24

8:30pm AUD CPI q/q

Wednesday, October 25

4:30am GBP Prelim GDP q/q

8:30am USD Core Durable Goods Orders m/m

10:00am CAD BOC Monetary Policy Report

10:00am CAD BOC Rate Statement

10:00am CAD Overnight Rate

10:30am USD Crude Oil Inventories

11:15am CAD BOC Press Conference

Thursday, October 26

7:45am EUR Minimum Bid Rate

8:30am EUR ECB Press Conference

8:30am USD Unemployment Claims

Friday, October 27

8:30am USD Advance GDP q/q