U.S. Highlights

- The U.S. economy had good news on the inflation front this week, as core inflation ticked down in July, even as unfavorable base-effects led to a marginal uptick in the headline measure.

- Some Fed speakers this week maintained a hawkish stance, suggesting September’s meeting is an open debate. Incoming inflation and labor market data will play a key role in the decision.

- Small businesses also showed signs that inflation is easing, with fewer of them raising or planning to raise prices.

Canadian Highlights

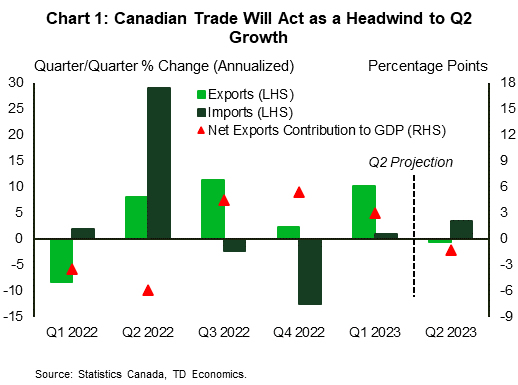

- Canada’s trade balance widened again in June as export activity slowed. Net exports are shaping up to be a net drag on Q2-2023 GDP growth, unlike previous quarters where trade activity was a tailwind for the economy.

- Next week’s inflation data for July could see prices tick up higher on the effects of elevated food costs and rising energy prices. Core inflation measures may decelerate slightly, but we expect stickiness of these prices gauges to persist until year-end.

- Canadian manufacturing sales and housing sales data will likely register contractions for June and July, respectively, after strong readings in months prior. This highlights the impacts of rate hikes delivered by the Bank of Canada (BoC) over the past couple of months.

U.S. – Word of the Week is Inflation

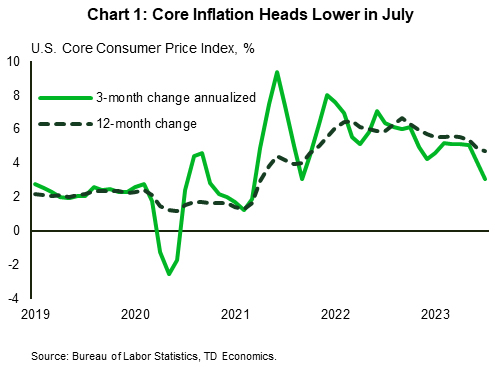

Since skyrocketing during the pandemic, inflation has been a key feature of the economic landscape. With both consumer and producer price data out this week there was much to add nuance to the scenery. Headline CPI inflation for July was 3.2% year-on-year (y/y), up 0.2 ppts from the previous month. The slight uptick was largely due to base-effects stemming from a notable decline in July 2022 energy prices. The monthly figure was more muted with a 0.2% increase, in line with expectations. Core prices also rose 0.2% month-on-month (m/m) contributing to a deceleration of annual core inflation from 4.8% in June to 4.7% (Chart 1).

Producer prices on the other hand rose slightly more than expected in July (0.3% m/m) due to a pickup in services inflation (0.5% m/m). The uptick in producer prices, which eventually feeds through to consumer prices, illustrates that it may still be too early for the Fed to let its guard down. Nonetheless, these inflation numbers combined with slowing labor market momentum do leave a cloud of doubt about whether the Fed will be raising rates again this year.

Comments from some voting members of the Federal Open Market Committee (FOMC) also suggest that a hike at the September meeting is not a foregone conclusion. NY Fed president Williams noted that both inflation and labor data are generally heading in the right direction, but both are still not quite there yet. He views the question of additional rate increases as still being “open”. Philadelphia Fed President Harker, contrary to his usual hawkish bent, noted that the Fed may be at the point where it can hold rates steady for a while. On the other hand, Fed Governor Bowman is of the view that additional hikes will likely be needed to tame inflation.

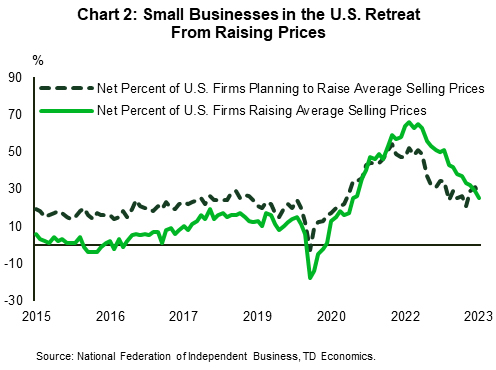

Data from the small business sector also supports the notion that price pressures are receding. The National Federation of Independent Business survey found that only about one-quarter of small business owners raised prices over the past three months, the lowest reading since January 2021 (Chart 2). Likewise, the share of owners planning to raise prices in the near-term retreated by 4 points following two consecutive monthly increases. Additionally, businesses reporting inflation as their single most important problem declined by 3 points to 21% in July. Overall, the survey suggests that price pressures are moderating, despite a still tight labor market.

One thing that could throw a kink in the downward trajectory of inflation, is rising energy prices in the face of crude oil production cuts by Saudi Arabia and Russia. While the Fed’s preferred measure excludes energy prices, rising oil prices will indirectly boost prices in most other categories.

Ultimately, core inflation should drift lower in the coming months. However, the battle is far from over given that the job market remains tight and the economy resilient. The risk that lower inflation could lift real wages and thus aggregate demand, thereby triggering another round of rising prices, means the Fed will be paying even closer attention to the evolution of jobs data.

Canada – All Eyes on Inflation Next Week

The Canadian economy booked some vacation time over the holiday-shortened week. Data updates were scarce, featuring only June’s international trade figures. Financial markets were also a bit quiet, with the Canadian dollar mildly weakened by half a cent to 74.3 cents. Yields finished the week a couple basis points higher across the curve and the TSX rose half a percent on the back of rallying oil prices.

Canada’s trade data for June underscored the divergence between resilient domestic demand and cooling global activity. Exports fell for a fourth time in five months, while imports remained elevated. This led to a widening of Canada’s trade deficit to levels last seen in late 2020. Now, the net exports tailwind that contributed significantly to growth over the last three quarters appears to be shifting course (Chart 1). Trade activity will likely act as a net drag on second quarter GDP growth. Into Q3, trade volumes will be impacted by the B.C. port strike and Nova Scotia Floods.

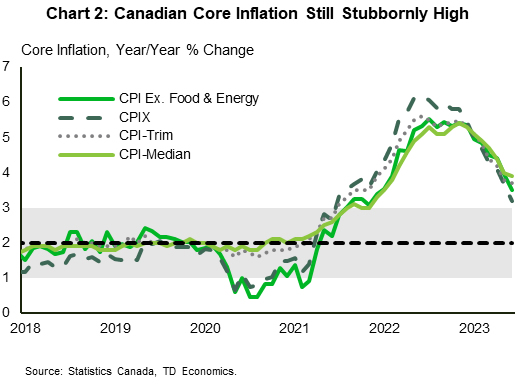

Chart 2 shows the four core measures of Canadian inflation since January 2018. CPI ex. As of June 2023, CPI ex. food and energy is at 3.5% year-on-year (y/y), with a high of 5.5% y/y in July 2022 and a low of 0.5% y/y in August 2020. Current CPIX inflation is at 3.2% y/y, with a high of 6.2% y/y in June 2022 and a low of 0.7% y/y in May 2020. CPI Trim inflation is at 3.7% y/y with a high of 5.6% in June 2022 and a low of 1.6% y/y in August 2020. Lastly, CPI median is at 3.9% y/y with a high of 5.4% y/y in November 2022 and a low of 1.8% y/y in August 2020.

Next week will be headlined by the July inflation data. We expect headline inflation to heat up a bit thanks to higher prices for food and energy. Inflation had decelerated into the upper end of the Bank of Canada’s (BoC) control range in June, but the last leg of the inflation fight will prove to be more difficult. Notably, core inflation is still running at an uncomfortable pace, with all core measures clocking in above 3% (Chart 2). Overall price stickiness had forced the BoC to adjust their path back to 2.0% inflation in their July Monetary Policy Report. Policy makers had previously thought this could be achieved by the end of 2024, but this has now been pushed until mid-2025. Incoming data will ultimately inform the BoC’s next move, but we believe July’s quarter-point hike was the last of the rate hiking campaign that has seen 475-bps of hikes delivered since early last year.

Meanwhile, next week’s monthly real manufacturing sales likely took a step back in June after rising for three consecutive months to their highest point since January this year. Canada’s manufacturing sector PMI has been in contractionary territory for the months of June and July. Canadian housing sales are also set to contract after preliminary housing numbers pointed to outsized weakness in Toronto’s housing market in July. The impact of further rate hikes over the past two months will put continued pressure on home sales, which we expect to decline, on average, in the second half of the year. Lastly, the release of the Senior Loan Officer Survey will inform business-lending practices of Canadian financial institutions over the second quarter.