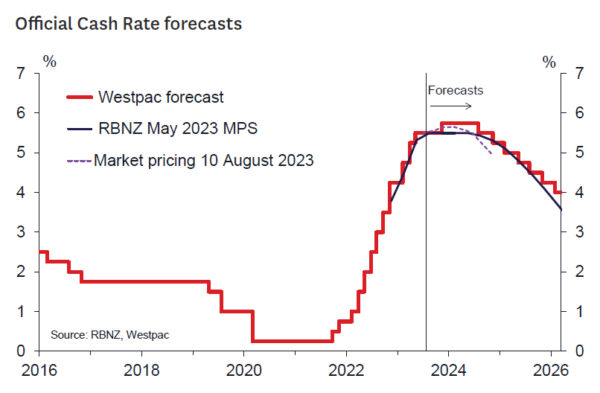

- The RBNZ will keep the OCR at 5.5% and retain its baseline forecast that the rate cycle has peaked.

- Economic developments will likely be viewed as broadly mixed and so will likely lead to only modest changes in the Bank’s growth and inflation forecasts.

- Looking beyond this meeting, the Bank’s forecast for the OCR should continue to indicate rates on hold until August 2024, falling slowly thereafter.

- The Bank will likely emphasise that any future move in policy will depend on the emerging data flow at home and abroad.

The August Monetary Policy Statement should be another “steady as she goes” affair. The RBNZ communicated a strong on-hold stance in the last Monetary Policy Statement in May and in the subsequent OCR review. The overall data flow would likely not have significantly shifted that stance in either direction.

That’s not to say there won’t be changes to their forecasts. Key factors pushing down inflation pressures in their forecasts will be:

- Weaker March quarter GDP: The RBNZ’s starting point for the level of excess capacity in the economy will be adjusted down to reflect that March quarter GDP was weaker than they expected in May. Consequently, the RBNZ he output gap estimate will point to a less overstretched economy.

- A weaker terms of trade and global outlook: Recent months have seen weakness in China, the key market for many of main exports and many of our imports. While the strength of global growth doesn’t have a large impact on the RBNZ estimates of inflation, the Bank may make some downward allowance for those developments. Of great significance has been the related substantial downgrade to the outlook for commodities export prices (milk, meat, logs for example), which will imply a weaker terms of trade and lower farm/business incomes. This is probably the largest negative factor weighing on the economic and inflation outlook and will matter for the short and medium- term outlook.

- Higher mortgage rates: the RBNZ noted in their July review these have trended up and marginally tightened financial conditions.

- Slightly weaker wages and a fractionally higher starting point for the unemployment rate: these adjustments were more marginal but nonetheless would be seen as helpful in managing upside risks to the inflation outlook. The Bank may also take comfort from the ongoing decline in the vacancy rate and reports of reduced job ‘churn’ when thinking about future risks to wages.

On the upside in terms of inflation pressure we expect to see:

- An upgraded house price outlook: House prices have found a base sooner than the RBNZ expected and have taken initial tentative steps higher. The RBNZ will need to reflect this at least in their near-term forecasts.

- A still resilient labour market: Population and labour force growth has been robust and has facilitated stronger employment growth. A sharp downshift in these indicators is required to square with the RBNZ’s projected recession over Q2-Q4 2023 making it likely that some upgrade to the nearterm growth outlook will occur – even if just to push the negative quarters of growth out a bit. This will likely broadly offset the downside surprise from the Q1 GDP report.

- Stronger domestic price pressures: While the headline CPI was in line with expectations, non-tradables inflation was higher than the RBNZ assumed, and that will raise questions on how persistent price pressures will be in the next few quarters. The wide-spread nature of pricing pressures should see some short-term upward adjustment to the inflation outlook here.

So where does this all leave us? Probably broadly unchanged in terms of the overall economic outlook and the forward inflation profile. Hence there shouldn’t be much change in the OCR track which will probably still show an unchanged OCR until the September quarter of next year (consistent with Westpac’s view of easings beginning in the August Statement).

However, what probably has changed is the spread of the risk distribution. Both upside and downside inflation risks have become more pronounced since the May Statement. On the downside the focus should be on the weakness in China and commodities markets and the potential for an earlier move lower in inflation and a deeper recession. A May 2024 easing could come into focus in that scenario.

On the upside, greater persistence in domestic inflation, stronger house prices, and a slower adjustment in the labour market would put the November Statement tightening Westpac sees firmly on the table.

Given these risks, it is probable that the Bank will emphasise that policy is not on a predetermined path and that it will be closely monitoring the emerging data flow both here and abroad.