Even after the US employment report revealed higher-than-expected wage growth for July, investors continued to believe that the Fed has already concluded its own tightening crusade. Will this week’s CPI numbers make them change their mind? Where are the risks tilted to and how could the markets respond?

“We could hike, we could pause”

At their July gathering, Fed officials decided to raise interest rates by 25bps to their highest level in 22 years, with the statement accompanying the decision nearly identical to the prior one, thereby leaving the door open to more action if needed.

Nonetheless, at the press conference following the decision, Fed Chair Powell did not appear hawkish enough to convince market participants that more hikes are in the Committee’s chamber. He said they will make decisions meeting by meeting, closely watching economic data, adding that they could hike again in September if the data suggests so, but also that they could choose to hold steady.

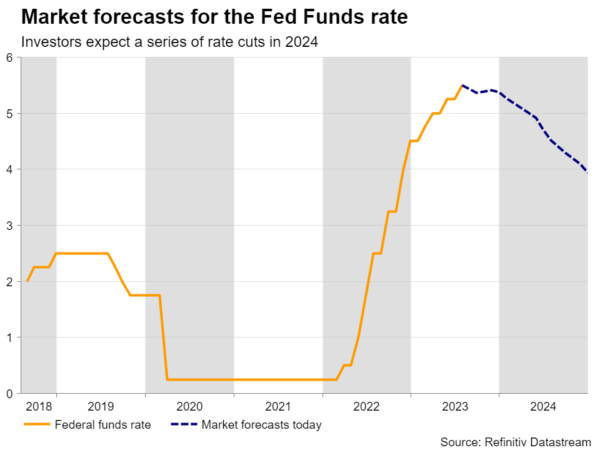

When asked about the possibility of rate reductions, Powell said rate cuts will not happen this year, but he refrained from closing the door to any cuts in 2024, adding that this is a judgement they will have to make when the time comes. This encouraged investors to add to their rate-cut bets for next year as his choice to put such a scenario on the table was interpreted as a softening stance compared to prior appearances where he said any rate cuts are ‘a couple of years out.’

Risks are tilted to the upside

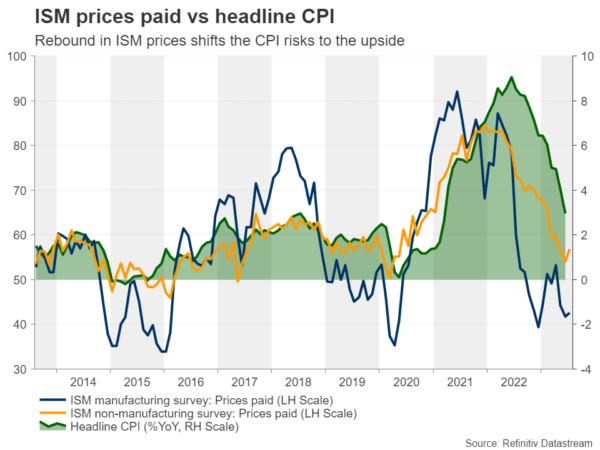

Both the ISM manufacturing and non-manufacturing PMIs for July came in below expectations, but the new orders subindex in the manufacturing survey and the prices charged subindex in the non-manufacturing rose by more than anticipated, suggesting improving demand for goods and perhaps a rebound in inflation.

That view is also corroborated by the S&P Global PMIs, with the Chief Business Economist at S&P Global Market Intelligence saying that the stickiness of price pressures remains a major concern and the overall survey sending a worrying signal that a further fall in the inflation rate below 3% may prove elusive in the near term.

Yet, market participants are largely convinced that the end credits for this tightening crusade have already rolled for the Fed, even after Friday’s jobs report revealed better-than-expected wage growth for the month of July. Investors also believe that nearly 140bps worth of rate cuts may be warranted during next year, despite economic data adding credence to the soft-landing narrative.

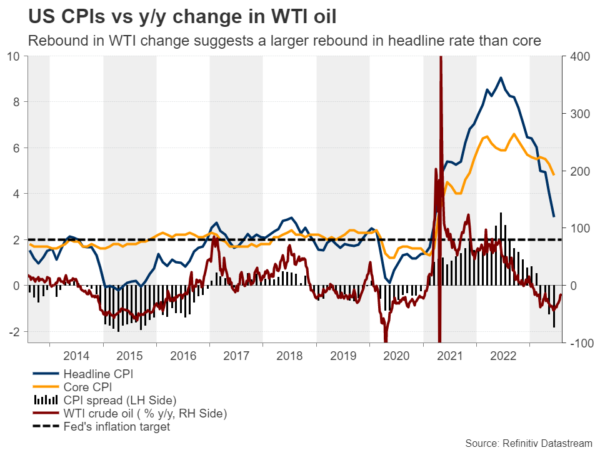

Perhaps traders are waiting for Thursday’s CPI data to confirm whether indeed inflation is now stickier than previously thought. The headline rate is expected to have rebounded to 3.3% year-on-year from 3.0% and the core one is anticipated to have ticked down to 4.7% from 4.8%. That said, the aforementioned business surveys and the wage growth data are implying that the risks may be tilted to the upside, while the rebound in the y/y rate of WTI prices is suggesting that if the core CPI rate moves somewhat higher, the headline rate may increase by even more.

Accelerating inflation could boost dollar and yields, hurt stocks

An upside surprise in the all-important CPIs may prompt market participants to reconsider the possibility of a hike in September and also scale back their rate cut bets, which could help Treasury yields and the US dollar drift further north. A higher implied rate path could also weigh on Wall Street, given that the latest rally was fuelled by a tech euphoria and high-growth tech firms are usually valued by discounting estimated free cash flows for the quarters and years ahead.

Dollar/yen uptrend stays intact

From a technical standpoint, dollar/yen continues to trade above the uptrend line drawn from the low of March 24, as well as above both the 50- and 200-day exponential moving averages, technical indications that keep the prevailing uptrend intact.

Although the pair pulled back last week, it found support and rebounded from 141.50 on Monday, and accelerating inflation on Thursday could help it breach last Thursday’s high of 143.95. That said, the move that would clearly signal a trend continuation may be a decisive break above the 145.10 zone, which marks the high of June 30. Such a break could carry larger bullish implications and perhaps pave the way towards the high of October 31 at 148.85.

For the outlook of dollar/yen to turn bearish, the price may need to fall below the 138.00 zone, a territory which offered strong support between July 13 and 24 and also strong resistance on March 8 and May 2. Such a dip may tempt the bears to dive all the way towards the 133.70 territory.