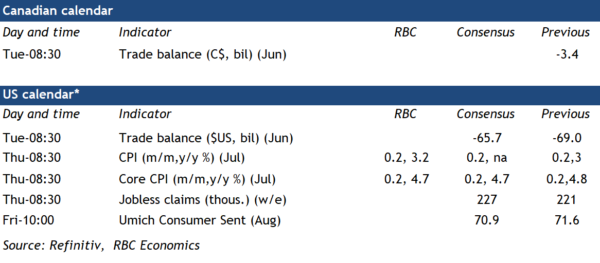

Year-over-year growth in U.S. consumer prices likely ticked slightly higher for the first time in a year in July – gasoline prices didn’t move much this July but a larger 8% drop in July a year ago will fall out of the 12-month growth rate. Year-over-year growth in core (ex-food & energy) prices will still be high (we expect +4.7%) in July, but we expect a moderate 0.2% month-over-month increase to match the June gain. Slower growth in core CPI has come alongside a pullback in home rent inflation as earlier slowing in market asking rent growth feed through to lower rent CPI with a lag as contracts get renewed.

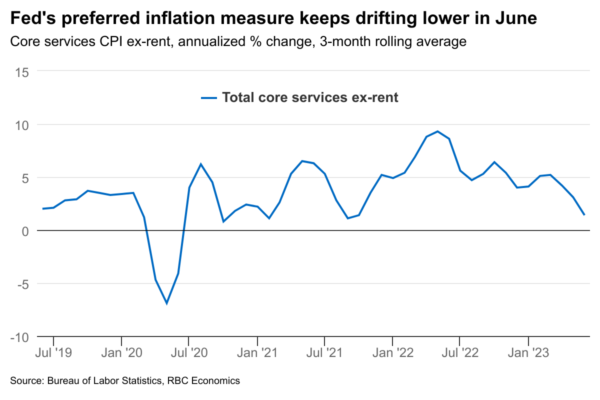

Stripping out shelter, energy, food and other goods, the Fed’s “supercore” CPI will be watched closely for signs that easing domestic inflation pressures are being sustained. The measure is designed to get a better gauge of broader inflation trends driven by domestic rather than global inflation pressures. It has slowed sharply in recent months – month-over-month increases averaged a 1.4% annualized rate in the three months to June (below the Federal Reserve’s 2% inflation objective) thanks to a month over month decline that was also the first one in two years.

Recent moderation in U.S. inflation has led to some speculation that slower consumer spending and weaker labour markets might not be needed to get inflation back under control – increasing the odds of a ’soft landing’ for the economy. Still, we continue to think that aggressive interest rates over the last year and a half will have economic consequences, even if the economy has been more resilient than expected to-date. Household liquid real assets, including cash, checking and time deposits have been dropping lower since early 2022. The share of consumer credit card and auto loans that are moving into 30-day delinquency status have also risen over recent quarters. With indicators on household finances suggesting rising number of challenges, it will be a matter of time for consumer demand to slow more significantly, bringing down GDP growth and labour demand along the way. Fed chair Powell in the July press conference stressed that hiking all the way until inflation’s back to 2% will be a “prescription of going way past target”. Absent a reacceleration in core inflation, we expect the Fed to step to and stay on the sideline and maintain the Fed Funds at 5.25% – 5% range until 2024.

Week ahead data watch

Canadian trade deficit likely narrowed from $-3.4 billion in May to $-3.2 billion in June. Exports (-1.2%) and imports (-1.6%) both declined during that month. Our expectation echoes with StatCan’s advance estimates on manufacturing sales and wholesales trade, both pointing to sizable contractions, and foreshadowing lower trade flows.

According to the advance U.S. economic indicators, the goods deficit shrank by $4 billion from the prior month in June. Exports on goods ticked up 0.2% on a month-over-month basis, supported by capital goods and other goods. Imports fell by 1.4%, slowdowns saw in several baskets, including industrial supplies (-4.4%), capital goods (-3.3%), and other goods (-4.2%).