- We expect the Bank of England (BoE) to hike the Bank Rate by 25bp on 3 August.

- We expect a peak in the Bank Rate of 5.50% with risks tilted to the upside. We see current market pricing of a peak in policy rates of 5.90% as too aggressive.

- EUR/GBP is set to move modestly higher on announcement. We do not expect the press conference to offer much further guidance than the written material.

BoE call. We expect the Bank of England (BoE) to hike the Bank Rate (key policy rate) by 25bp on 3 August, bringing it to 5.25%. Markets are currently pricing around 33bp for the meeting next week. While the latest UK economic data releases, in our view, support a return to a smaller increment hike pace of 25bp on Thursday, we acknowledge that the probability of a larger 50bp hike remains considerable given the evidence of (still) strong underlying inflationary pressures in the service sector and wage growth developments.

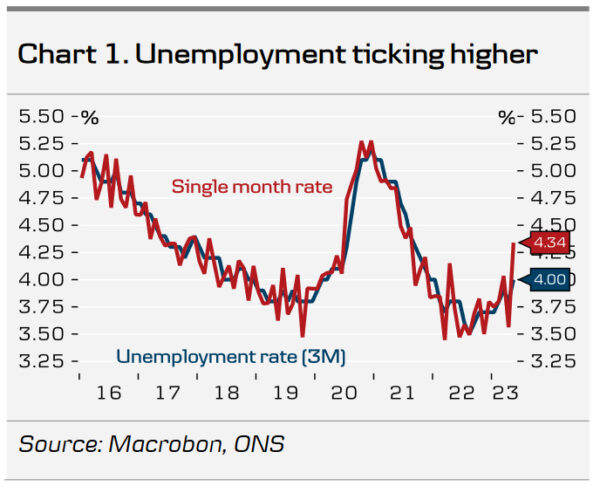

Since the last monetary policy decision in June, there have been limited new UK economic data releases. Likewise we have received little guidance from the MPC with speakers rigorously repeating official guidance from the latest meeting. The latest labour market report delivered a mixed bag of news. Single month unemployment increased to 4.3%, inactivity decreased and unfilled vacancies continued to decline indicating some rising slack in the labour market. However, wage growth remains elevated with wage growth excl. bonuses showing no clear signs of slowing. Large public sector wage agreements announced by the government at the beginning of July of pay rises between 5-7% also pose as further upward pressure on wage growth and hence possible second round effects.

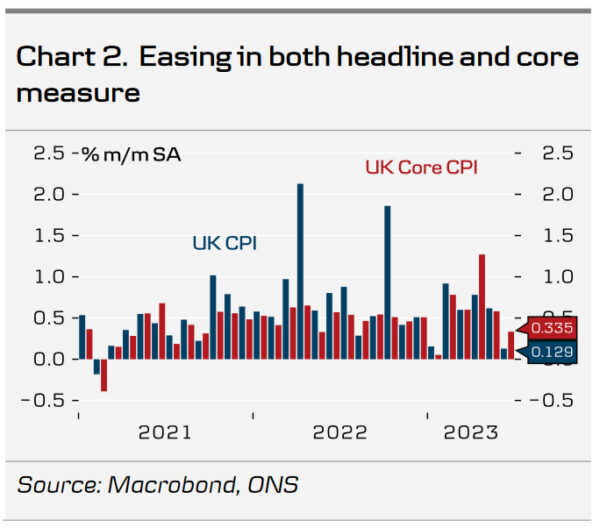

On the other hand, CPI for June came in lower than expected for the first time since January with a broad easing in both the core and headline measure. While the BoE in the minutes of the June meeting projected service inflation to remain “broadly unchanged in the near-term“, service inflation declined to 7.2% y/y (down from 7.4% in June). Likewise, PMIs for July surprised to the downside and pointed to growth weakening further in the months ahead. The composite index remained in slightly expansionary territory at 50.7, whereas manufacturing continued to weaken further at 45.0. Momentum in the service sector continues to fade in line with the past two months releases with July at 51.5.

We maintain our call for a 25bp hike in September and see the Bank Rate peaking at 5.50%. This is less than market pricing, which remains above our call despite having decreased the past month to a peak rate of 5.90% in February 2024. Based on MPC member Ramsdens recent comments, an increase in the size of the gilt reduction program is likely from the current GBP 80bn the past 12 months. We expect no rate cuts until 2024.

FX. In our base case of a 25bp hike, we expect EUR/GBP to move slightly higher and volatility to be high. We anticipate Governor Bailey to reiterate the BoE’s data dependent approach at the press conference, essentially kicking the can down the road. Overall, we expect the BoE to highlight the continued tight labour market and keep the door open for further tightening. On balance, we continue to see relative rates as a positive for EUR/GBP, which is one of several reasons behind our fundamental predisposition of buying EUR/GBP dips.