- The Fed hiked rates by 25bp to 5.25 – 5.50% as widely anticipated. We make no changes to our Fed call, and still think this was the final hike of the cycle.

- Powell’s tone was balanced, as he gave few new signals on the future rate outlook. Markets interpreted this slightly dovishly, as the latest ‘dots’ from June were still clearly in favour of one more hike beyond July.

- The decision provided moderate support to US Treasuries, and lifted EUR/USD close to 1.11. We still see the cross at 1.06/1.03 on the 6M/12M horizon.

The Fed delivered the widely anticipated 25bp hike in the July meeting while keeping the door open for further hikes. That said, Powell carefully refrained from pre-committing to any future policy actions.

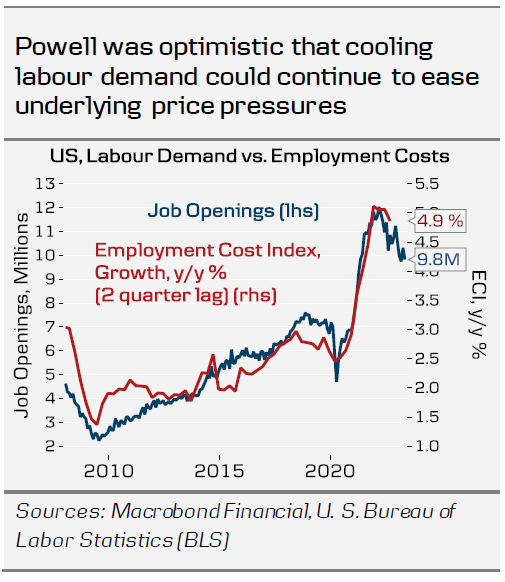

The focus remains on incoming data, with two more CPI prints and Jobs Reports still to go before the September meeting. Powell highlighted that the June CPI had been a modest positive surprise, and underscored that the combination of easing labour demand and recovering labour force participation has loosened labour market conditions as well.

On the other hand, he acknowledged that stronger-than-expected economic activity as well as the recent easing in financial conditions (weaker USD, stronger equities) could contribute to prolonging inflation pressures.

Responding to a question on the lags of policy transmission, Powell hinted that the upcoming Q2 Senior Loan Officer Opinion Survey (due for release 31st July) will signal further tightening in credit conditions. The Fed staff is no longer forecasting a recession for the US economy, but a clear slowdown remains the most likely scenario.

Powell emphasized that the Fed’s policy stance is now clearly restrictive, as real yields have risen sharply over the past year. We discussed this in our Fed preview, 20 July, and this week, the Conference Board’s consumer survey showed further signs of declining inflation expectations, despite overall positive development in the sentiment.

Powell also noted that the Fed could continue QT even when cutting rates in the future. We agree, as over the summer, even the increased T-bill issuance following the debt ceiling raise has had little impact on USD liquidity conditions. So far, money market funds have absorbed the issuance by reallocating funds from the Fed’s ON RRP facility, while bank reserves remain steady at a healthy level. This means the Fed can continue QT well into 2024, while as our base case, we forecast the first rate cuts in Q1 next year.

Overall, with few new policy signals, we make no changes to our Fed call, and still think today marked the end of the rate hiking cycle. We expect the upcoming inflation releases to continue signalling cooling underlying inflation, and track the July Core CPI close to the June print around 0.2% m/m. With excess savings soon depleted and credit conditions still tightening, the balance of risks for the economic outlook remains tilted to the downside despite the most recent encouraging data.

Markets: Slightly dovish, no changes to longer-term views

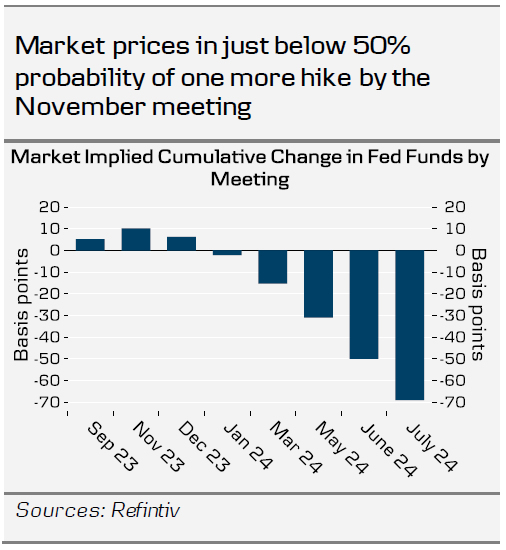

Today’s message from the FOMC provided moderate support to treasuries, with the 10Y UST yield down by about 4bp since the rate announcement. Money markets are still pricing in a decent probability (just below 50%) for a final 25bp hike by the November meeting. Nonetheless, we expect the market pricing to align with our view of no further hikes as signs of softening labour market conditions and inflation show up in the data. This should make better room for duration plays, as the end of the hiking cycle will draw market focus towards the timing and pace of future rate cuts. Weakening US macro data should have a stronger impact on FOMC pricing in that environment. With the 2s10s UST curve rather extremely inverted at currently -98bp, the conclusion of the hiking cycle should also pave the way for a more resilient bull steepening of the curve going forward.

EUR/USD moved slightly higher just below 1.11, as the market interpretation was a bit to the dovish side. Overall, however, there were no surprises from the Fed, and hence it does not give us reason to change our FX view. We maintain our strategic case for a lower EUR/USD. We expect the relative strength of the US economy to weigh on the EUR/USD in the coming months, and we continue to forecast the cross at 1.06/1.03 in 6/12M. Tomorrow, we expect a relatively muted market reaction on the back of the ECB meeting. If anything, EUR/USD could move lower if the ECB does not deliver any firm signs of a September hike.