Summary

- The FOMC raised its target range for the fed funds rate by 25 bps today. The move was widely expected by financial markets and economists. The Committee has hiked its policy rate by 525 bps since March 2022.

- The post-meeting statement was little changed from the previous statement released in June. The Committee characterized the ongoing expansion in economic activity as “moderate,” a small upgrade from “modest” in the June statement. The Committee continued to describe unemployment as low and inflation as elevated.

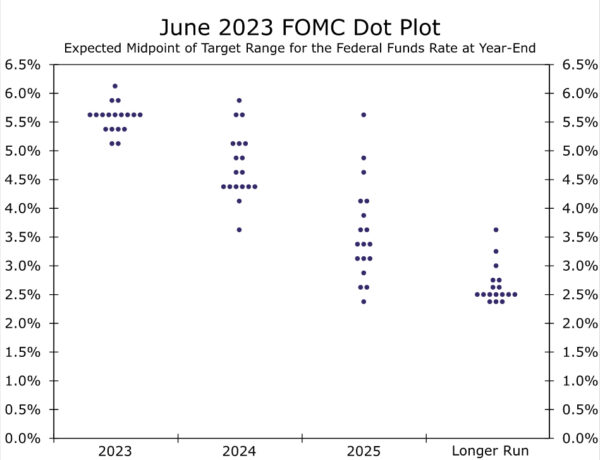

- This meeting did not include an update to the Committee’s Summary of Economic Projections, which includes the dot plot. The median dot in the June projections was for a federal funds rate of 5.625% at year-end, which implies one more rate hike between now and the end of 2023.

- In his press conference, Chair Powell stated that it was “possible” the Committee could hike again at its September meeting, but he quickly followed that statement by noting that it was also “possible” the FOMC would be on hold come the next meeting. Data dependency was a key theme that emerged during his post-meeting presser.

- Our base case remains that today’s rate hike will be the FOMC’s last of this tightening cycle. That said, we would not be shocked if the FOMC squeezed in one more rate hike between now and the end of the year. Regardless, quantitative tightening should continue for the foreseeable future.

FOMC Hikes Rates by 25 bps. Will It Be the Last?

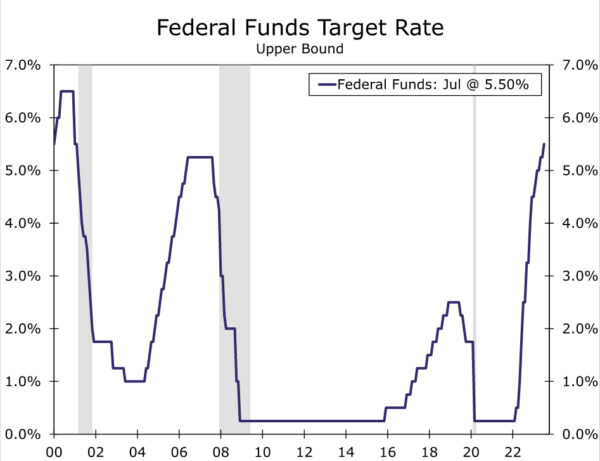

After pausing in June, the FOMC resumed its rate hike campaign at its July meeting, increasing the target range for the federal funds rate by 25 bps. The range now stands at 5.25%-5.50% and has increased by 525 bps since March 2022 (Figure 1). The decision to raise rates was supported by all 11 members who were eligible to vote at this meeting. The FOMC also reaffirmed the current pace of quantitative tightening. That is, the Federal Reserve will allow up to $60 billion of Treasury securities and up to $35 billion of mortgage-backed securities to roll off its balance sheet every month.

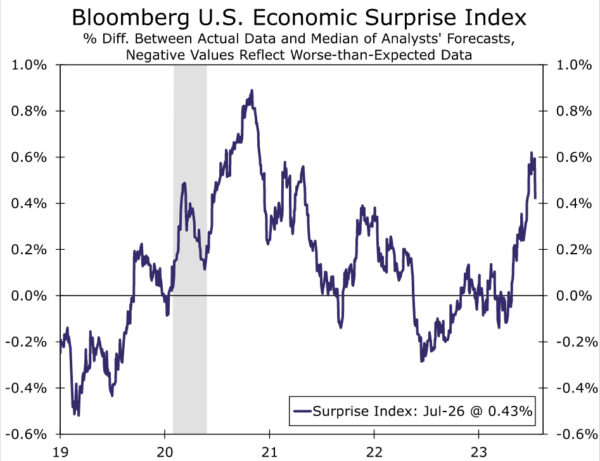

Since the FOMC last met on June 13-14, the economy has continued to weather the headwinds stemming from tighter monetary policy better than expected. In recent weeks, the Bloomberg Economic Surprise Index, which measures the degree to which economic data come in stronger or weaker than consensus expectations, has come off its recent peak but remains near a two-and-a-half year high (Figure 2). The post-meeting statement changed slightly to reflect this reality. The Committee upgraded its assessment of economic activity by characterizing the pace of expansion as “moderate” instead of “modest”. The statement still characterized recent job gains as “robust” and the unemployment rate as “low.”

Otherwise, there were essentially no other changes to the post-meeting statement. This meeting did not include an update to the Committee’s Summary of Economic Projections, which includes the dot plot. The median dot in the June projections was for a federal funds rate of 5.625% at year-end, which implies one more rate hike between now and the end of 2023 (Figure 3). The statement language reaffirmed that the FOMC wants to keep its options open in regard to future tightening: “In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

In his press conference, Chair Powell highlighted the progress that has been made in bringing down inflation thus far, but he cautioned that the “process of getting inflation back down to 2% has a long way to go.” The Chair stated that it was “possible” the Committee could hike at the September meeting, but that it was also “possible” the FOMC could be on hold. The importance of future economic data and its role in future monetary policy decisions came up numerous times during the presser, and Chair Powell explicitly stated that this is “not an environment where we want to provide a lot of forward guidance.” Generally speaking, the Chair’s comments seemed to reiterate that the FOMC wants to preserve maximum flexibility as it awaits future data that will help determine whether monetary policy is sufficiently restrictive to bring inflation down to a more tolerable level.

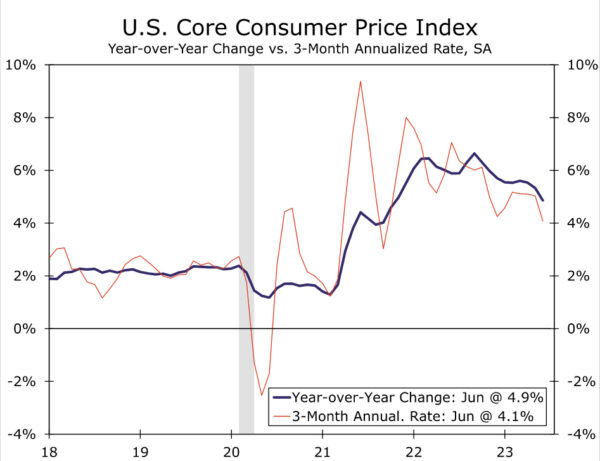

Our base case remains that today’s rate hike will be the FOMC’s last of this tightening cycle. For much of this tightening cycle, the FOMC has been playing catch up amid sky-high inflation and a federal funds rate that was at the zero lower bound just 16 months ago. Today, with the fed funds rate comfortably north of 5%, the Fed’s balance sheet steadily shrinking and core inflation trending down (Figure 4), the case for additional tightening is more tenuous. That said, we would not be shocked if the FOMC squeezed in one more rate hike between now and the end of the year. Regardless, quantitative tightening should continue for the foreseeable future. The FOMC will get two more employment reports and two additional CPI readings between now and its next meeting on September 19-20. The annual Jackson Hole Economic Symposium, to be held August 24-26, affords Chair Powell another opportunity to offer his assessment of the U.S. economic outlook.