The focus this week is on Wednesday’s UK CPI release (06.00 GMT). With the next Bank of England meeting scheduled in two weeks, this report will probably determine the size of the expected rate hike. In the meantime, the pound continues to outperform the euro but a potential downside surprise on Wednesday could really clip its wings.

BoE’s inflation problem

Compared to the rest of the central banks rushing to raise rates to squelch the acute inflationary pressure, the BoE opted for a more measured approach. As a result, headline inflation remains the highest in the developed world, failing to record the noteworthy drop seen in other regions over the past few months. Thus, the BoE has decided to act more forcefully as, following the surprise 50 bps rate hike at the June 22 gathering, there are growing expectations for a similarly sized move in two weeks’ time.

The main issue is that the BoE has lost valuable time and these rate hikes are probably coming too late. One of the reasonings behind the BoE’s cautious approach may have been the expectation that the US economy would already have entered a recession by now, cooling US inflationary pressures, and also dragging UK inflation lower. This expectation was not confirmed and hence Bailey et al are now “forced” to adopt a more aggressive strategy that is bound to cause further significant damage to the real economy.

The housing sector is expected to really feel the higher interest rates. The BoE’s Credit Conditions Survey found that mortgage defaults in the March-May 2023 period increased to the highest level since 2009 when the subprime-induced recession was ravaging the global economy. This means the peak in defaults has yet to be seen in this cycle, potentially delivering a massive hit on total household wealth amidst the strongest inflation period since the 1970s.

June CPI on Wednesday morning

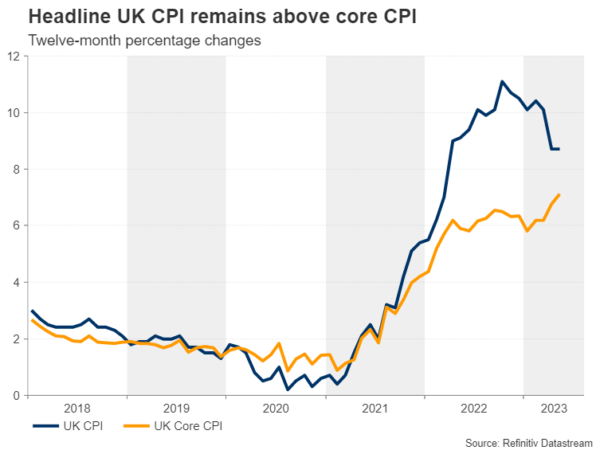

In this environment, Wednesday’s CPI prints for June are extremely important. The headline figure is expected to edge lower to an 8.2% year-on-year increase from 8.7% in May. If confirmed, this will be the lowest print since April 2022. However, it is still above its core component. This is forecast to remain at the record high of 7.1% YoY, confirming its stubborn nature. While we have seen numerous comments on the ability of core CPI to predict future inflation levels, it is an undeniable fact that the UK continues to experience significant inflationary pressure, well above the levels seen in both the US and the euro area.

In the meantime, there are increasing demands for strong salary rises to alleviate the inflationary problem. Last week’s offer by the government for 5-7% rises in public sector workers’ pay is sizeable but smaller than feared by the BoE. However, the risk of continued industrial action and an associated hit on the economy would have been devastating for the UK’s growth outlook at this juncture. In this context, on Friday we get a double dose of data releases regarding the consumer sector that the BoE will be monitoring very closely.

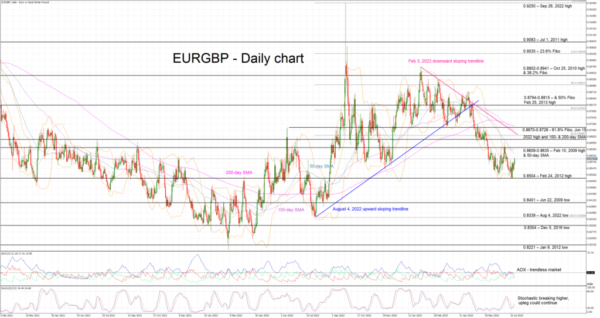

Euro/pound touched 0.85

The pound remains the star of 2023 and it is currently trading close to an 11-month high against the euro. The pound has shown extreme resilience throughout the year despite the different pace of monetary policy adjustment between the BoE and the ECB. This balance has tipped in favour of the pound lately, opening the door to more significant gains against the euro going forward.

The euro/pound pair almost broke 0.85 on July 11, prompting a small upleg towards the 0.8580 area. If the CPI report produces a significant downside surprise, especially if core inflation finally records a sizeable drop, the euro/pound pair could find strength to make a higher high and stage a move towards the 0.8670-0.8726 range. On the flip side, confirmation of current forecasts or a small pickup in inflation rates could probably cement the expectations for another 50bps move at the early-August BoE meeting, and hence allow the euro/pound pair to test the 0.8400 area.