Research US – Rising Real Rates Cast a Shadow Over Upbeat Macro Data

- The persistent strength of the US economy’s service sector combined with steady labour market and too fast wage inflation call for one more Fed hike in July.

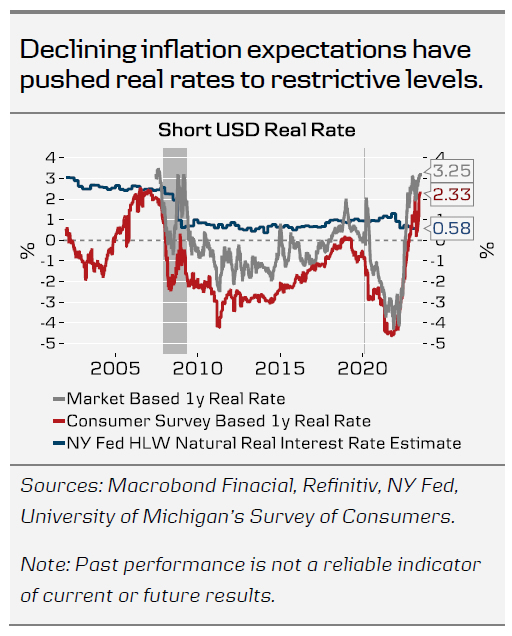

- As inflation expectations decline, real rates have risen above levels prevailing before SVB’s collapse – increasing the risk of a hard landing down the line.

While the June macro data has been mixed, the overall tone has been more positive than anticipated. ISM Services showed a clear pick-up in both business activity and new orders, and even on the manufacturing side, order-inventory balance is gradually recovering. While PMIs sent somewhat contrasting signals, both surveys signalled that price pressures have continued to ease across different sectors.

Growth has relied heavily on the consumer, and so far, strong labour market has been a key factor supporting both real income growth and consumer confidence. Even though job openings declined modestly in the May JOLTs report, both voluntary quits and hiring picked up, suggesting that confidence in finding new jobs remains high.

While NFP growth slowed down in June, wage and wage sum growth remained too fast to be consistent with 2% inflation. Hence, we revise our Fed call, and now expect the Fed to hike by 25bp to 5.25-5.50% at the July meeting. We do not expect hikes beyond July.

Since November, we have been calling for the Fed to end the hiking cycle at the current level of 5.00-5.25%. We expected the Fed to hike the nominal policy rate until real interest rates are at a positive and modestly restrictive level, where we are today based on most estimates. This cools the excessively high aggregate demand over time, bringing inflation down slowly but sustainably. Given the recessionary signals from longer-lead monetary indicators and the first ‘cracks’ in the economy emerging last March, we think this approach strikes the best balance for cooling inflation while minimizing the risk of a hard landing.

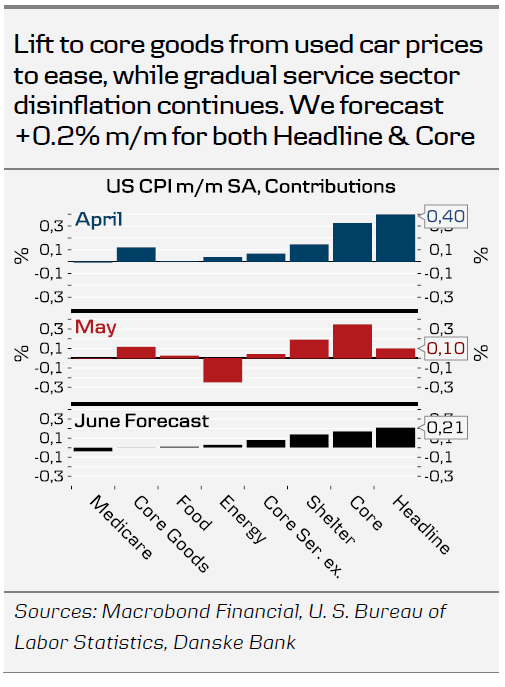

Next week, we forecast a downside surprise to the Core CPI (+0.2% m/m), as temporary lift from used car prices eases, and services disinflation continues. For now, yields have headed steadily higher ignoring the disinflationary signals, but over the past year, the market has not been able to sustain 10y UST yields above 4% for long before recession fears from tightening financial conditions have settled in. Today, real yields are at the highest levels since the GFC. The decline in inflation expectations has been evident not just in markets, but lately especially on the consumer surveys.

Continuing to hike nominal rates further from here will ultimately increase the risk of a hard landing down the line, but with few data releases remaining before the meeting, and following hawkish comments from the Fed, we see the chance of another pause low.

A pause would likely require 1) a low CPI print, 2) further decline in University of Michigan’s short-term inflation expectations (due 14 July) and 3) deterioration in market risk sentiment, reflecting growing recession fears. If the Fed chooses to signal another hike beyond July in line with the June SEP, we think a risk of a deeper downturn increases, despite the recent upbeat macro data. This would also imply faster turn towards cutting rates in the future.