Following the 50bps hike by the Bank of England in June, many market participants are now convinced that another increase of that size will be delivered in August, while they are anticipating several more hikes before the Bank calls the end of this tightening crusade. So, as they try to better assess how the Bank will move forward, next week, investors are likely to pay attention to Tuesday’s jobs data for May (06:00 GMT) and Thursday’s monthly GDP for that same month (06:00 GMT).

Investors anticipate another 50bps hike in August

With UK inflation staying stubbornly high and political pressure mounting, the BoE decided to proceed with a 50bps rate increment at its June gathering, reiterating the guidance that if there were evidence of more price pressures, further tightening in monetary policy would be required.

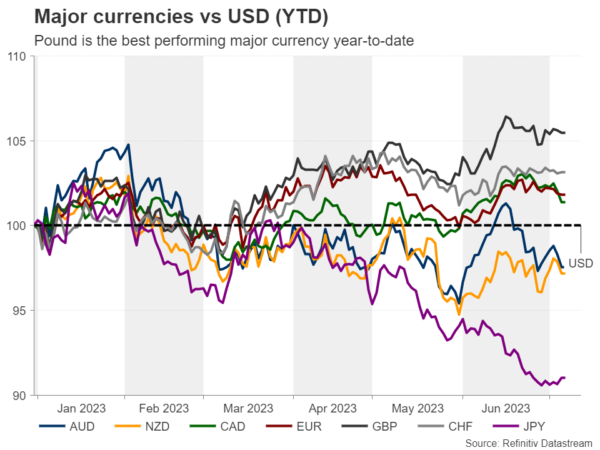

This, combined with yesterday’s comments from Governor Bailey that they must act now to bring inflation to heel, allowed market participants to maintain bets of several more hikes before the Bank decides the end credits of this tightening season roll. Investors are now pricing a 70% probability of another double hike at the upcoming gathering, with the remaining 30% pointing to a quarter-point increase, while they are penciling in slightly more than 100bps worth of additional rate increases thereafter. This puts the BoE at the top spot in terms of hike expectations among other major central banks, a view that allowed the pound to perform better against every other major currency year-to-date.

Will upcoming data add to the need for more hikes?

Since the last Bank decision, the only top-tier data that was released were the retail sales for May, which slowed instead of contracting as the forecasts suggested, and the PMIs for June. Both the manufacturing and services indices fell by more than expected, driving the composite PMI down to 52.8 from 54.0. On top of that, the surveys revealed that prices charged by private sector firms slowed to the lowest pace in 26 months, which is somewhat encouraging inflation-wise.

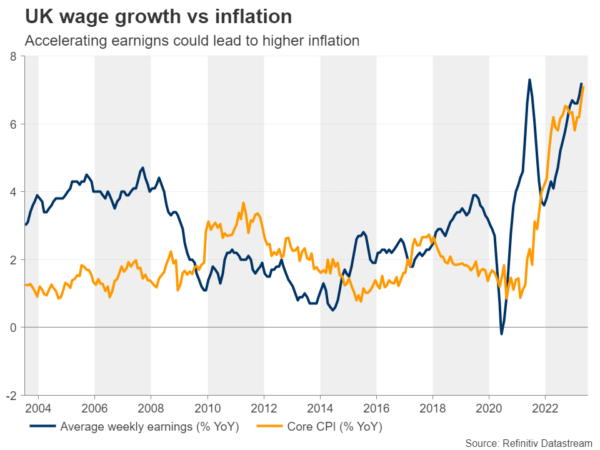

That said, with the headline CPI rate staying at 8.7% in May, more than double the US rate, and underlying price pressures accelerating to 7.1% from 6.8%, the June PMIs are far from alleviating any pressure from the BoE to continue raising rates aggressively. Next week brings more UK data to the table, with the employment report for May coming out on Tuesday and the monthly GDP for the same month on Thursday. Industrial and manufacturing production data will also be released that day.

There are no forecasts currently available for the jobs report, but GBP-traders are likely to pay extra attention to wage growth. In April, average weekly earnings, both including and excluding bonuses, accelerated and thus, another acceleration in May could revive fears that inflation is unlikely to cool anytime soon.

Pound’s uptrend likely destined to continue for a while more

This could prompt investors to add to their already brave rate-hike bets, thereby supporting the pound. The currency could extend its gains if Thursday’s data confirmed that the economy is able to bear a series of additional rate hikes.

Having said that though, monetary policy expectations are not the only catalyst behind the pound’s rally. Due to the UK’s twin deficit, the British currency has developed risk-linked characteristics in the last few years, with the correlation coefficient between pound/dollar and the S&P 500 since the October lows, being at an impressive 0.85. Therefore, an uptrend continuation in global equity markets could keep giving that extra boost to the pound.

From a technical standpoint, pound/dollar has recently rebounded from near the 1.2590 zone, staying above the uptrend line drawn from the low of October 12. This suggests that the upward trajectory remains intact, but its continuation is likely to be signaled upon a break above 1.2845, a move that will confirm a higher high on the daily chart.

If indeed this is the case, the bulls may quickly test the 1.2975 zone, which acted as strong support during March and April last year, and should they manage to overcome it, they may start marching towards the peak of March 23, 2022, at around 1.3305.

For the outlook to turn bearish, the pair may need to fall below the key zone of 1.2340, which offered both strong support and resistance during the last year or so. Such a break may encourage the bears to dive towards the 1.2025 zone, the break of which could carry extensions towards the low of March 8 at 1.1795.