With the July Bank of Canada meeting gradually creeping into the traders’ minds, this week’s calendar is unlikely to tip the balance in favour of another rate hike or a rate pause. Nevertheless, the loonie might enjoy a boost as the euro/loonie pair is trading very close to its 2023 lows.

Market split on the next BoC decision

The focus this week will understandably be on the US labour market data and their likely impact on the end-of-July Fed meeting. In the meantime, the BoC is holding its fifth meeting for 2023 next week and the market is currently split on the outcome. Earlier this year, the BoC surprised when it restarted its rate hikes following two consecutive meetings, the March and April gatherings, with no rate changes. This “stop-and-go” strategy appears to have been adopted by other central banks as they prefer to keep their options open. However, there is a widespread feeling that most of them are at or very close to their interest rates’ peak.

Manufacturing surveys are not a pleasant reading

The week kicked off with another weak print by the Manufacturing PMI survey. This is a common theme across the globe, evident even in the neighboring US that is arguably in the best economic spot at this stage. Crucially, the closely watched new orders components in both the US and the euro area remain stuck below the 50-midpoint, pointing to a rather bleak outlook for the sector. China holds the key to the manufacturing sector’s recovery, a potentially crucial growth factor for the second half of 2023 that just commenced.

Next stop is Thursday’s trade balance and the BoC would be happy if the current trade surplus continues, confirming that the 2021-2022 phase was not a result of the Covid situation. But Friday is the key day in terms of data releases. Wages are the hottest topic of discussion among central bankers, with ECB’s president Lagarde being quite vocal about the impact of unit labour costs on the elevated inflation outlook at the post-meeting press conference in June.

Tight labour market fuels higher wages

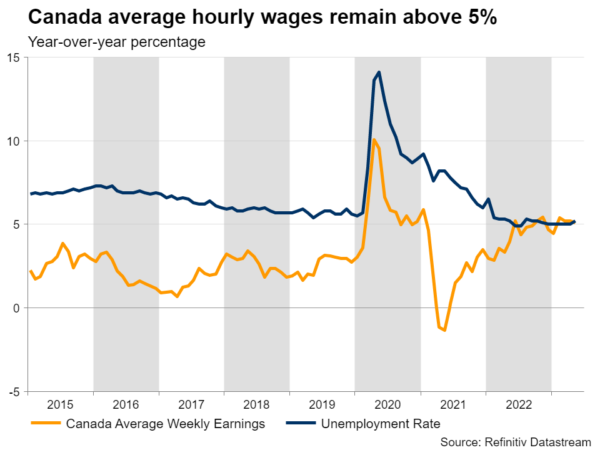

In the case of Canada, the average hourly wages remain above 5%, clearly surpassing the pre-Covid rate. If this trend continues, there is a considerable risk of these increases becoming the norm, elevating workers’ expectations and hence making the 2% inflation target a tough challenge for the BoC. Its April Monetary Policy Report had headline inflation dropping to 2.1% by the end of 2024. A potential revision higher at next week’s update would mostly be due to the elevated labour costs.

Similar to other regions, Canada is enjoying a golden period of employment with the unemployment rate hovering at record-low levels. It is worth noting that the labour force participation rate remains around 0.5% lower than its pre-Covid average level. On the margin, this could mean that the return of this population segment in the labour force – to take advantage of the increased wages – could gradually put downwards pressure on labour costs.

Loonie would love a bit of a boost

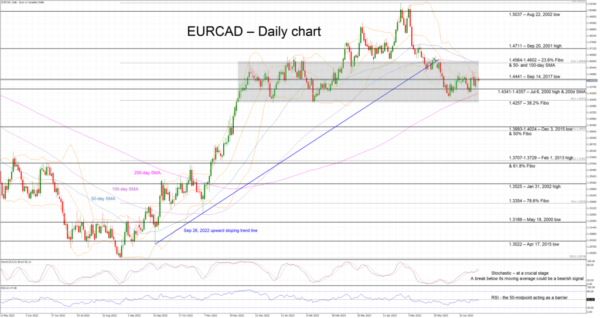

Despite the fluctuations, the euro/loonie pair is just pips above the level it opened on January 1, 2023. Actually, the loonie has been on the back foot until April 2023, weakening to the lowest level against the euro since August 2021. However, it has managed to recover since, with the pair now trading in the 1.4425 area.

A positive set of data on both Thursday and Friday, especially if the average hourly wages surprise on the upside, would be welcomed by the loonie bulls. They could then defend the 1.4441 level and attempt a retest of the busier 1.4341-1.4357 range. This correction could gain further strength if the stochastic halts its recent upward sloping trend and breaks below its moving average.

On the other hand, weaker data releases, which will essentially reduce the chances of a BoC rate hike next week, would most likely disappoint the loonie bulls and potentially result in a sizeable rally towards the 1.4565-1.4602 area.