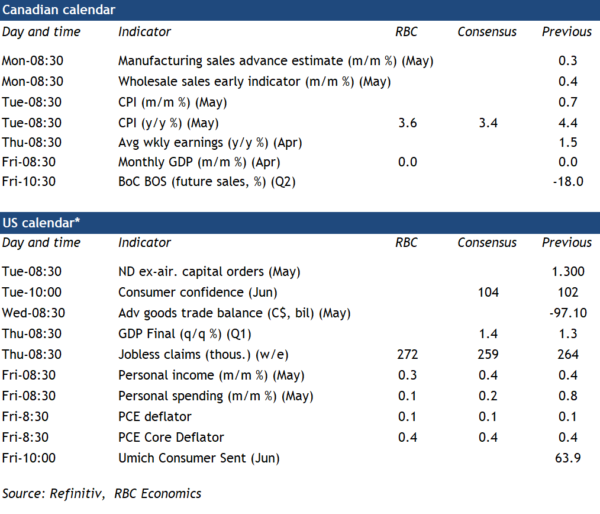

The Bank of Canada will scrutinize a number of top-tier economic data releases next week as it contemplates how much higher to push interest rates.

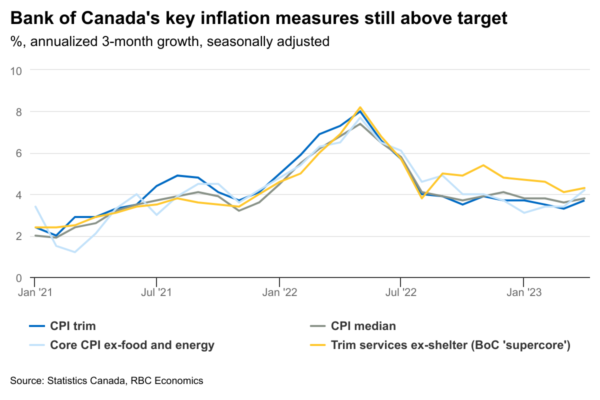

Canadian CPI inflation data should look better in May after surprising on the upside in April. We look for ‘headline’ price growth to slow—falling to 3.6% annually from 4.4% in April. Lower energy prices (gasoline and fuel oil prices were down 18% and 36%, respectively, from year-ago levels in May) explain most of that slowdown. And food price inflation is expected to edge lower again after peaking in January. More important for the Bank of Canada will be further signs that the pressures fueling inflation across other products and services continue to narrow. Annual growth in the BoC’s preferred ‘core’ measures will very likely slow due to favorable ‘base effects’ (that is, unusually large month-over-month increases a year ago not expected to be repeated this year). More recent month-over-month increases in those measures are down sharply from peak levels last summer. But they’ve been sticky, hovering at around a 4% annual rate (still well above the 2% inflation target).

The central bank’s own quarterly Business Outlook Survey (BOS) will be watched closely for signs that weaknesses are emerging in what has been a resilient economic backdrop so far in 2023. The last BOS flagged an unexpected easing in the intensity of labour shortages. And the number of job openings has continued to trend lower into June. Future sales growth will likely remain soft and investment plans have moderated in recent quarterly surveys. Economic data releases for Q2 have so far remained relatively resilient, but we are tracking a flat reading for April GDP next week. That’s still firm given the federal worker’s strike that month likely subtracted 0.2 to 0.3 percentage points from growth—but it’s below StatCan’s 0.2% preliminary estimate a month ago. We continue to see signs of cracks forming in the economic backdrop, but it’s highly unlikely that the BoC ended its pause in interest rate hikes in June for just one additional 25 basis point increase. It would likely take substantial downside surprises in data releases (i.e., lower inflation and / or GDP data) to prevent another hike at the next meeting in July.

Week ahead data watch

We expect Canadian April GDP to hold unchanged at March’s level—softer than the 0.2% prelim estimate from StatCan a month ago. The federal worker’s strike likely subtracted 0.2 to 0.3 percentage points from GDP growth in April. But retail and manufacturing sale volumes rose, and an 11% surge in home resales increased activity in real estate offices. The return of those federal workers to the job will boost May GDP growth but forest fires disrupted oil activity and hours worked (not including the strike impact) declined by 0.4% in May.

U.S. personal income likely edged up 0.3% in May alongside a smaller 0.1% rise in spending. Wage incomes likely rose 0.2% with higher hourly wage rates offsetting a tick down in hours worked, and household rental income has been rising strongly in recent months.

The Canadian SEPH employment report will be watched closely for further easing in labour demand. Job vacancies are already down almost 20% from their peak as of March and data from indeed.com are pointing to further declines in April.