The central bank theme will continue in the coming week with the Bank of England and Swiss National Bank next to announce their interest rate decisions. Both are expected to raise their policy rates but is there room for hawkish surprises? The flash PMIs for June will also be on investors’ radar as some regions such as the Eurozone grapple with a recession. Inflation data will be the highlight in Japan but it’s looking like a quieter period in the United States, allowing the US dollar to take a backseat after the Fed’s decision to pause.

BoE to likely play it safe despite inflation risks

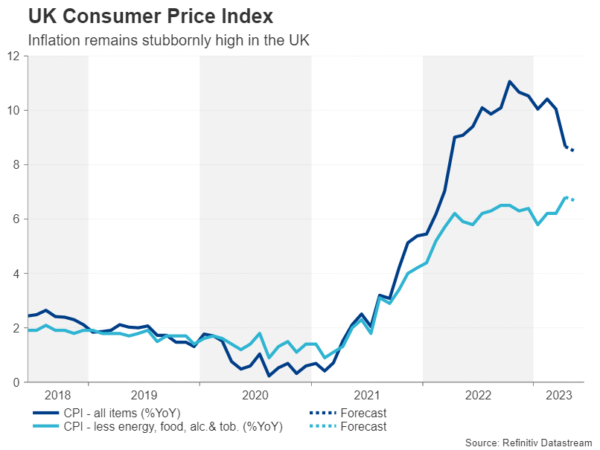

It is no secret that Britain has one of the highest inflation rates in the Western world, thanks to Brexit, high fuel prices and a tight labour market. The Bank of England has been trying to tame inflation for the past 18 months, but it has yet to cool off substantially.

Pressure is building on policymakers to get a grip on inflation fast after both wage growth and underlying prices pressures started to heat up again recently, dashing hopes for a pause. Fortunately for the Monetary Policy Committee (MPC), they will have some help on Wednesday before they vote when they get their hands on the latest CPI report.

Headline inflation is anticipated to have moderated further in May, declining to 8.5% y/y. However, even if there is another sizeable drop in headline CPI, policymakers will likely be more concerned about the core measure. After shooting up to 6.8% in April, core CPI is expected to have inched marginally lower to 6.7% in May, suggesting there is another wave of second-round effects underway.

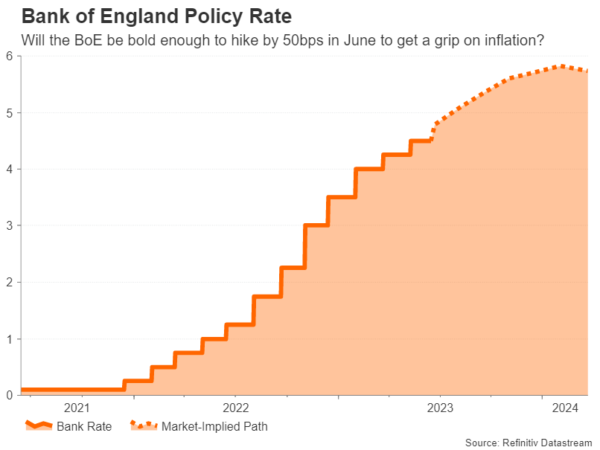

If the CPI figures are hotter-than-expected, which would come on the back of a strong employment report, the Bank of England might well decide to raise interest rates by a larger 50-basis-point increment. However, the chances of that are quite low. Investors have assigned just a 12% probability of a 50-bps hike and the BoE has not gone against the markets during the course of this tightening cycle except when it surprised at liftoff.

The MPC will probably point to the lag effect of its existing policy tightening as well as the risks to the housing market if it raises the Bank rate by only 25 bps as expected on Thursday. There is no press conference or updated forecasts at the June meeting but any changes to the language in the statement that flags additional rate increases would be positive for the pound.

Even if the BoE gives little away about its intentions at future meetings, sterling could benefit from a broadly positive set of data, as retail sales numbers for May are also due on Friday, along with the flash PMIs for June.

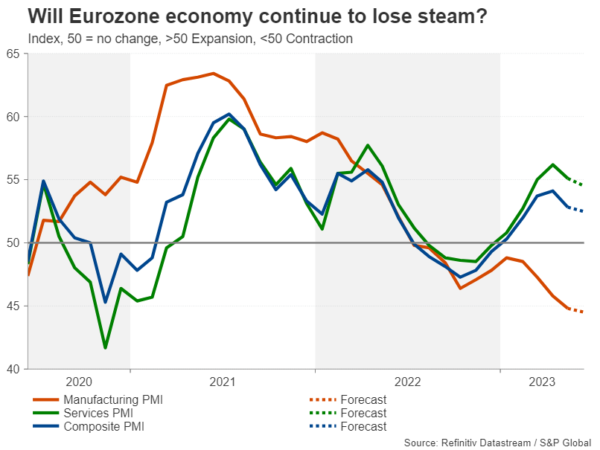

Will Eurozone PMIs soothe recession woes?

Across the channel, the flash PMIs will take centre stage in the euro area as doubts grow about the resilience of the bloc’s economy after revised GDP estimates put the Eurozone in a technical recession. So far, the recession tag hasn’t led to a significant shift in market expectations about further tightening from the European Central Bank as growth in Q1 was dragged lower by poor performance in a small number of countries, including Germany, but other economies continued to expand.

The preliminary PMI readings for June should give some idea as to whether this mild downturn is turning into something deeper or if economic activity in places like Germany is starting to rebound.

The euro could appreciate against the US dollar from any upside surprises in the manufacturing and services PMIs, especially after the ECB hiked rates this week and signalled they will have to go even higher, while the Fed kept its policy settings unchanged.

But against the Swiss franc, the single currency might struggle should the Swiss National Bank follow suit and lift rates next week.

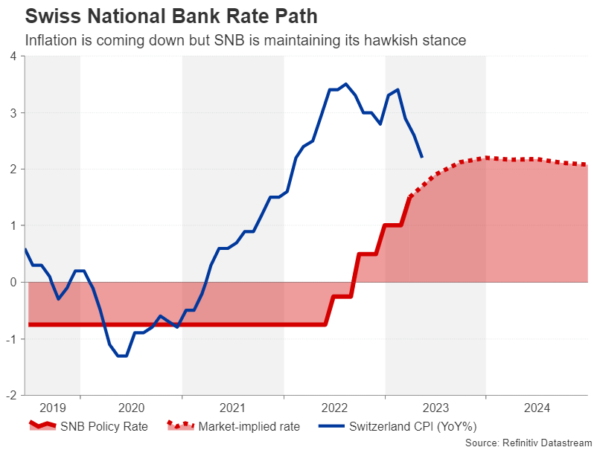

SNB not done raising rates

The odds of a 50-bps hike by the SNB on Thursday went up after unusually hawkish language from Chairman Thomas Jordan recently. The hawkish rhetoric comes despite the fact that inflation in Switzerland fell to 2.2% in May, much to the envy of other nations.

Nevertheless, the SNB doesn’t seem to think that policy is restrictive enough as it wants to see inflation fall below 2%. Policymakers might also be worried about the fall in CPI being temporary and considering that the SNB meets only four times a year, a 50-bps hike seems more likely.

If that turns out to be the case, the franc could enjoy strong gains as a 50-bps move is only about 60% priced in at the moment. Though the scale of the boost would depend on whether or not the SNB signals further tightening in the second half of the year.

Japan’s reflation still has some way to go

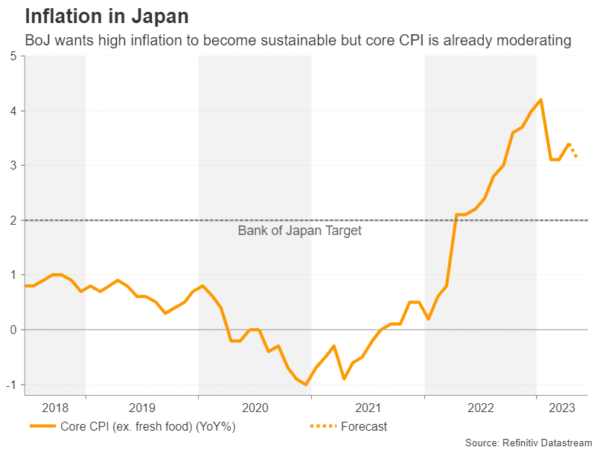

Another country where the inflation problem has been more manageable is Japan. After peaking at 4.2% in January, core CPI has eased somewhat, although it did edge up to 3.4% in April. It is forecast to have eased to 3.1% y/y in May when the data is released on Friday. From a policy perspective, inflation does not necessarily have to climb to new peaks for the Bank of Japan to think about changing course and it only needs to stay above 2% for an extended period of time.

For the time being, however, the Bank of Japan is maintaining its easing stance as it wants to be certain that the pickup in prices and wages is sustainable. This is reflected in the Japanese yen, which has tumbled sharply against major currencies this month.

Yet, with many traders thinking that it’s only a matter of time before the BoJ starts unwinding its massive stimulus, the yen could begin to show signs of life should a clearer pattern of persistent inflation begin to form. Also to watch out of Japan next week are Friday’s flash PMIs amid an upturn in economic growth lately.

Minor risks for the aussie and greenback

Staying in the region, the Australian dollar will be keeping an eye on monetary policy in both China and Australia. The People’s Bank of China will decide on Tuesday whether to cut its loan prime rates, following the recent 10-bps cuts to its medium-term lending facility and seven-day reverse repo rate. The Reserve Bank of Australia, meanwhile, will publish the minutes of its June policy meeting the same day.

The aussie has been on a roll lately, as the RBA pivots further to the hawkish side and Beijing steps up its efforts to stimulate the Chinese economy, which is the biggest market for Australian exporters. Further gains could be in store for the currency if the minutes reinforce bets for further rate hikes by the RBA and China sticks to its pledge to boost growth.

Finally, over in the US, it’s going to be a relatively quieter week, allowing traders some time to process the Fed’s decision to temporarily pause but pencil in two additional rate increases before the year end. Markets are not convinced the Fed will be able to deliver on this but Fed Chair Jerome Powell will get another chance to get his message across to investors when he addresses lawmakers for his semi-annual testimonies on Wednesday and Thursday. In data, housing figures due on Tuesday and Thursday, as well as S&P Global’s manufacturing and services PMI prints on Friday might shed some useful light on these key sectors of the US economy.