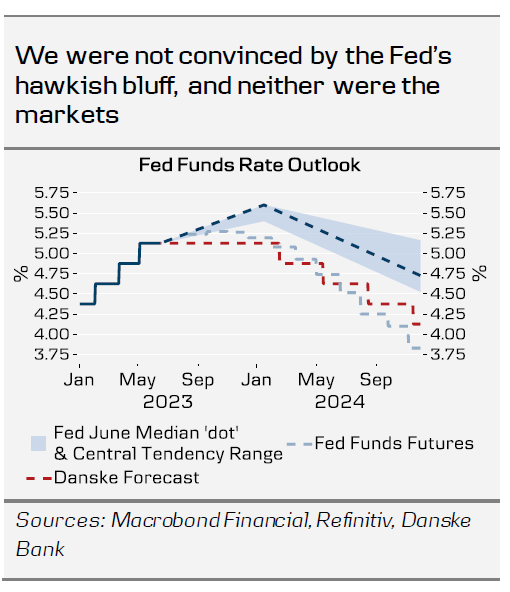

- The Fed held rates unchanged at 5.00-5.25% as widely anticipated. However, the updated ‘dots’ surprised hawkishly, signalling two more 25bp rate hikes.

- Between the lines, Powell did hint that the Fed is seeing underlying inflation cooling. While the strong macro data calls for hawkish communication, we doubt the rate hikes will end up materializing, and make no changes to our Fed call.

While the decision to pause rate hikes was widely anticipated, all eyes were on the communication regarding possibility of future rate hikes. The FOMC participants surprised hawkishly, as the median end-2023 Fed Funds forecast rose by 50bp to 5.50-5.75%.

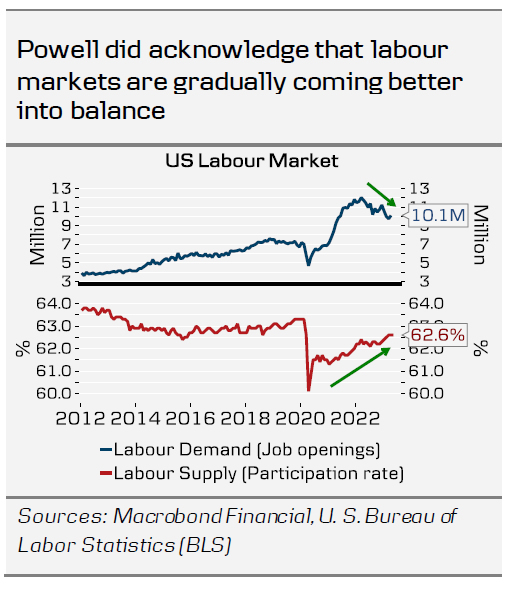

However, between the lines of Powell’s communication, one could still hear that the Fed is now seeing underlying inflation moderating. As we wrote in Global Inflation Watch, 14 June, wage-sensitive components of inflation especially in the broader services sector, have recorded a clear slowdown over the past months. Some slack is slowly building into the labour markets, evident in household employment declining by 310k in May. In Powell’s words, ‘the things we need for disinflation are coming into play’.

But the disinflationary process will be gradual, and as long as realized inflation stays high, the Fed needs to sound hawkish. Powell emphasized the Fed’s commitment to bringing inflation down, while firmly signalling the possibility of further hikes. But it will be up to the markets to call the Powell’s bluff, and as only 19bp is currently priced in by September, it does not seem like the message was all that convincing after all.

While financial conditions were not discussed in detail, we know from past minutes that FOMC participants are well aware of the inflation-prolonging risk of allowing financial conditions to ease prematurely, as was the case in early 2023.

The forecast for two more rate hikes relies on an optimistic growth outlook. The Fed sees 2023 GDP growth at 1.0% in Q4/Q4 basis (up from 0.4% in March), which is far from recessionary even after accounting for the strong start of the year. We do not consider such soft landing as impossible, but see risks tilted towards weaker, or modestly contractionary GDP development during H2. Furthermore, hiking rates further from here increases the risk of a hard landing down the line, which seems to be at odds with 2024 growth forecast being little changed (at +1.1%). As we wrote back in our May Fed Preview, 24 April, holding rates steady at the current restrictive level strikes the best balance between bringing inflation down, and avoiding a hard landing. We still think this holds today.

As such, we stick to our forecast, and expect no further rate changes this year. The risks are inarguably skewed towards at least one more hike, and the June Jobs Report and CPI will be the key to watch ahead of the July meeting, which will be ‘live’ according to Powell.

Initially, the hawkish pause weighed on the EUR/USD, but the knee-jerk reaction towards 1.0800 somewhat retraced during Powell’s speech. We stick to our strategic case for a lower EUR/USD in H2, as we expect relative growth differentials to favour the USD despite lower carry. We see the cross at 1.06/1.03 on 6M/12M. Tomorrow, potentially hawkish ECB could drive the cross higher, which could give rise to selling opportunities.