An inflation peak is not enough for central banks to stop raising interest rates. The Reserve Bank of Australia and the Bank of Canada resumed their rate hike strategy unexpectedly last week for the sake of their inflation target, having previously pledged a pause. The European Central bank (ECB) could follow suit on Thursday at 12:15 GMT, but the announcement might not surprise investors, with guidance on future rate increases likely attracting the most attention.

Pause not in sight as inflation remains elevated

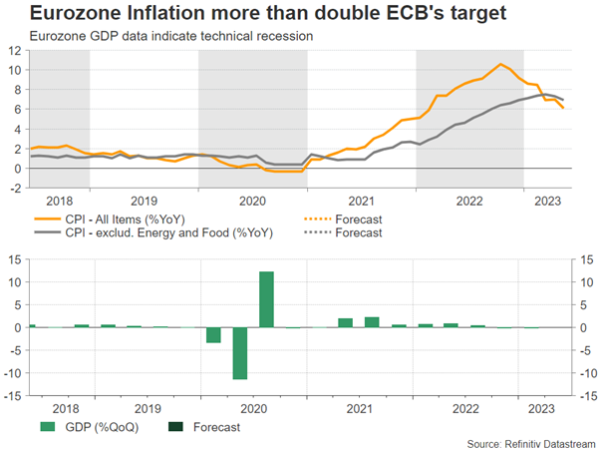

It’s hard to argue that the fight against inflation is over. Even though the CPI inflation figures are past their 2022 peaks in developed economies, they are still more than double the central banks’ targets. Many focus on the falling headline CPI, but the core measure, which is a better proxy of the inflation trend, has barely eased from its April peak of 5.7% y/y in the eurozone, flagging a permanent inflation risk that the ECB might struggle to overcome. Notably, the core measure, which excludes food, energy, and tobacco, has barely eased, arriving at 6.9% y/y recently.

Hence, ECB policymakers are reasonably sustaining a hawkish communication, with President Lagarde recently stressing the need to raise rates to levels sufficiently restrictive and keep them at those levels as long as necessary. She also highlighted the impact of some businesses profiting from high inflation by raising prices more than they have to and urged competition authorities to investigate.

Guidance important for euro

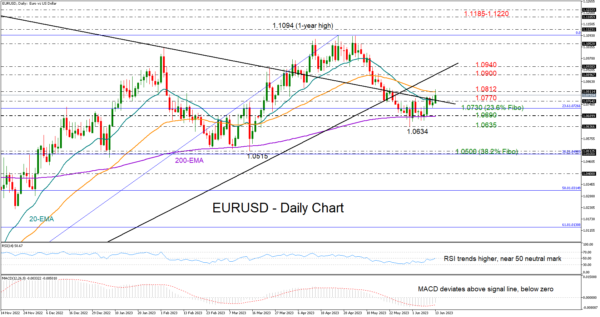

Another quarter percentage rate hike to 3.5% is currently looking like a done deal, and there is a negligible group of investors who are even thinking that the rate discussion may expand to a bolder 50bps rate hike. That suggests there is a lot of hawkishness priced in already, which could consequently leave little room for improvement for the euro.

Commentary on future policy actions, however, could still help euro/dollar extend its positive momentum and run towards the 1.0900 territory. Policymakers have clearly restated that the costs of doing too little is still greater than the costs of doing too much. Therefore, the negative GDP growth figures, which put the bloc in a technical recession, may raise some caution within the board but are not expected to prevent additional rate hikes in the coming months.

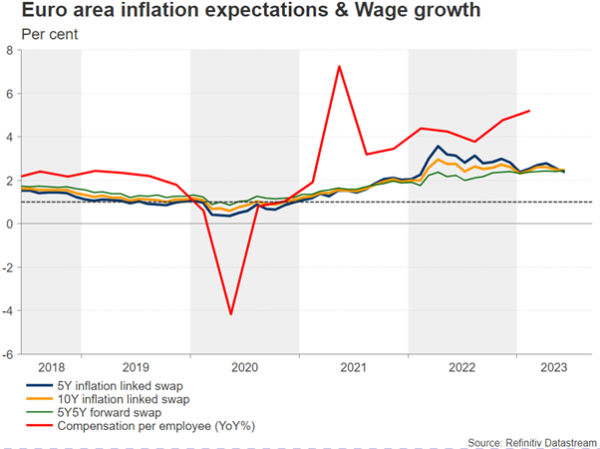

Investors anticipate an equal 25bps rate hike in July with a probability of 62% before a period of steady rates kicks in. Apparently, a repetition of the aggressive rate increases that took place over the past year could find little backing given the worsening economic picture and the falling household inflation expectations. Yet, policymakers may judge that acting now rather than later could be a safer option, especially as long as the labor market remains tight and wage growth trends higher. New economic projections, and specifically updated inflation forecasts, could provide more evidence on the central bank’s thinking.

Should the central bank lower its inflation estimates, signaling that a rate peak is closer than analysts believe, euro/dollar could erase its latest pickup to test its flattening 200-day exponential moving average (EMA) at 1.0690 ahead of May’s low of 1.0635. A decisive close lower could intensify selling pressures towards the 1.0500 floor.

Quantitative tightening

In other interesting topics, balance sheet talks could also come under the limelight. The ECB has been struggling to reduce the size of its huge balance sheet after the pandemic boost, leaving excess liquidity in money markets and making its monetary tightening less effective. It promised to accelerate quantitative tightening by reducing reinvestment from maturing securities at a faster pace of 25 billion euros in July compared to 15 billion euros before. Therefore, any extra details on the matter could make headlines, although that might be a story for the next policy meeting.