Wednesday October 18: Five things the markets are talking about

Regional equity bourses are providing mixed results as investors patiently wait for the next catalyst to deliver directional support. A plethora of central bankers are due to speak today (ECB’s Draghi, NY Fed Dudley and Dallas Fed President Kaplan), and a deadline on Catalonia’s independence claim from Spain is forthcoming.

Note: Catalonia has until tomorrow to back down from a challenge to separate.

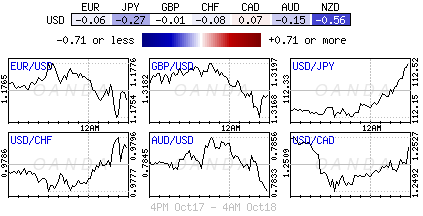

The ‘mighty’ dollar is little changed as the market continues to fixate on speculation about the next Fed head – volatility across G7 currency pairs is trading atop of a three-month low.

In China at the opening of the twice a decade 19th Chinese Party Congress, President Xi said that China “will push ahead with market-oriented reforms of its foreign exchange rate as well as its financial system, and let the market play a decisive role in the allocation of resources.”

Note: Later this evening, China will releases data for GDP, industrial production and retail sales.

1. Stocks mixed performance

In Japan, the Nikkei share average rallied for a 12th consecutive day overnight, finding support on hopes that this weekend’s election will produce political stability and continuation of loose monetary policy. PM Abe coalition is on track for a roughly two-thirds majority in this weekend’s general election. Both the Nikkei and broader Topix ended up +0.1% higher.

Down-under, Australia’s S&P/ASX 500 index ended flat, while South Korea’s Kospi index was little changed.

In Hong Kong, the Hang Seng index inched lower, while the Shanghai Composite Index was up +0.1%.

In China, blue-chip stocks ended at a 26-month high as party congress opens. Investors are pinning their hopes on reforms to boost domestic growth. The blue-chip CSI300 index rallied +0.8%, while the Shanghai Composite index added +0.3%.

Note: Despite investors seeking direction on economic and financial market reform over the next five-years, China’s leadership events historically have been light on detail.

In Europe, regional indices trade mostly higher across the board with the Spanish IBEX once again under performing, however, ranges again remain relatively tight.

U.S stocks are set to open unchanged.

Indices: Stoxx600 +0.2% at 391.3, FTSE +0.3% at 7537, DAX +0.3% at 13027, CAC-40 +0.2% at 5371, IBEX-35 -0.3% at 10184, FTSE MIB -0.1% at 22305, SMI +0.2% at 9292, S&P 500 Futures flat

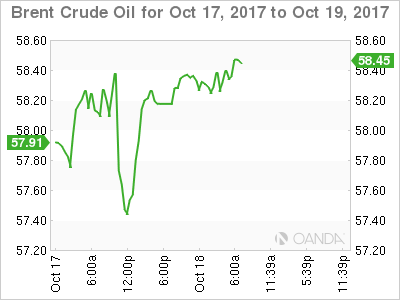

2. Oil prices rise on tighter U.S market, Middle East tensions, and gold lower

Oil prices have rallied overnight, lifted by a fall in U.S crude inventories and concerns that tensions in the Middle East could disrupt supplies.

Brent crude futures are at +$58.16, up +28c or +0.5% from their last close, while U.S West Texas Intermediate (WTI) crude futures are at +$52.03 per barrel, up +15c, or +0.3%.

Note: Trading volumes were limited during Asian hours due to a public holiday in Singapore, Malaysia and parts of India.

API data from the U.S Tuesday showed a big draw – inventories fell by -7.1m barrels in the week to Oct. 13 to +461.4m barrels.

Investors are expected to take direction from today’s EIA report (10:30 am EDT). The market is looking for another drawdown of -4.7m barrels.

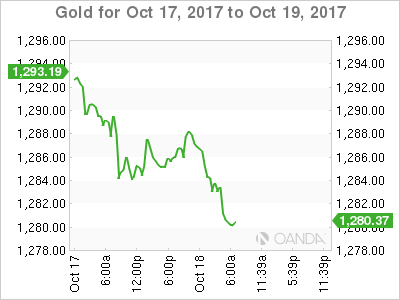

Ahead of the U.S open, gold prices remain on the back foot as the dollar strengthened a tad amid speculation that the next U.S Fed chief may be a policy hawk. President Trump is likely to announce his choice before going to Asia in early November. Spot gold is down -0.1% at +$1,283.16 an ounce.

3. Sovereign yield back up

Reports that President Trump might pick John Taylor to lead the Fed after Janet Yellen’s term ends next year has sent two-year U.S Treasury yields to their highest level in nine-years this week.

Taylor is an advocate of a rules-based approach to interest rate policy that would likely see official Fed rates much higher than at present – at least +3.5% according to some observers.

The back up in short-yields (U.S 2’s +1.53%) has not been matched at the long-end. The yield on 10-year Treasuries gained +1bps to +2.31%.

With no eurozone macro-economic data on tap, the German Bund market continues to focus on speeches by ECB officials ahead of next week monetary policy meeting (Oct 26).

Note: The market’s expectations on how the ECB will taper QE have shifted to a nine-month extension at +€30B of purchases per month, rather than the previously expected six-month extension at +€40B.

Germany’s 10-year Bund yields have increased +1 bps to +0.38%, while Spain’s 10-year yield decreased less than -1 bps to +1.578%.

4. Dollar’s tentative support

The ‘mighty’ USD is maintaining a steady bid tone with market participants continuing to focus on Trump’s appointment for the Fed Chair position.

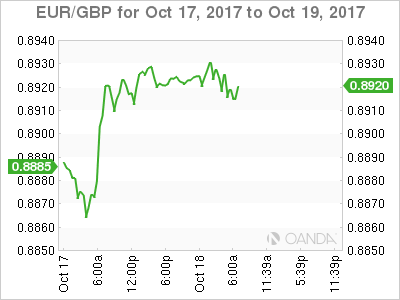

GBP (£1.3170) traders have been focusing on unemployment and earnings data out of the U.K this morning. The slight beat on hourly earnings has kept the door open for a possible BoE rate hike as soon as next month. The U.K’s unemployment data (see below), which is steady, did provide some underlying support, however, Brexit discussion concerns continue to provide the pound with resistance.

The EUR/USD (€1.1747) is little changed in the session, as ECB chief Draghi provided no clues on monetary policy ahead of next week’s rate decision. USD/JPY (¥112.73) is higher with focus on the upcoming Japanese elections (Oct 21/22) seen as maintaining its Abenomics path to recovery.

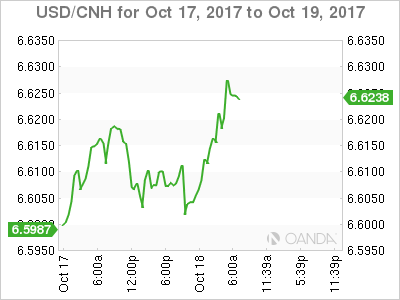

CNY is a tad firmer as Chinese President Xi pledged to deepen reforms in his address at the 19th Party Congress.

5. U.K real wages fall, job growth peaks

Data from the ONS (Office of National Statistics) revealed that real wages in the U.K fell in August for the fifth month in row. Wage growth after inflation in August was -0.3% as inflation once again outpaced pay increases.

Other data suggests that the U.K’s buoyant job growth may be coming to an end. The number of people in work in the month of August was -108k fewer than in May, while there were +208k more people saying they were not looking for work.

Note: Monthly labor market statistics can be volatile. The ONS puts more emphasis on three-month averages, which continued to show gains in employment and a decline in inactivity in the three months through August.

Nevertheless, many continue to question how the U.K could sustain its growth streak given a slowing economy and uncertainty around Brexit.