The U.S. Federal Reserve (Fed) looks likely to pass on raising interest rates next week—though policymakers are talking about a “skip” rather than a pause. The U.S. unemployment rate ticked higher in May, and job openings have continued to fall. But labour markets are still exceptionally tight and have been more resilient than expected despite higher interest rates. Still, it takes time for tighter monetary policy to impact the economy and there are signs that inflation pressures are easing, even if it’s happening more slowly than policymakers would like.

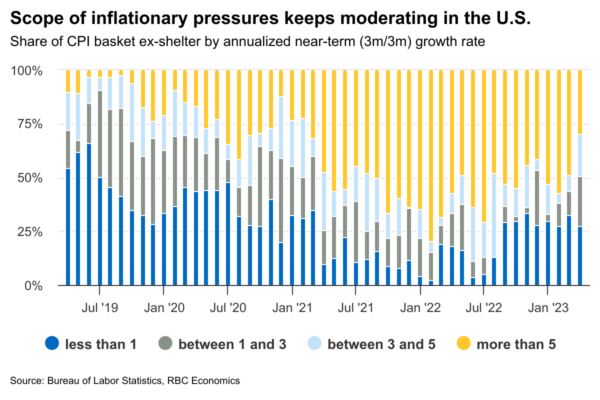

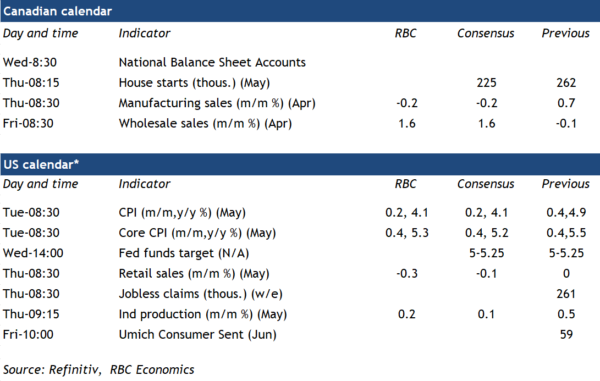

We expect year-over-year growth in the U.S. consumer price index (released a day ahead of the Fed’s rate decision) to slow substantially to 4.1% in May from 4.9% in April. Gas prices were 20% below year-ago levels in May. Oil prices are down after surging in the wake of Russia’s invasion of Ukraine. And soaring food inflation has cooled in recent months with back-to-back month-over-month declines in grocery prices over March and April. Slower food price growth should continue as supply chain pressures ease, and commodity and transport cost all move lower. Rent costs that drove core (ex-food & energy) price growth higher look to have turned a corner as an earlier decline in current market rent price growth ripples through to new leases. The share of goods and services with abnormally high inflation slowed over the spring. And the New York Fed’s inflation persistence index (based on PCE price deflators) also showed a significant deceleration in April. Still, progress has been slow and inflation pressures are still running well above the Fed’s 2% inflation target, making another rate hike in July look likely—even if the Fed takes a pass on a hike next week.

The impact of interest rate increases should be evident in next week’s Canadian National Balance Sheet Accounts data. The debt service ratio (the share of disposable household incomes eaten up by debt payments) almost certainly continued to rise in Q1 of this year—and we expect it to hit a record by the end of 2023. The Bank of Canada ended its conditional pause with a surprise 25 bp hike this week, citing a growing risk that inflation “could get stuck materially above the 2% target” amid persistent excess demand. But higher debt payments and prices are still likely to cut deeply enough into household purchasing power to slow consumer spending and ease inflation pressures over the second half of 2023.

Week ahead data watch

Manufacturing sales in Canada are expected to have declined by 0.2% in April despite strength in motor vehicle shipments, according to an advance estimate from Statistics Canada. That’s not the only soft spot in April. Oil production was flat on a seasonally adjusted basis month over month and the PSAC strike likely subtracted 0.3% from growth. We continue to expect a softer turnout for April GDP than the preliminary 0.2% growth reported by Statistics Canada.

U.S. retail sales likely edged lower in May on lower auto sales and a decline in gasoline prices. Industrial production likely edged higher in May on a weather-related increase in utilities output. Manufacturing hours worked were little-changed in May.