The economy’s resilient start to 2023 likely has the Bank of Canada actively considering raising interest rates next week. But we think it will ultimately maintain the pause in hikes that began in January, keeping the overnight rate steady at 4.5% for now. The advance estimate of April GDP bounced back sharply after little growth in February and March (controlling for the impact of the large federal workers strike in April). Growth in the first quarter also came in slightly firmer than expected this week thanks to still strong consumer spending and a big boost from exports. So far this year, unemployment hasn’t budged from exceptionally low levels. Home resale markets look like they bottomed out earlier than previously feared, and inflation surprised on the upside in April.

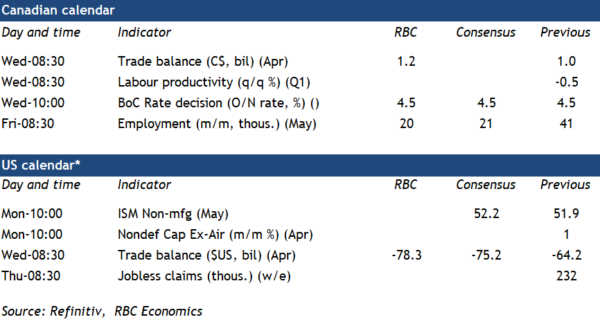

Still, there are signs that cracks are forming under the surface. Labour markets are still running strong, partly due to a surge in population growth that’s increasing both consumer demand and available labour supply. We expect May employment in Canada to post another increase of 20,000, building on the ~250,000 surge between January and April. But the unemployment rate is still expected to tick higher, as the amount of ‘excess’ labour demand continues to ease. Job vacancies are down almost 20% from peak levels as of March, consumer delinquencies have been edging higher, and worker quit rates have been slowing in recent months..

The 425 basis points worth of BoC rate hikes since March 2022 will ultimately take a broader toll in the form of higher unemployment and lower GDP—even if it’s taking longer than previously thought. But with inflation still running hot, the BoC won’t be able to wait too long if recent positive momentum persists. Two additional employment reports, one more inflation report, and the always closely-watched Business Outlook Survey will all be released in between policy decisions in June and July. Further signs that higher interest rates aren’t slowing the economy as expected would tip the scales towards a hike in July, even if the BoC opts to stick with its pause next week.

Week ahead data watch

The Canadian trade surplus likely edged slightly higher in April. An increase in oil prices (subsequently reversed in May) will raise the value of April exports more than imports. Imports of consumer goods (soft in March, but in part due to reversal of an earlier surge in pharmaceutical imports) and equipment imports will be watched closely for any signs domestic demand is softening.

Previously released advance estimates for the U.S. goods trade balance showed a widening deficit, from US$82.7B in March to US$96.8B in April driven by lower exports. We look for a wider U.S. trade deficit in April, with total exports declining by 3.7% and imports rising 1.4%.