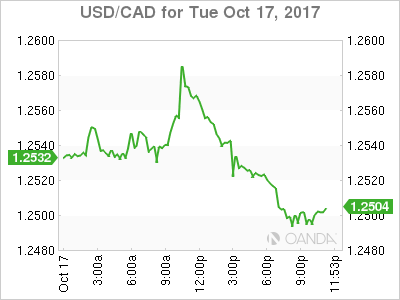

The Canadian dollar depreciated against the US dollar on Tuesday as the NAFTA negotiations intensify. The American, Canadian and Mexican negotiation teams will deliver a joint statement at 3pm EDT. The US has made proposals that are expected to be rejected by Canada and Mexico, but neither will walk out of the negotiations. The two proposals focus on American content in autos to be increased and to introduce a five year expiry date to the deal.

The Trump administration has made it clear it would prefer to have two bilateral trade agreements, but ending NAFTA would be a economic disaster in the short term, and with looming elections in Mexico and the United States there is no clear timeline of when that would occur. For the time being negotiations are planning to expand the duration of the talks beyond the 5 day sessions.

Canadian mortgage rules were announced today and will take into effect in 2018. The intent of the rules is to require more stress tests on uninsured mortgages. The move is designed to reduce the debt load Canadian households are putting on, but critics point out that it could also lead to pushing borrowers to riskier lenders.

The USD/CAD gained 0.28 percent on Tuesday. The currency pair is trading at 1.2545 heavily influenced by NAFTA comments. The US team is playing hardball and Canada and Mexico will not give any concessions this early even as the window to wrap up renegotiations before the end of the year is fast approaching.

The Canadian economy would be hard hit by a sudden end of the 23 year old trade treaty. The same applies to the Mexico and the United States, but hard stats have taken a back seat to politics and more important optics.

The economic calendar this week won’t feature any major releases for the United States. Canadian data will be scarce with the main events the release of inflation data and retail sales on Friday, October 20 at 8:30 am EDT. The lack of solid economic data leaves the pair vulnerable to shifts in the political arena putting more weight on the NAFTA comments this week.

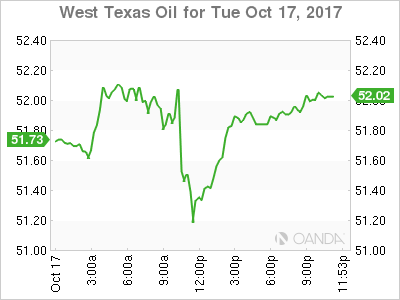

West Texas Intermediate is trading at $51.61. The price of crude rose as tensions intensified in Northern Iraq. Earlier today the Kurds retreated from Kirkuk and oil disruptions should be limited. Interruptions to the global oil supply have been the main drivers of the lift in oil prices. Social and political unrest in some oil producers, but also the landmark production cut agreement between Organization of the Petroleum Exporting Countries (OPEC) and other major suppliers.

The market will be watching the release of the weekly US crude inventories on Wednesday, October 18 at 10:30 am EDT. The report by the Energy Information Administration (EIA) is forecasted to show another major drawdown of around 4.7 million barrels.

Market events to watch this week:

Monday, October 16

5:45pm NZD CPI q/q

8:30pm AUD Monetary Policy Meeting Minutes

Tuesday, October 17

Tentative GBP BOE Gov Carney Speaks

4:30am GBP CPI y/y

Wednesday, October 18

4:30am GBP Average Earnings Index 3m/y

8:30am USD Building Permits

10:30am USD Crude Oil Inventories

8:30pm AUD Employment Change

10:00pm CNY GDP q/y

10:00pm CNY Industrial Production y/y

Thursday, October 19

4:30am GBP Retail Sales m/m

8:30am USD Unemployment Claims

Friday, October 20

8:30am CAD CPI m/m

8:30am CAD Core Retail Sales m/m

7:15pm USD Fed Chair Yellen Speaks