- USD/CNH (offshore yuan) has surged to a 6-month high of 7.08.

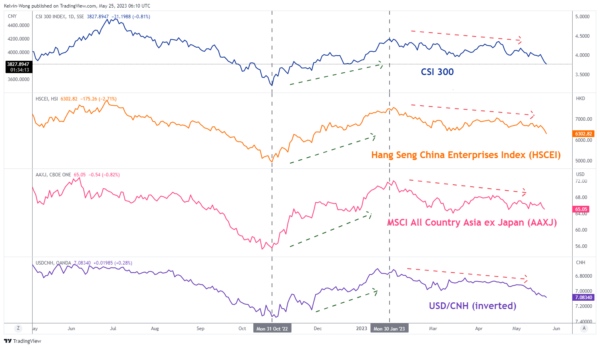

- Since late Oct 2022, the movement of USD/CNH has had a high degree of correlation with China and Asia ex-Japan equities.

- Positive momentum factor remains intact for USD/CNH which may add further potential headwinds for China and Asia ex-Japan equities.

The earlier “China re-opening theme play” gains of +20% to +56% that were seen in the China benchmark stock indices and its proxies (such as CSI 300 & Hang Seng China Enterprises Index) from late October 2022 have almost been reduced by 50% till to date. In addition, the CSI 300 and HSCEI 2023 year-to-date returns as of 25 May have slipped to negative territory with losses of -0.8% and -5.6% at this time of the writing; the worst performers among the major developed countries’ benchmark stock indices.

The key reasons for such weakness have been lackluster leading economic data out from China and the “inaction” of PBoC to implement more accommodative monetary policies. More details were highlighted in our previous analysis, “China equities bulls in need of fresh liquidity”, click here to read.

A weakening yuan is adding another layer of headwinds for China equities & rest of Asia ex Japan

The fate of the other Asia Pacific (excluding Japan) stock indices is directly intertwined with the performance of the China stock market since late last year due to the positive feedback loop from the “China re-opening theme play” narrative that will eventually lead to an increase in exports trading volume and tourism activities.

But once this feedback loop turns negative, it tends to have an opposition adverse effect on the Asia Pacific benchmark stock indices where the MSCI All Country Asia ex Japan Index saw its initial 2023 year-to-date gain of +13% dwindled to +0.40%.

Fig 1: Correlation between CSI 300, HSCEI, MSCI All Country Asia ex Japan & USD/CNH as of 25 May 2023

(Source: TradingView, click to enlarge chart)

One of the other drivers of the weak underperformance of the China stock market and its proxies has been the speed of the downside momentum of the Chinese currency, the yuan against the US dollar (yuan weakness) where the offshore USD/CNH has staged a rally of 2.4% in the recent three weeks to hit close to a 6-month high of 7.08.

People’s Bank of China (PBoC) seems to be tolerant of the current bout of yuan weakness

Also, the Chinese central bank, PBoC seems to be comfortable with the current bout of yuan weakness as indicated by its current mode of operation.

Despite a statement issued by PBoC last Friday, 19 May that stated the Chinese central bank together with the foreign exchange regular will “strengthen market expectation guidance and take actions to correct pro-cyclical and one-way market behaviours when necessary”.

A hint that has suggested PBoC “does not desire one-way speculative bearish bets on the yuan” but the daily fixing on the onshore yuan (USD/CNY) reference rate as seen in the recent two weeks stated otherwise, it has been in line with market forces; gradually moving up above the 7.00 psychological level and in the last five days hovered between 7.0157 to 7.0560.

Hence, the current actions of PBoC seem to be allowing more leeway for the yuan to move in line with broad-based US dollar strength seen at this juncture.

USD/CNH Technical Analysis – Holding above 50-day moving average with upside momentum intact

Fig 2: USD/CNH trend as of 25 May 2023 (Source: TradingView, click to enlarge chart)

The downside momentum of the yuan may continue to persist where a further rally in the offshore USD/CNH cannot be ruled out in the coming weeks with the next key medium-term resistance zone coming in at 7.1445/7.1730 (see chart above). Thus, if such a base case scenario unfolds, we cannot rule out further potential weakness at least in the near term for China and Asia ex-Japan equities.