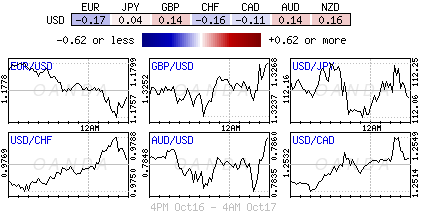

The ‘mighty’ U.S dollar has found some tentative support as investor speculation climbs on the back of the next Fed head being more ‘hawkish.’

John Taylor, a candidate for Fed chair is known for a policy rule that would suggest higher interest rates, was said to have impressed President Trump in an interview last week. The President is to reportedly formally interview Fed Chair Yellen later this week.

Elsewhere, ongoing geopolitical risks (N. Korea, Spain’s Catalan region and Brexit) has convinced many equity investors to consider taking a ‘time-out.’ Regional equity bourses are seeing mixed results as N. Korea warned that a nuclear war could ‘break out any moment,’ while in Europe, investors await the next move in the standoff over independence for Catalonia, while in the U.K Brexit talks could be headed for a breakdown.

Note: Bank of England (BoE) Governor Carney appears before the U.K Parliament’s Treasury Committee for the first time since June’s election this morning (06:15 am EDT).

A host of Fed speakers and the publication of the Beige Book this week may provide further clues about the U.S policy path – Philly Fed Harker today, and NY President Dudley and Dallas Fed Kaplan tomorrow.

1. Stocks pause atop lofty heights

In Japan, the Nikkei share average rallied for a 11th consecutive session as a stable yen (¥112.17) supported exporters, while expectations that Abe’s ruling bloc will win the election this weekend continues to underpin sentiment. The Nikkei ended +0.4% higher, while the broader Topix was up +0.2%.

Note: A survey Monday showed that Japanese PM Abe’s ruling coalition is on track for a big win in Sunday’s general election.

Down-under, Australia’s S&P/ASX 200 Index rose +0.7% and South Korea’s Kospi index was up +0.2%.

In Hong Kong, stocks were little changed in quiet trading as investors wait for China’s Communist Party congress to begin and Q3 Chinese economic data this week. The Hang Sang index was unchanged, while the China Enterprises Index lost -0.3%.

In China it was a similar situation, stocks ended little changed overnight as investors awaited economic data and a major leadership summit this week. The blue-chip CSI300 index was unchanged, while the Shanghai Composite Index lost -0.2%.

In Europe, regional bourses are trading slightly lower across the board as indices retreat from recent highs.

U.S indices closed Monday at another all time high, although volume continues to be light amid lack of volatility.

U.S stocks are set to open unchanged.

Indices: Stoxx600 -0.1% at 391.1, FTSE -0.2% at 7515, DAX -0.1% at 12996, CAC-40 -0.2% at 5354, IBEX-35 -0.4% at 10144, FTSE MIB -0.5% at 22317, SMI -0.2% at 9256, S&P 500 Futures flat.

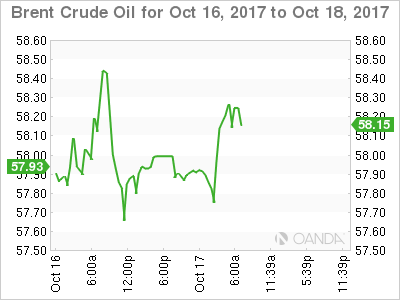

2. Oil rises as Iraq fighting shuts output in Kirkuk, gold lower

Crude prices rallied +1% Monday as Iraqi forces entered the oil-rich city of Kirkuk, seizing territory from Kurdish fighters and briefly cutting some crude output from OPEC’s second-largest producer.

Note: Iraqi Kurdistan briefly shut down some +350k bpd of production from the major Bai Hassan and Avana oilfields due to security concerns.

Brent crude futures settled up +65c Monday, or +1.1% to +$57.82 per barrel while U.S crude ended up +42c, or +0.8% higher at +$51.87 per barrel.

Also supporting prices are renewed worries over U.S sanctions against Iran. President Trump on Friday refused to certify that Tehran was complying with the accord even though international inspectors say it is.

Note: During the previous round of international sanctions, roughly -1m bpd of Iranian oil was cut off.

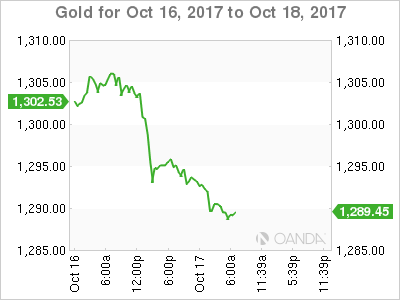

Gold prices trade on the back foot, pressured by a firmer dollar, however, investor worries over geopolitical tensions in the Middle East and on the Korean peninsula is managing to keep these losses in check. Spot gold is down -0.4% at +$1,289.20 an ounce.

3. Sovereign yields back up

Reports that President Trump might pick John Taylor to lead the Fed after Janet Yellen’s term ends next year has sent two-year Treasury yields to their highest in nine-years.

Taylor is an advocate of a rules-based approach to interest rate policy that would likely see official Fed rates much higher than at present – at least +3.5% according to some observers.

The back up in short-yields (U.S 2’s +1.53%) has not been matched at the long-end. The yield on 10-year Treasuries gained +1bps to +2.31%.

In the U.K, inflation data this morning (see below) has bolstered the chances of the BoE’s first interest rate hike in over a decade next month. U.K’s 10-year yield has rallied +2 bps to +1.336%.

Elsewhere, in Germany, 10-year Bund yields have increased +1 bps to +0.38%, while Spain’s 10-year yield decreased less than -1 bps to +1.578%.

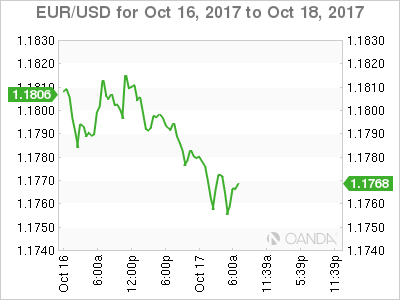

4. Dollar finds tentative support

The EUR (€1.1783) has fallen to its lowest levels in a week overnight on reports that Fed chief candidate John Taylor made a good impression on Trump. Also providing pressure for the ‘single unit’ are reports that Spain is preparing to replace Catalan security officials. Outright, the EUR is down -0.3%, while against sterling, the unit is trading atop of its two-week lows (€0.8873).

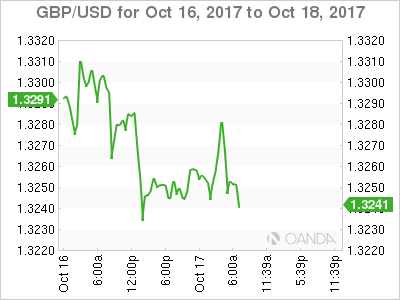

The pound (£1.3247) continues to trade below the psychological £1.33 handle despite U.K Oct CPI coming in-line with expectations (see below) – the highest annual pace since Apr 2012, keeping t expectations that Governor Carney could raise BoE’s interest rates in November.

5. UK inflation keeps BoE hike on track

Data this morning showed that British inflation rose to its highest level in more than five years last month and would suggest that the Bank of England (BoE) is on track to tighten rates next month.

The Office for National Statistics (ONS) said that consumer prices last month were +3.0% higher than a year ago.

Digging deeper, the rise is been driven largely by rising food prices and transport costs. Despite the U.K’s economy slowing this year, the BoE has repeatedly signalled that interest rates are likely to rise.

Note: Rising inflation – driven largely by the pound’s fall since the Brexit vote – is squeezing household incomes, causing broader economic growth to slow, as wages have failed to keep pace with the rising cost of living.