Market picture

The total crypto market capitalisation is down 1.7% over the last 24 hours to $1.13 trillion. Bitcoin is down 1.6%, Ether is losing 1%, and among the top altcoins, only Litecoin and Tron show positive dynamics, adding around 0.8%.

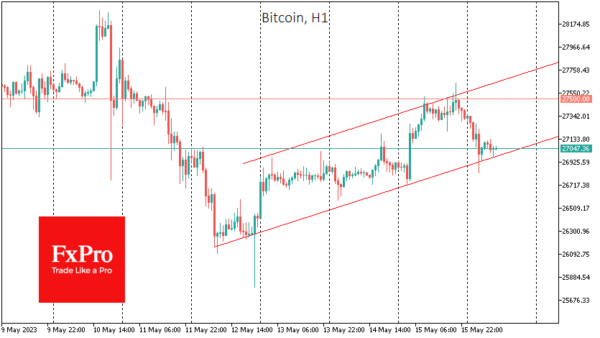

Bitcoin’s advance on Monday stopped near $27.5K, and at the time of writing, the price has rolled back to $27K, the lower boundary of last Friday’s short-term uptrend channel. A break below $ 26.7K could put more pressure on the cryptocurrency.

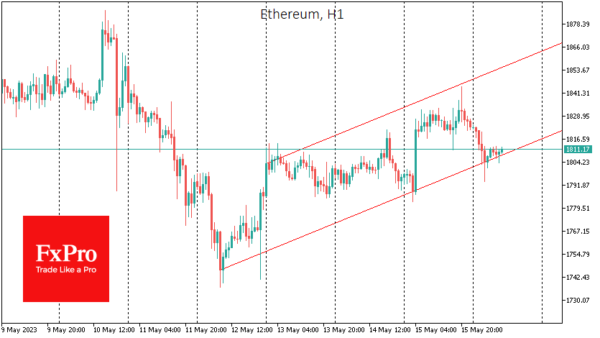

There is also a similar short-term channel in ETHUSD, and a failure from the current $1,810 to $1,780 would mark a new short-term victory for the bears, potentially triggering a downward spike.

According to CoinShares, investments in crypto funds fell by $54 million last week, the fourth consecutive week of outflows. Bitcoin investments fell by $38 million, while Ethereum rose by $0.1 million. Investments in bitcoin short funds fell by $10 million.

News background

According to a Bloomberg survey, Bitcoin has become one of the three most attractive assets amid default risk in the US. About 10% of US investors said they would hedge their risks by buying the first cryptocurrency. The first two positions were taken by gold and US government bonds.

According to Kaiko, the correlation between Bitcoin and Ethereum exchange rates has declined for over two months and fallen below 80%. This is the lowest level in a year and a half. This is due to the banking crisis in the US, which has led to an increase in investment in safe-haven assets, including BTC.

According to Glassnode, the number of investors with 1 BTC or more has exceeded one million.

The popularity of Bitcoin Ordinals and BRC-20 tokens will fade in a few months as they overload the blockchain and lead to higher transaction fees, says JAN3 CEO Samson Mow.