The next batch of economic indicators out of China are due on Tuesday (02:00 GMT) and after some dismal numbers recently, all eyes will be on the industrial output and retail sales releases for April. Fears have been running high lately that the post-pandemic recovery in China is stuttering as the country transitions from a high-growth to sustainable-growth economy. The concerns have added to broader recession risks globally, weighing on market sentiment. Thus, any positive surprises could buoy risk appetite.

Where did the recovery go?

China’s economy made a solid comeback in the first three months of the year following the removal of all Covid curbs back in December. However, the upbeat GDP print was greeted with some scepticism as investors were unconvinced whether there were enough drivers other than the reopening effect to maintain momentum beyond the first quarter. Those persisting concerns appear to be materializing as the data available to date for April is far from encouraging.

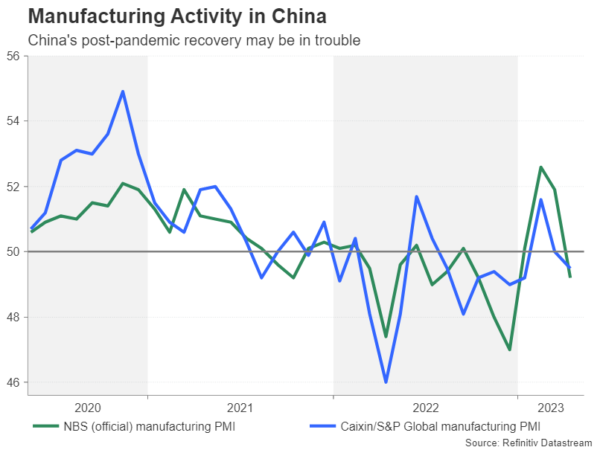

It all started with the manufacturing PMIs, as both the government’s and the Caixin/S&P Global surveys indicated that the sector contracted in April. Trade data for the month seemed to support the deteriorating trend. Export growth moderated in April, while imports plunged by 7.9% y/y, declining for a second straight month amid lower demand for commodities such as oil, copper and iron ore.

Most recently, inflation figures showed factory gate prices fell deeper into deflationary territory in April, suggesting that demand for industrial and manufactured goods is weakening rather than improving. Consumer prices were also subdued, with the annual increase in CPI slowing to just 0.1%.

An April bounce might be misleading

But there may be better news on the way from the next set of figures, based on the forecasts that is. Year-on-year growth in fixed asset investment likely quickened slightly to 5.2% between January and April. In the first quarter, much of the investment was driven by government spending so investors will want to see evidence of private investment picking up.

Industrial output made a modest rebound in Q1 and was up 3.9% y/y in March. It is expected to have surged by 10.1% in April. The recovery in consumer spending has been much stronger and retail sales are forecast to have jumped by 20.1%, accelerating from a 10.6% increase in March.

Unfortunately, as spectacular as both these forecasts are, there’s good reason to be cautious as the numbers are being skewed from a dip in April last year due to the lockdowns. It might therefore be difficult to draw too many conclusions about the state of the recovery in April. Yet, with markets going through a jittery phase amid the heightened fears of a global recession, any surprises could spark some volatility in equity markets, particularly in Asia, as well as for the risk-sensitive Australian dollar.

Rangebound aussie is looking for a breakout

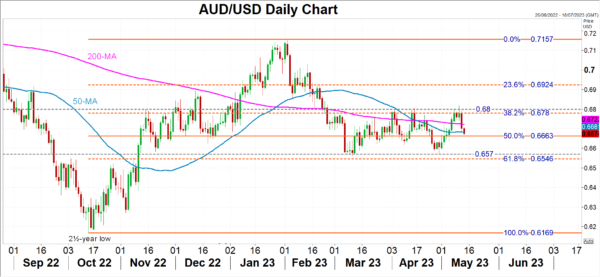

The aussie has been finding it tough to crack the $0.68 handle and it’s by no means certain that stronger-than-expected data out of China on Tuesday would be enough to achieve an upside break.

On the other hand, with any disappointing numbers not only hurting the aussie for domestic reasons – as China is Australia’s biggest export market – but also boosting the US dollar for its safe-haven attributes, the pair could re-test the current range floor at around $0.6570 in the negative scenario.

Government is under pressure to do more

Looking at credit growth, financial instructions gave out fewer loans in April despite being under pressure from authorities to lend more, in another sign of a weak start to Q2. This could just be a natural drop after the massive expansion in credit in the first few months of 2023, but that won’t allay much worries about a slowdown. Although the People’s Bank of China (PBOC) has been injecting plenty of liquidity into the financial system, it has been reluctant to use other tools such as cutting interest rates.

The government as well has been treading carefully when it comes to stimulating the economy so as not to risk inflating the country’s already high debt-to-GDP ratio. Unless Beijing steps up with its promised structural reforms, it may be hard for investors to get too optimistic about the outlook.