U.S. Highlights

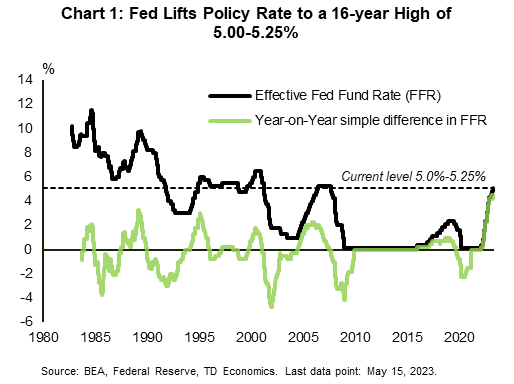

- The Federal Reserve hiked the policy rate 25 basis points this week, lifting it to a 16-year high of 5.00-5.25%. Changes in FOMC statement hinted at the potential for a pause, though Chair Powell stated that such a decision had not been made.

- The banking stress continues to fester, with this week marking the failure of another bank (First Republic).

- Though still slowing on a trend basis, hiring ticked up in April, with the economy adding 253k jobs. That was above market expectations for a gain of 180k, but downward revisions to the prior months tempered the optimism.

Canadian Highlights

- Oil prices slid this week on growth concerns, pressuring equities lower. However, we think that oil prices will ultimately rise as the year wears on.

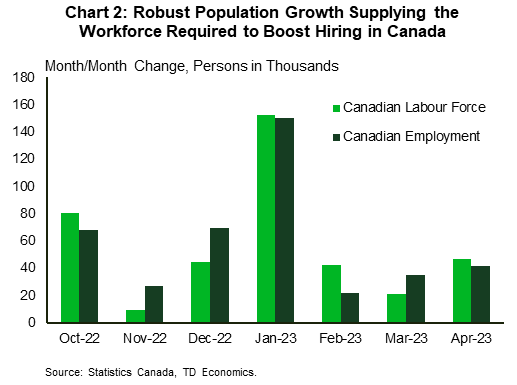

- This week’s data flow skewed positive, highlighted by a jobs report where headline employment growth was healthy. However, job markets didn’t tighten further, as labour force growth was also robust.

- The jobs report reinforced our view that the Bank of Canada will likely keep interest rates unchanged this year, as it showed that healthy job gains can manifest without materially tighter conditions.

U.S. – Fed Lifts Policy Rate to a 16-year High

The Fed followed through with its highly anticipated decision to hike the policy rate by 25 basis points (bps) this week. This lifted the fed funds rate to 5.00-5.25% – the highest level in 16 years – in what has been a historically aggressive hiking cycle (Chart 1). Changes in the FOMC statement hinted at the potential for a pause, so this could very well be the last hike of this cycle. But, stating this explicitly would not serve the Fed well at this point. In the press conference, Chair Powell tried to keep his options open, stating bluntly that a decision on a pause had not been made.

The Fed’s communication is at odds with market expectations. Markets are dismissing the possibility of further rate hikes and are instead signaling that after a brief pause the Fed will begin cutting rates. Market odds as tracked by the CME Group point to 75 bps in cuts over the last few months of the year. Asked about this divergence, Powell pushed back against the notion of soon-to-come cuts. In his words, the reasoning is that the Fed sees inflation coming down “not so quickly”, and that if that outlook proves to be broadly correct then “it would not be appropriate to cut rates”.

Fed Chair Powell noted that upcoming policy rate decisions would ultimately be data-dependent, mentioning the usual suspects (i.e., inflation and labor market metrics), while also putting a focus on credit conditions. Tighter credit conditions ultimately serve a similar purpose to rate hikes when it comes to cooling economic growth and inflation. This is something that the Fed considers in setting monetary policy, especially in light of the recent banking stress, with this week marking the failure of another regional bank. Powell had access to the Senior Loan Officer Opinion Survey (SLOOS), due to be released publicly on Monday, and noted that it would show a tightening in credit conditions among small and medium sized banks.

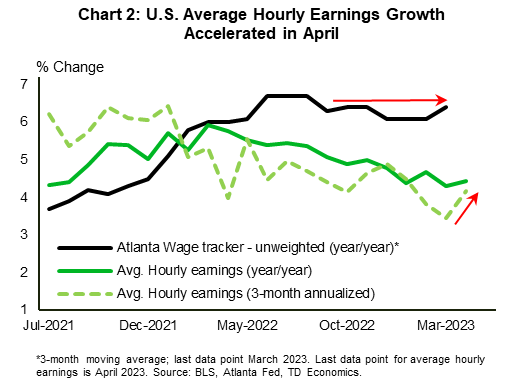

Factoring in the banking stress and tighter credit conditions suggests that the Fed has done enough, but labor market resilience continues. On the one hand, the pace of job creation continues to trend down on a three-month moving average basis. On the other hand, it’s hard to discount the strength in the April jobs report. The economy added 253k jobs last month – well above expectations for 180k. Gains were concentrated in service sectors (+197k). The labor force participation rate held flat at post-pandemic high of 62.6%, while the unemployment rate ticked down to 3.4%, matching January’s multi-decade low. Amidst the ongoing tightness in the labor market, growth in average hourly earnings accelerated both on a year-on-year and month-on-month basis, while other wage measures also point to some resilience (Chart 2).

Should the strength seen in April extend in the months ahead, it could push the Fed to hike a bit more. However, other labor market indicators – such as job openings, which are trending down, and initial jobless claims, which continue to trend up – are not in tune with this view. All told, the upcoming data will continue to bear careful watching, with next week’s CPI report next under the magnifying glass.

Canada – Canada’s Goldilocks Jobs Market

In a week that was chock full of U.S. developments, Canadian markets largely took their cues from south of the border. Pessimism reigned for much of the week, as investors fretted over the economic outlook, on-going turmoil in the U.S. banking sector, and unsettling news that the so-called “x-date” on the U.S. debt ceiling could be fast approaching. At one point, the Canadian 10-year bond yield had fallen about 30 bps from its Monday high. However, much of this gloom was undone at the end of the week by a pair of solid job reports in the U.S. and Canada. This shift in sentiment wasn’t enough to pull WTI higher, as it slid about 7% this week (as of writing). However, we see it rising through the rest of the year, supported by Chinese economic growth.

As for the Canadian economic outlook, this week’s data reinforced the narrative that near-term resilience is in the cards, despite some indications that activity could be easing. On the negative side, the Canadian manufacturing PMI indicated only modest growth in April, and forward-looking indicators were soft. In addition, import volumes fell again in March, suggesting flagging domestic demand.

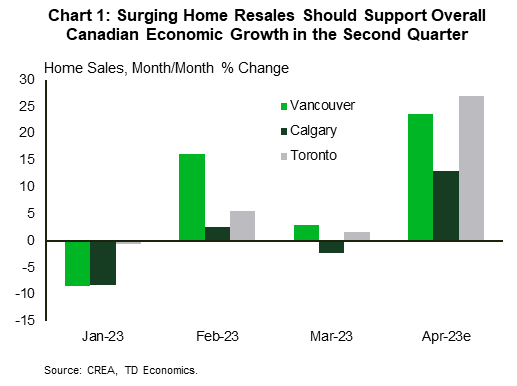

On the other hand, housing data from local boards released during the week pointed to surging home sales in April (Chart 1). This result was supported by lower interest rates, solid job markets and the jolt to buyer psychology sent from a central bank that’s currently on pause. Furthermore, the rapid run up in interest rates had pushed sales to levels far below any reasonable long-run trend – given fundamentals (like household income) – and so some recovery to trend is likely to continue.

However, what’s most germane for the outlook is the fact that Canada’s jobs market continues to be firm. This morning’s employment report showed that 41k net new positions were added last month and that solid growth was recorded in highly cyclical industries. Hours worked even managed to climb 0.2% m/m, despite job gains being driven by part-time work. It also helped that the federal worker’s strike fell outside of the survey week. Notably, the strike ended this week and while it should weigh on GDP growth in April, a bounce back in May will likely follow.

Strikingly, what would have been considered a very robust headline employment in the past didn’t flow through to a materially tighter job market. Indeed, the unemployment rate was unchanged and wage growth (while remaining robust) decelerated slightly during the month. This speaks to yet another solid gain in Canada’s labour force (Chart 2) which, in turn, is being driven by robust population growth.

In terms of the outlook for interest rates, the jobs report makes us more confident in our view that the Bank of Canada will keep its policy rate unchanged this year. On the one hand, the positive indications for growth flowing from the report argue against the notion of rate cuts. On the other, the fact that healthy job growth didn’t result in a tighter labour market likely discourages any lean towards tighter policy.