- China equities & its proxies are resilient against a lacklustre macro environment.

- Sentiment-driven animal spirits are playing a key role in the recent rebound of China equities.

- USD/CNH (part of the sentiment-driven factor) has flashed exhaustion conditions after failing to break above the key 200-day moving average.

The past four days of performances seen in the China stock market and its proxies seem to be more driven by animal spirits rather than fundamentals.

Let’s discuss a bit about the current macro environment of China. Both the official NBS and Caixin (consisting of more small and medium-sized firms) Manufacturing and Services PMIs data for April have shown a decline in activities after a growth spurt in Q1 due to policy changes such as more expansionary fiscal and monetary easing measures as well as the removal of stringent Covid-19 lockdown rules.

Key sub-components data of the China NBS Manufacturing PMI are pointing to weaker implied growth for the global economy in the coming months, such as New Orders and Import components have decelerated to 48.80 to 48.90 respectively.

Today’s release of the Caixin Services PMI saw a slowdown of growth in the services sector for April after four consecutive months of increase in growth, it declined to 56.4 from March’s 28-month high of 57.8 which suggests that China’s internal consumption growth is showing signs of fatigue.

In the past two trading sessions, China-related equities shrugged off such negative fundamental factors; both the US-listed iShares China Large-Cap ETF and KraneShares CSI China Internet ETF (a proxy for China Big Tech) rose +2.7% and +1.7% respectively yesterday which outperformed the iShares MSCI All-World Index ETF that recorded a loss of -0.4%.

Signal for more potential upcoming fundraising activities for China equities

The animals’ spirits seem to have come in the form of positive feedback loops in two different asset classes. Firstly, China’s Big Tech equities are back on the radar screen triggered by future potential international fundraising activities that gained traction after Alibaba Group announced that its international online unit that consists of the major brands Lazada and AliExpress is looking for a US initial public listing next year. This IPO valuation is estimated at around US$29 to US$39 billion according to research reports from Morgan Stanley and CICC released in March respectively.

A reversal of Yuan’s weakness is supporting recent up moves in China equities

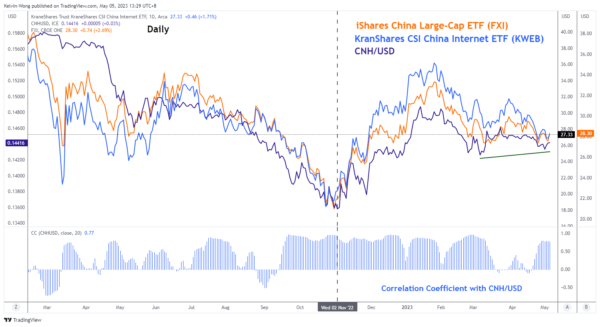

Fig 2: CNH/USD correlation with iShares China Large-Cap ETF and KraneShares CSI China Internet ETF as of 4 May 2023

(Source: TradingView, click to enlarge chart)

Secondly, the movement of China equities has moved in tandem with the offshore yuan (CNH) since early November 2022. The strengthening of the CNH against the US dollar as depicted by the foreign exchange rate of CNH/USD has led to an up move in both the iShares China Large-Cap ETF and KraneShares CSI China Internet ETF and vice versus when the CNH/USD staged a decline.

The past three sessions of movement seen in the CNH/USD have a high direct 20-day rolling correlation coefficient of around 0.80 with the KraneShares CSI China Internet ETF which implies that CNH/USD is a significant factor that may impact the future movements of China equities and its proxies at least in the near-term.

The sentiment of the US dollar has soured in recent weeks due to an increase in the expectations of a pause in the current Fed’s interest rate hiking cycle and the possibility of the US Congress that fails to extend the debt limit ceiling in a potential fast-approaching June deadline due to partisan squabbles.

Hence, a further strengthening of the CNH against the US dollar may add further impetus for animal spirits to push up the share prices of China equities and its proxies.

USD/CNH Technical Analysis – Bulls are capped below the 200-day moving average

Fig 2: USD/CNH trend as of 5 May 2023 (Source: TradingView, click to enlarge chart)

The minor uptrend of the USD/CNH (offshore yuan) from its 14 April 2023 low to its recent high of 6.9646 printed on 2 May 2023 has shown signs of bullish exhaustion after it failed to break above the key 200-day moving average decisively.

In addition, the 4-hour RSI oscillator has flashed a prior bearish divergence signal at its overbought region and broke below corresponding support at the 50% level thereafter which indicates that short-term downside momentum remains intact.

The intermediate support to watch will be at 6.8750 (the ascending trendline in place since the 16 January 2023 medium-term swing low) and failure to hold at this level exposes the USD/CNH to the next support at 6.8170.

On the other hand, a clearance with a 4-hour close above 6.9640 key medium-term pivotal resistance negates the bearish tone for the next resistance coming in at 7.0415.