Summary

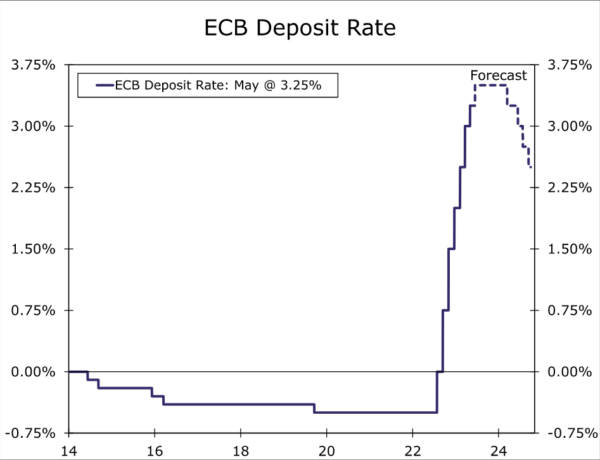

- The European Central Bank (ECB) offered its latest monetary policy assessment today, delivering a smaller rate increase than at previous meetings. In a widely expected move, the ECB raised its Deposit Rate by 25 bps to 3.25%. Meanwhile, the economic message was little changed, in that the ECB said the “inflation outlook continues to be too high for too long.”

- Today’s ECB announcement does not meaningfully alter our outlook for Eurozone monetary policy. We think the ECB will deliver at least one more 25 bps rate hike in June, which would take the Deposit rate to 3.50%. If core inflation does not slow meaningfully in the months ahead, then further tightening beyond that remains a distinct possibility. The risks around our peak policy rate forecast of 3.50% remain tilted to the upside.

European Central Bank Slows The Pace Of Monetary Tightening

The European Central Bank (ECB) offered its latest monetary policy assessment today, delivering a smaller rate increase than at previous meetings. In a widely expected move, the ECB raised its Deposit Rate by 25 bps to 3.25%. Meanwhile, the economic message was little changed, in that the ECB said the “inflation outlook continues to be too high for too long.” The ECB said headline inflation has declined over recent months, but underlying price pressures remain strong.

With regard to balance sheet reduction, the ECB’s action was also broadly as expected. The ECB said its Asset Purchase Programme portfolio is declining at €15 billion per month on average, and will continue to do so through until June 2023. The ECB said it expects to discontinue reinvestments under the APP as of July 2023. Given that APP redemptions are projected to average €23.3 billion in Q3-2023, €26.2 billion in Q4-2023, and €30.1 billion in Q1-2024, that represents a modest ramping up in the pace of balance sheet reduction. While the ECB’s key interest rates and its balance sheet management are distinct elements of its monetary policy toolkit, the fact the ECB is quickening its balance sheet reduction doesn’t sound to us like a central bank that has imminently reached the end of its rate hike cycle. Indeed, in the post meeting press conference ECB President Lagarde said it’s “very clear that we are not pausing and that we know we have more ground to cover.”

Finally, we also note a modest change in language that arguably gave today’s announcement a modestly dovish tinge, perhaps in part explaining the decline in the euro and fall in Eurozone government bond yields immediately following the announcement. The ECB said “past rate increases are being transmitted forcefully to euro area financing and monetary conditions.” The use of the word “forceful” is new, and perhaps a reference to the bank lending survey earlier this week that showed tight lending standards and soft loan demand.

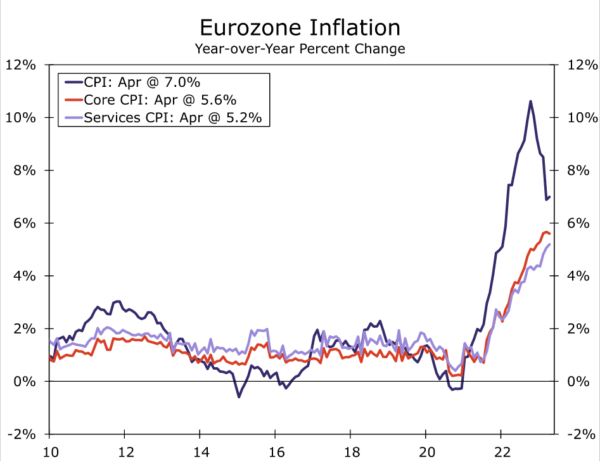

That said, today’s ECB announcement does not meaningfully alter our outlook for Eurozone monetary policy. Even given some signs of tighter credit conditions and softer loan growth, we believe it will be inflation trends, and in particular underlying inflation trends, that will be most critical to the ECB’s future policy actions. In that context, the Eurozone April CPI released earlier this week was something of a mixed bag. The headline CPI unexpectedly ticked higher to 7.0% year-over-year, and while the core CPI eased to 5.6%, services inflation actually quickened a touch to 5.2%. We think that this pace of inflation will be enough for the ECB to deliver at least one more 25 bps rate hike in June, which would take the Deposit rate to 3.50%. If core inflation does not slow meaningfully in the months ahead, then further tightening beyond that remains a distinct possibility. The risks around our peak policy rate forecast of 3.50% remain tilted to the upside.