Fed Preview: One More Hike – Cuts Still Far Away

- We expect the Fed to deliver a final 25bp hike next week and then maintain the Fed Funds rate at 5.00-5.25% for the remainder of the year.

- Powell is unlikely to close the door for further hikes, but even with nominal rates on hold, we expect the monetary policy stance to continue tightening towards H2.

- We see modest upside risks to short-term yields, i.e. out to 6M, but with no updated projections, markets’ focus will remain on macro data.

We expect the Fed to deliver a final hike of the tightening cycle bringing the Fed Funds Rate to 5.00-5.25%. With no updated projections and markets already pricing in around 20bp ahead of the meeting, the main emphasis will be on Powell’s verbal guidance.

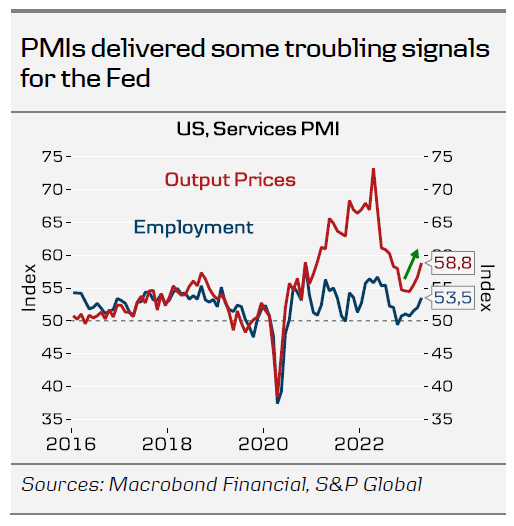

We doubt Powell will fully close the door for further hikes in the summer, and see some room for the markets to speculate with higher rates. The Flash PMIs suggested that banking sector turmoil’s immediate negative consequences for the broader economy have been limited, yet December Fed Funds pricing remains 110bp below early March peak.

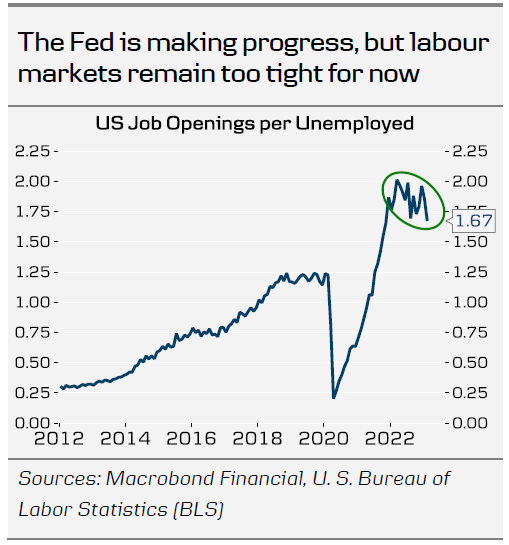

We still think maintaining rates at modestly restrictive levels for longer strikes the best balance between avoiding a hard landing and ensuring inflation comes down for good. As service sector inflation remains too fast, we see little room for easier policy anytime soon. Minutes from the February meeting showed that FOMC participants are well aware of the risk of allowing financial conditions to ease prematurely. In the March SEPs, 7 out of 18 preferred hiking rates above 5.00-5.25% even amid the high uncertainty at the time.

Even if the Fed ends the hiking cycle next week, we expect it to tighten monetary policy further rest of the year. The market discounts around 60-65bp of rate cuts before the end of the year. Hence, the inverted curve allows the Fed to tighten monetary policy passively by keeping the Fed Funds rate unchanged. In addition, short-term consumer inflation expectations have been on a downwards trend. A further drop in inflation expectations will push real interest rates higher and deliver further passive monetary tightening. Finally, we look for the Fed to continue quantitative tightening even if the hiking cycle ends.

In the press conference, Powell will likely be asked about the debt ceiling, but we think he will simply reiterate that it is the congress’ duty to ensure US avoids a default. A failure to do so could lead to a sharp tightening in financial conditions, which would naturally warrant a reaction from the Fed, but hinting about potential support would create moral hazard.

For markets, we do not expect the meeting to be a game changer, as the pricing for the summer meetings is well in line with our view, and as the renewed uncertainty around First Republic Bank this week reminded that visibility much beyond remains low.

Rather, we will pay close attention to ISM, JOLTs and the Jobs Report, where we expect NFP to settle at a moderating, yet still upbeat +200k on the back of recovering labour supply and rising PMI employment indices. We generally see some upside risks to short USD rates, and forecast lower EUR/USD towards the latter half of the year, but next week the ECB meeting will likely be relatively more important for the latter.