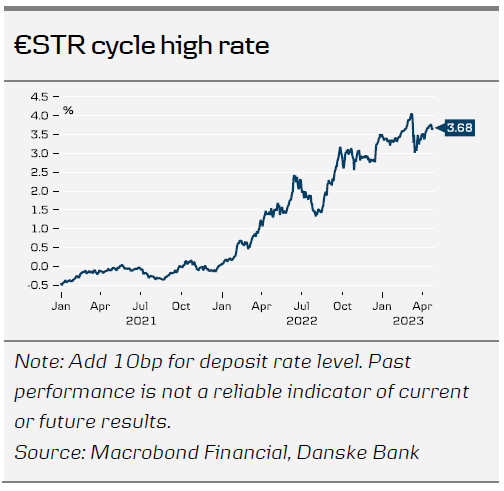

Next week, the ECB will meet to deliver another rate hike in its hiking cycle that started in July last year. This time, the question is whether it will slow the hiking pace to 25bp or continue to hike once more by 50bp. We believe it will be a 50bp compromise deal with no specific forward guidance (nor guidance on balance sheet normalisation in H2 yet), but repeating a data-dependent approach to future policy decisions.

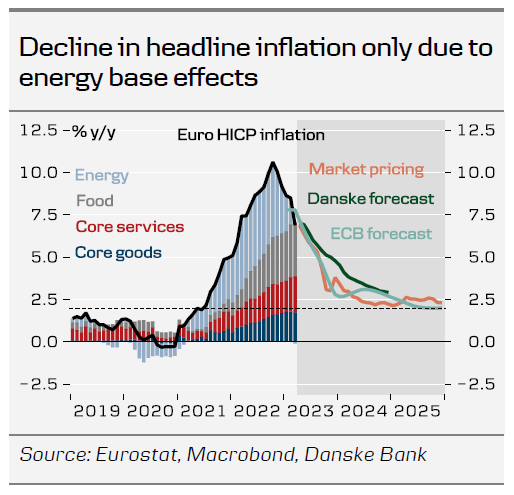

Economic developments since the ECB meeting, coinciding with the banking turmoil, have shown resilient economic activity and another record-high core inflation print. Headline inflation has declined on the back of base effects, but the stickiness of core inflation and wages should pave the way for another 50bp rate hike, in our view.

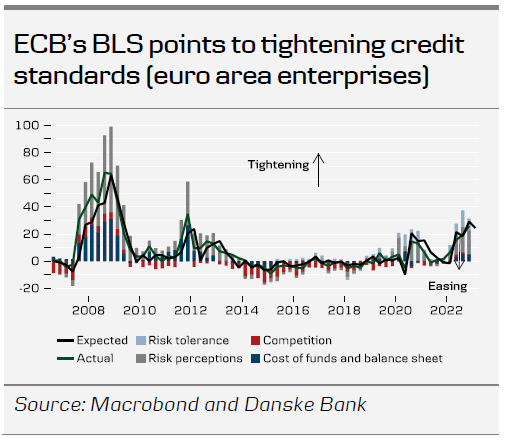

On Tuesday 2 May, the ECB and Eurostat will publish the last and important data releases ahead of the meeting. The Bank Lending Survey (BLS) and loan growth data will likely deteriorate compared with previous releases, while inflation is set to bring another high print (core around 5.7%). A significant surprise in any of the releases could change the market pricing and hence probabilities of a 25bp or 50bp rate hike outcome.

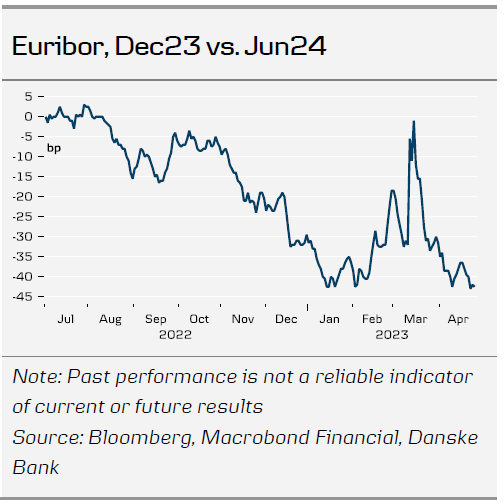

Refraining from delivering a 50bp rate hike at this meeting is set to result in a dovish market reaction, with easing financial conditions to follow. We recommend to receiving the Dec-23 euribors and pay the Jun-24 euribors at -42bp with a target of -20.

Strong services economy keeps ECB’s inflation concerns alive

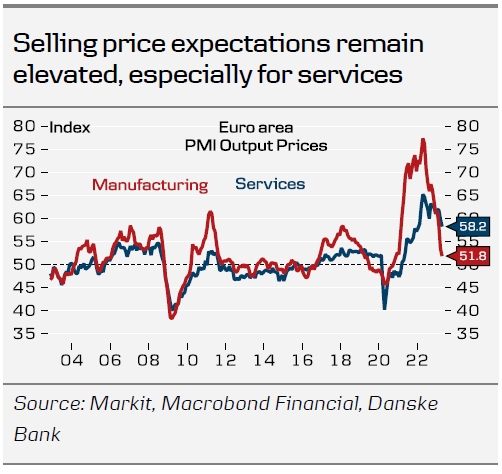

Despite banking sector jitters and the ECB’s ongoing tightening efforts, the euro area economy has continued to show remarkable resilience since the March meeting. Business surveys suggest the economy picked up momentum at the start of Q2, with the services sector in particular (accounting for 73% of GDP) driving the ongoing improvement. The labour market remains tight and firms’ hiring activity continues to increase, especially amid services providers, where jobs growth picked up to the fastest rate since July 2007. This is pressuring wages, as demonstrated by the latest collective wage agreement for German public sector employees, which expects wage growth of 11.5% over the next two years. The decline in headline inflation in recent months remains almost entirely due to energy base effects, while core and food prices have continued their uptrend. With this dynamic, the ECB can hardly declare ‘mission accomplished’ on inflation in our view. With easing input cost inflation, consumer goods inflation showed signs of peaking in March. But the same cannot be said for services inflation, where rising wage costs play a greater role, taking over as the prime core inflation driver. Selling price expectations and most underlying inflation measures point to a peak in core inflation in the next 1-2 months, but they also suggest ‘sticky’ core inflation will remain a concern for the ECB for some time, setting the scene for further rate hikes. We still expect the ECB’s monetary tightening to take its toll on the economic outlook (see Nordic Outlook – Unchartered territory, 4 April), but in contrast to markets, our forecasts show core inflation still above the ECB’s target by the end of 2024, with the green transition and higher than expected wage growth still presenting upside risks.

2 May releases and banking turmoil

The March monetary policy meeting took place at the height of the banking turmoil last month. A key discussion point at the May meeting will therefore be how much tightening of financial conditions the banking turmoil in itself has triggered. On Tuesday 2 May, the ECB and Eurostat will publish the last and important release ahead of the meeting. The upcoming Bank Lending Survey has received significant attention by the GC members in recent communication, as they want to see the results before making up their mind on the size of the rate hike. We take it as given that the BLS will point to tightening credit standards, as the ECB is already in a tightening cycle, which means that we see the focus of this BLS to be on what additional tightening the recent turmoil has added. On 2 May we also get the loan growth data for March, which we also view as important for the decision, as the ECB mulls the transmission of monetary policy to the real economy. A significant surprise in any of the releases could change the market pricing and hence probabilities of a 25bp or 50bp rate hike outcome. If the BLS and the risk perception aspect as well as the loan growth developments to March deteriorate substantially, we see markets pricing out the probability of a 50bp rate hike, while a rise in underlying inflation would lead to an upward revision of the rate hike size, beyond 40bp.

A ‘dovish’ 50bp or ‘dovish’ 25bp hike

There should be little doubt that any ECB decision at the coming meetings will be a compromise. At the March meeting a ‘very large majority’ supported the 50bp rate hike and comments since then from GC members such as Stournaras, Panetta, and Visco call for a more cautious approach to monetary policy tightening. While only the most hawkish GC member Holzmann has voiced clear support for 50bp, the members of the ‘hawkish camp’ have said that a 50bp rate hike should be considered. In light of the incoming data, we see that option to gain the most support. However, that also means that any decision taken at the upcoming meetings will not be unanimous, which we also discussed in COTW: Unanimity is utopia, 21 April. This divergence of views will likely keep realised volatility in markets high in the short-term.

If President Lagarde wants to send a hawkish signal, we believe a 50bp rate hike is a prerequisite, but that alone is not sufficient as markets are forward looking by nature. That means that she also needs to back it up with hawkish arguments on the labour market, wage growth, and the stickiness of underlying inflation. But even in that case, we see a risk of markets reacting with lower yields, as this will likely be the final 50bp rate hike from the ECB. A 50bp rate hike would implicitly also be a signal for a July hike in our reading. Hence, the risk for lower medium-to long-term rates, irrespective of the hiking, is prominent, in a bearish flattening move of the curves. If the ECB chooses to go for a 25bp rate hike, we also see the risk for a dovish market interpretation with a bullish steepening, given that the ECB has refrained from giving guidance for the coming meetings, and thereby letting the prevailing market narrative of lower rates / central bank pivot continue. With a 25bp rate hike, we find it difficult for Lagarde to communicate a rate hike beyond June, which could take around 15bp out of the peak policy rate pricing, and in this case we see further lowering on the real rates and as such easing of the monetary policy stance.

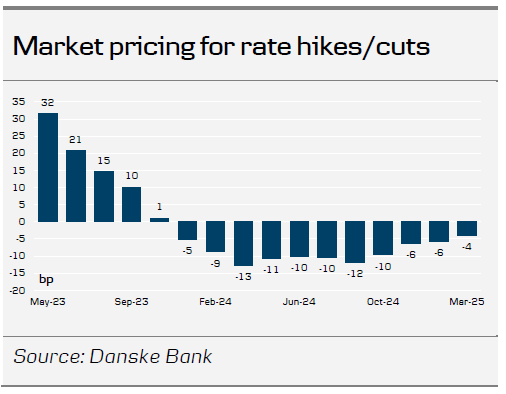

70% probability of 25bp and 30% probability for 50bp

Markets are currently pricing 32bp for next week’s meeting, well below our baseline expectation of a 50bp rate hike. Looking beyond the most imminent meetings with 21bp for June and 15bp for July, the peak policy rate is priced to be 3.78% after summer, which we find to be on the low side. At the same time, markets are pricing a sharp rate cut process to commence next year, where markets are pricing 82bp altogether, and more than half of that already in H1 24. We like to pay that segment (for less rate cuts), and therefore recommend to receiving the Dec-23 euribors and pay the Jun-24 euribors at -42bp with a target of -20 and a stop loss of -52bp. We remain open for further rate cuts to come in September.

No discussion of future decisions

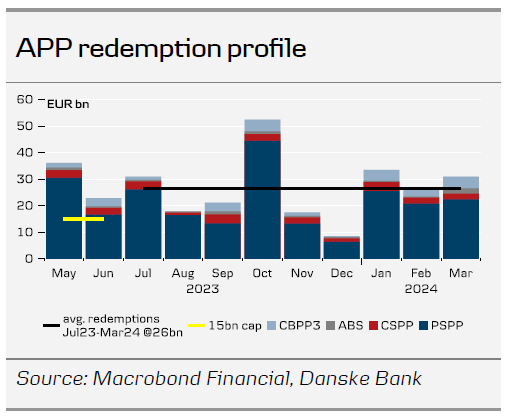

At the March meeting, the ECB refrained from giving explicit guidance for the May policy meeting, but outlined the reaction function that consists of 1) its assessment of the inflation outlook in light of the incoming economic and financial data; 2) the dynamics of underlying inflation; and 3) the strength of monetary policy transmission. We do not expect firm guidance for June to be delivered next week. That also means no guidance for the APP bond holding normalisation at this meeting, but a discussion and a decision to be announced at the June meeting. At that meeting, we expect a full end to APP reinvestments starting 1 July until the first rate cut from the ECB (which we pencil in for summer 2024). This amounts to an increase from on average EUR15bn to EUR26bn/month. Earlier this month, sources reported that a growing consensus in the GC was for a full end to APP reinvestments. Note that the PEPP reinvestments in full are still expected at least until December 2024– in line with current guidance.

FX reaction will likely be EUR positive in case of a 50bp rate hike

A 50bp rate hike will likely contribute to a broad EUR appreciation on impact, although it depends on the sequential growth outlook priced by markets.

The EUR/USD has been on an upward trajectory over the past two months supported by general growth optimism in the euro area, likely fuelled by the reopening in China, implying significant outperformance in euro area risk assets. Furthermore, lower energy prices and narrowing of rates spread between the US and the euro area have likely also been a tailwind for the cross, especially the latter.

Overall, we still have a bearish stance on the EUR/USD in the medium- to long-term, as rate hiking cycles generally are approaching an end, we think focus will increasingly turn from relative rates differentials to relative growth differentials. We are particularly sceptical about the longevity of the euro area optimism, although we acknowledge that there is a possibility of it continuing in the short-term, adding to tactical topside risk in EUR/USD in conjunction with further narrowing of relative rates spread on the back of the ECB meeting. That said, we still expect the EUR/USD to head lower based on relative terms of trade, real rates, and relative unit labour costs. The Fed meeting on 3 May – the day before the ECB meeting – is also worth having in mind, where our expectation of a 25bp rate hike is almost fully priced by markets. We forecast the cross to remain range bound in the next 1-3M, but expect it to decline to 1.06 and 1.03 on a 6-12M horizon.