- We do not expect any changes to monetary policy on the new Governor Ueda’s first monetary policy meeting on 28 April.

- Inflationary pressures seem persistent, especially fuelled by stronger-thanexpected wage growth, which could pave the way for the BoJ to at least tweak the Yield Curve Control (YCC) on either the June or the July meeting.

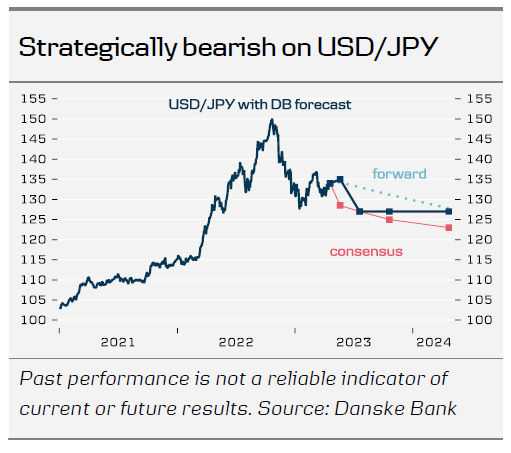

- We remain bearish on USD/JPY on a strategic horizon and expect the cross towards 127 in 3M.

Calling the timing of BoJ backtracking from its YCC is a difficult task. If the BoJ starts guiding the market by indicating a steeper JGB-curve, investors will immediately dump their bond holdings, and BoJ will be forced to throw in the towel. Thus, we should not expect any clues from the BoJ and we do not read too much into Governor Ueda’s message to maintain monetary stimulus.

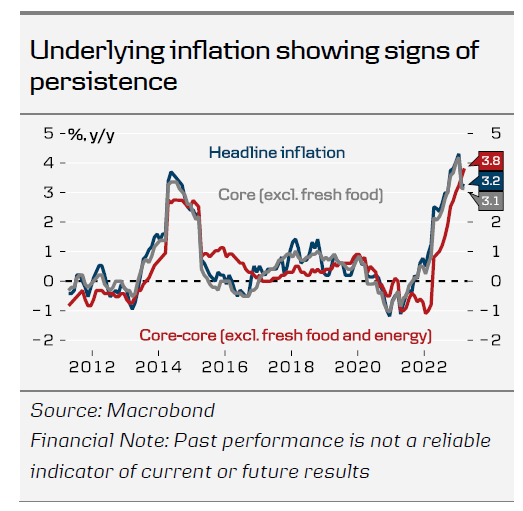

Recent CPI prints show more broad-based price pressures in Japan. Even though headline inflation fell slightly to 3.2% y/y in March, down from 3.3% in February, the core-core measure, which excludes fresh food and energy and more interesting for the BoJ, increased to 3.8% y/y in March, up from 3.5% in February, suggesting underlying price pressures are increasingly becoming more persistent. Latest figures for wage growth indicate increases well above consensus for the fiscal year of 2023. Currently the figures suggest 3.5% y/y broad nominal wage hikes, which is substantially above consensus and above the 3.0% the BoJ states is needed to obtain 2% inflation sustainably.

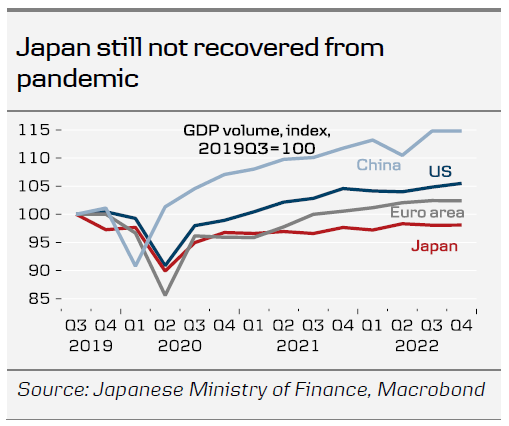

When discussing BoJ entering tightening mode, it is also important to remember that Japan, as opposed to the other big global economies, actually still has not recovered from the pandemic. Although improving, domestic private demand remains subdued due to VAThike, COVID-related lockdowns and higher inflation. Following decades with deflation, it remains a significant risk that tightening too soon sends the economy back in to deflation or low-inflation mode, before a sustainable price-wage dynamic is achieved. We think the BoJ will wait for confirmation of broad wage increases before it tightens policy. It is a fine balancing act, though, and we believe the BoJ will ultimately see the current situation as a good opportunity to finally loosen the grip on the yield curve and back away from a policy, which is highly distorting markets. However, we also know, there is no consensus on the policy board on the urgency to back off YCC.

We expect a cautious approach from the BoJ and see it slowly widening the tolerance band around the 0% 10-year JGB yield target at either the June or the July meeting. We think tweaks are more likely than an outright abandonment of the YCC – it could e.g. be by widening the YCC band from +/- 50bp to +/- 100bp.

We remain strategically bearish on USD/JPY; although we acknowledge there could be topside risk to the cross in the near-term on a relatively hawkish Fed and dovish BoJ. On the strategic horizon, our models suggest the cross is fundamentally overvalued, and together with monetary tightening from the BoJ, we forecast the cross lower at 127 in 3M.