Summary

- Canada’s economy has made a solid start to 2023, with sturdy employment gains over the last six months and monthly GDP figures pointing to respectable growth in the first quarter. However, the cumulative effects of past monetary tightening and lower energy prices should, together, weigh on consumer and business activity going forward. We forecast 1.0% GDP growth in 2023, down from 3.4% in 2022.

- A slowing in Canadian inflation is a silver lining, with a drop in energy prices driving headline inflation lower and core inflation trends also showing a perceptible slowing. That said, the underlying pace of inflation of around 3.25%-3.50% during the past three months is likely still uncomfortably high for central bank policymakers. That discomfort was reflected in the Bank of Canada’s April monetary policy announcement. The BoC held its policy rate at 4.50%, but repeated that it was prepared to raise rates further if needed.

- Our base case is for no further rate hikes and, as growth and inflation slows, for rate cuts to begin in Q4-2023 with a cumulative 50 bps of easing. That easing in policy should also see the Canadian dollar underperform, remaining broadly steady against a soft U.S. dollar. The most significant risk to our outlook is that core inflation fails to slow below a 3% pace. In that scenario, rate cuts could get pushed back to 2024, and the Canadian dollar would likely be stronger than we currently forecast.

A Solid Start to 2023, But Slower Growth Still Ahead

We have, for some time, been anticipating a slowdown in Canada’s economy in 2023, given an accumulation of headwinds through late last year. While we still believe that slowdown will be forthcoming, the economy has proved surprisingly resilient at the beginning of 2023. To be clear, we don’t think the Canada’s economy has been suprising or strong enough to prompt further Bank of Canada (BoC) rate hikes. However, depending on how quickly (or not) any growth slowdown transpires, it is possible that BoC easing begins later than our current forecast for initial rate cuts starting in Q4-2023.

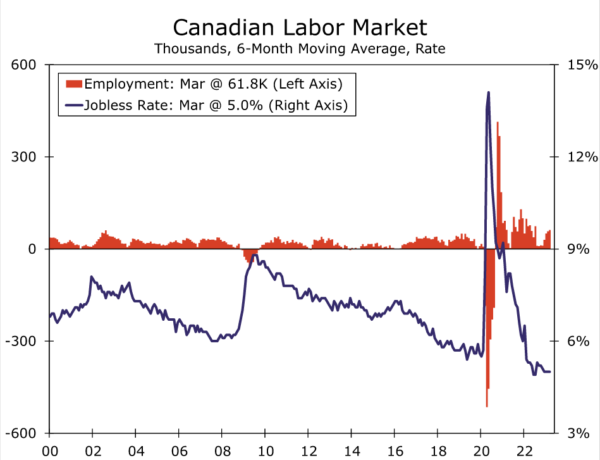

Perhaps the most notable area of strength over the past several months has been the Canadian labor market. Employment rose by 34,700 in March, reflecting an 18,800 gain in full-time jobs and a 15,900 gain in part-time jobs. The March increase comes after a run of solid job gains, such that the monthly employment increase has averaged 61,800 over the past six months. The unemployment rate remained low in March at 5.0%, although hourly wage growth for permanent employees did ease a little to 5.2% year-over-year.

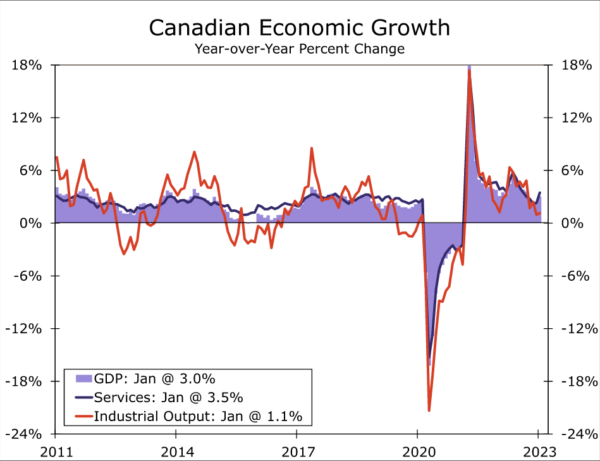

It is not just the labor market that has shown solid trends in early 2023. Canada’s January GDP also rose 0.5% month-over-month, a bit more than the consensus forecast, as both services activity (+0.6%) and industrial output (+0.4%) rose. In that same release, Statistics Canada said its advance estimate is for GDP to rise another 0.3% in February. If realized, that would leave Canadian GDP for the January-February period up 0.7% over its Q4 average and, as a result, we have lifted our GDP growth forecast for the first quarter as a whole.

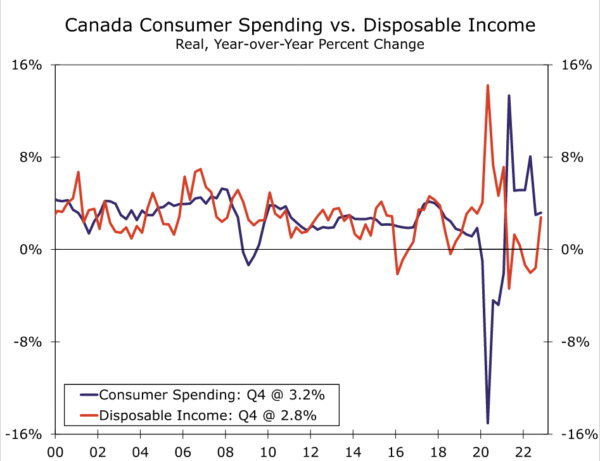

Finally, there was also some favorable news with respect to consumer fundamentals from the Q4 GDP report, as household disposable income rose 3.0% quarter-over-quarter and the household saving rate rose to 6.0% from 5.0% in Q3. To be sure, the gain in disposable income was due in part to one-off factors, including a Goods and Services Tax credit top-up and an increase in Old Age Security payments. That said, even allowing for inflation, real disposable income growth turned positive in Q4-2022 with a gain of 2.8% year-over-year, likely contributing to some resilience seen in the economy early this year.

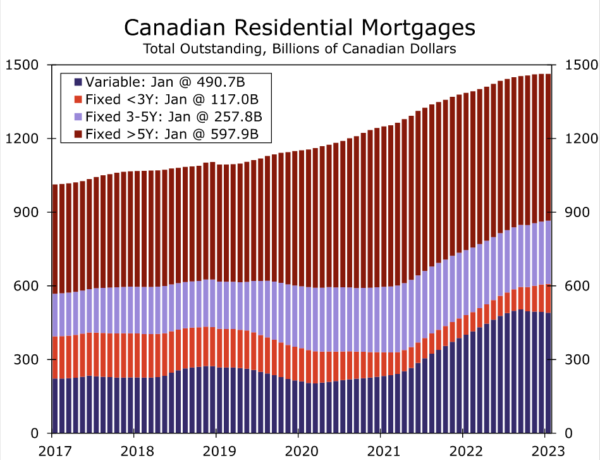

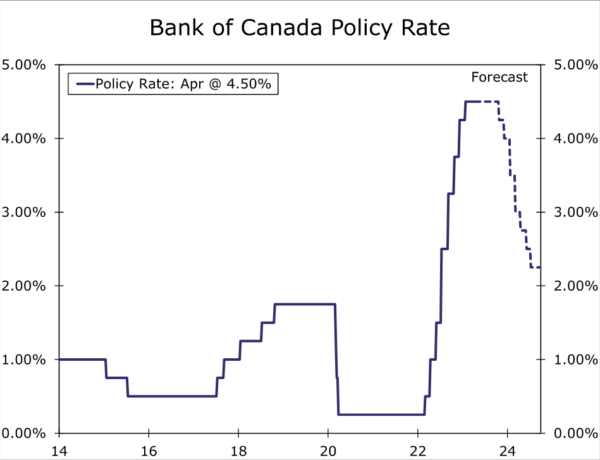

However, while Canada’s economic resilience in early 2023 has been—for us—a pleasant surprise, we still believe a slowdown is approaching. We see several factors as likely to weigh on activity as the year progresses, though chief among these are cumulative rate hikes and monetary tightening from the Bank of Canada. Since the start of 2022, when the Bank of Canada’s policy rate was just 0.25%, the Bank of Canada has hiked rates by 425 bps, reaching 4.50% by the time of the January 2023 meeting, a level it has remained at since. The impact of these interest rate increases have yet to be fully felt, although they are still working their way through (and relatively quickly we think) the economy. Variable rate mortgages became very popular in Canada during the pandemic, a period when policy interest rates were at record lows. Thus, even given some waning in demand recently, variable rate mortgages remain a sizable portion of housing loans and were still some 33.5% of outstanding residential mortgages as of January 2023.

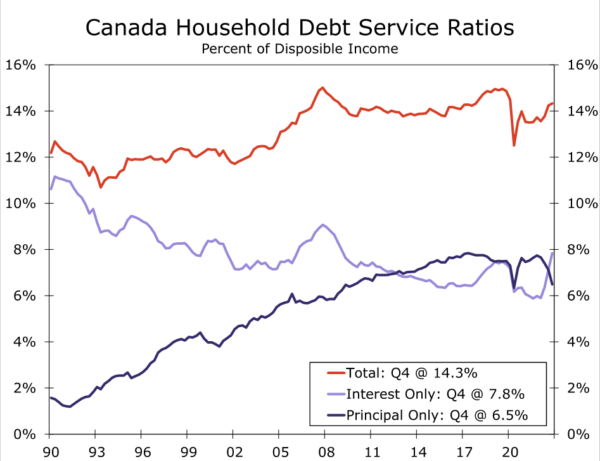

This sizable proportion of variable rate mortgages means interest costs for Canadian households have also risen relatively quickly. Interest costs rose to 7.8% of disposable income by Q4-2022 from just 5.9% at the beginning of last year, meaning that even with some offsetting decline in principal payments, the total debt service ratio for Canadian households has risen to 14.3% of disposable income.

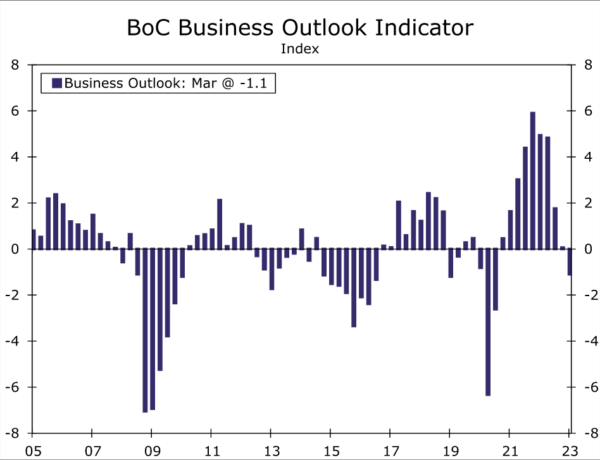

It is not just Canadian households that face a more challenging outlook. In the BoC’s Q1 Business Outlook Survey, firms indicated for the fifth quarter in a row that they expected a decline in future sales. On the energy front, oil and natural gas prices are both well below their 2022 peaks, also diminishing the business outlook to some extent. In terms of investment spending, business fixed investment fell 1.4% quarter-over-quarter in Q4, which was the third straight quarterly decline. Against the backdrop of Canada’s mixed economic outlook, the BoC’s Q1 Business Outlook Indicator fell to -1.1, the first time that indicator has dropped into negative territory since Q3-2020 during the height of the pandemic. Overall, although the relatively solid signals for Q1 economic activity recently prompted us to lift our 2023 full year GDP forecast for Canada to 1.0%, that would still be much slower than the 3.4% GDP growth seen in 2022.

Slowing Canadian Inflation is a Silver Lining

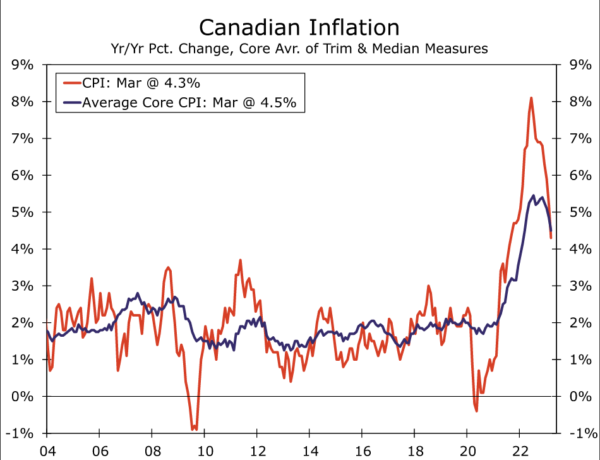

In addition to an approaching slowdown in economic growth, the other key trend within the Canadian economy that has already been evident for some months is receding inflation. The latest news on the price front came earlier this week as the March CPI slowed to 4.3% year-over-year, down from a peak of 8.1% in June last year. Lower energy prices have been an important driver of slower inflation trends. Perhaps even more significant than slower headline inflation is a perceptible slowing in underlying inflation trends, as reflected in the Bank of Canada’s core inflation measures. The March trimmed mean CPI slowed to 4.4% and the weighted median CPI slowed to 4.6%, while on a three-month annualized basis those core inflation measures are running at around a 3.25%-3.50% pace. Overall, there is both good and bad news in the recent inflation figures, in that the slowing trend is clearly encouraging, but inflation is still high enough to be uncomfortable for central bank policymakers.

That discomfort was reflected in the Bank of Canada’s April monetary policy announcement at which it held its policy rate steady at 4.50%. The BoC said it “continues to assess whether monetary policy is sufficiently restrictive to relieve price pressures and remains prepared to raise the policy rate further if needed to return inflation to the 2% target”. With respect to the CPI outlook, the BoC said its expects inflation to fall quickly to around 3% in the middle of this year, but “getting inflation the rest of the way back to 2% could prove to be more difficult because inflation expectations are coming down slowly, service price inflation and wage growth remain elevated, and corporate pricing behaviour has yet to normalize.” In his post meeting press conference and subsequent comments, Boc Governor Macklem also said policy rate cuts this year do not look like the most likely scenario, and that it is too early for the central bank to consider rate cuts.

In terms of our outlook for Bank of Canada monetary policy, we do not forecast any further rate increases. Even though the Bank of Canada has signaled it is prepared to tighten further, we remain comfortable with our view, especially in the context of slower growth and inflation trends. Our outlook for Bank of Canada monetary policy also envisages monetary policy easing beginning in Q4-2023 with a cumulative 50 bps of rate cuts, with further easing anticipated in 2024. That easing is predicated upon, or in other words would require, the growth slowdown we forecast, as well as some further declaration in core inflation trends to below a 3% pace. Our BoC policy outlook is a more aggressive view than implied by market pricing, which currently sees only a moderate 14 bps of rate cuts by the end of this year, and also a reason we expect the Canadian dollar to be an underperfomer among to G10 currencies over the medium-term. Indeed, we forecast little change in the Canadian dollar versus a broadly soft greenback through the end of 2023 and through until mid-2024. We acknowledge that the more relevant risk to our Bank of Canada outlook would be later central bank rate cuts than we currently forecast, with BoC easing potentially not beginning until 2024. Whether such a delay occurs will largely hinge on whether underlying inflation trends remain stubbornly persistent and core inflation trends remain stubbornly above 3%. We will be monitoring Canada’s CPI outcomes even more closely than usual in the months ahead. If core inflation fails to slow meaningfully, clearly rate cuts could be delayed until next year, in which case the risk is for a stronger Canadian dollar than we currently forecast.