There are no major central bank decisions scheduled for next week, but that doesn’t mean markets will be quiet as there’s a ton of data releases that can fuel volatility. The highlight will be China’s economic growth, which will reveal exactly how powerful the reopening boost was. Meanwhile in Europe, the latest business surveys could decide whether the euro’s rally still has some miles left in the tank.

China set for growth rebound

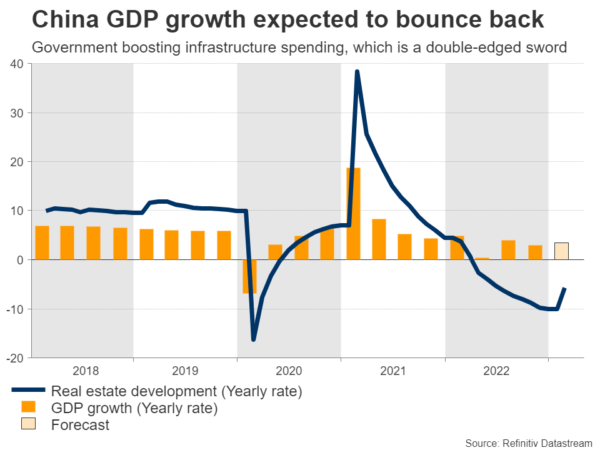

The world’s second-largest economy has been battered and bruised over the last year, grappling with a double whammy of draconian lockdowns and the meltdown in the nation’s property sector. Luckily both problems have eased in recent months, as the anti-covid measures were lifted and the real estate market has started to heal.

Next week, the ball will get rolling with China’s GDP growth numbers on Tuesday. Business surveys painted a mixed picture during the first quarter, signaling that the services sector continues to enjoy a reopening boost but manufacturing has started to lose momentum.

Accordingly, forecasts from economists suggest economic activity picked up steam in Q1. Economic growth is expected to have risen by 1.2% from the previous quarter, after a flat reading in Q4. Hence, the situation seems to be improving, but it’s questionable whether this will last once the reopening boom fades.

Overall, the outlook for China is still worrisome. The global economy is slowing and manufacturing demand has been hit particularly hard, spelling bad news for China’s manufacturing-heavy model. In addition, the real estate sector is recovering mostly because the government is boosting infrastructure spending again, which is a dangerous strategy as it can reinflate the property bubble.

In the FX market, the most sensitive currencies to Chinese data are the Australian and New Zealand dollars. While encouraging GDP numbers could provide a short-term lift to these currencies, it’s tough to be optimistic in the bigger picture, with storm clouds gathering over the global economy.

Eurozone braces for business surveys

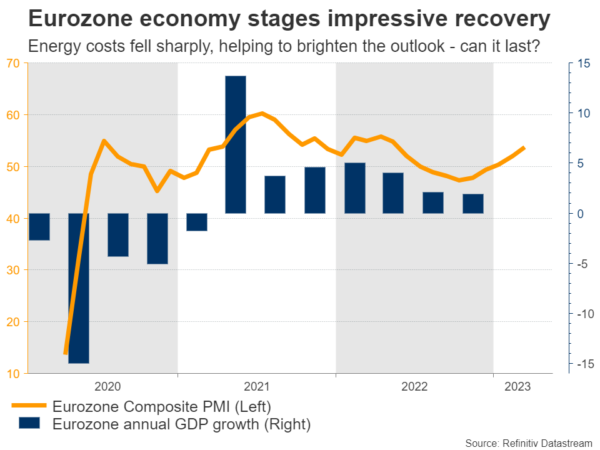

Crossing into Europe, the main event will be the latest round of PMI surveys on Friday, which will showcase what’s next for economic activity now that the energy shock has receded.

This sharp decline in energy costs helped the Eurozone economy stage an impressive recovery in recent months, with the business surveys for March signaling that recession risks have diminished for now. Traders will be searching for clues around whether this encouraging phenomenon persisted in April.

However, that’s doubtful considering the recent rally in oil prices after OPEC cut supply and the turbulence in the banking system. On top of the relentless increase in borrowing costs, business leaders might have turned less optimistic entering the second quarter.

As for the euro, it has gone on a rampage since the banking panic subsided. Behind this stunning rally was speculation that the Fed will be forced to slash rates later this year, which wounded the US dollar. In contrast, market pricing suggests the European Central Bank will keep raising rates throughout the year to deal with elevated inflation.

Therefore, the quality of the upcoming dataset will be critical in shaping these expectations and hence decide whether euro/dollar has enough juice to break above the $1.10 zone that rejected the pair back in January.

Barrage of UK data on tap

In the United Kingdom, there’s a storm of economic data coming up, starting with employment numbers on Tuesday. Then on Wednesday, inflation figures will enter the spotlight, before the week concludes with retail sales and the latest business surveys on Friday.

Similar to the Eurozone, the economic landscape in the UK has turned a little brighter lately, with business surveys rebounding and the labor market staying tight. The problem is that inflation continues to rage, having crossed back above 10% in February. Consumption is struggling too, with retail sales falling from last year as the cost of living crisis continues to haunt people.

As for sterling, it has returned back to its old habits of tracking stock markets. The one-month correlation between Cable and the S&P 500 has risen to 84%, which suggests that the main driver of the pound is the global investment mood. This explains why sterling has performed so well this year, but it also implies that any turnaround in equities could be particularly damaging.

In this sense, the risk of a selloff in stock markets seems high, as earnings have started to decline while valuations are quite expensive. Earnings will be in focus next week with Tesla, Netflix, Johnson & Johnson, TSMC, and Lockheed Martin being among the biggest names to report results.

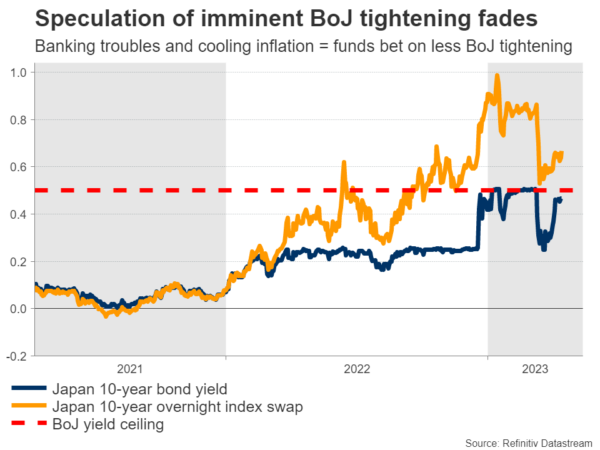

Japan, Canada and New Zealand await inflation updates

The yen came under fire lately as the Bank of Japan pushed back against speculation about further tightening. Governor Ueda essentially signaled he’s not in a rush to remove stimulus because inflation is likely to fall soon. In this sense, the latest batch of inflation stats on Friday could attract special attention.

Likewise, Canadian inflation numbers for March will be released Tuesday, ahead of retail sales for February due out on Friday. In New Zealand, the inflation report for Q1 will hit the markets Thursday.

Last but not least, it’s going to be a quiet week in the United States, although the S&P Global business surveys on Friday will provide crucial insights about the economy’s health.