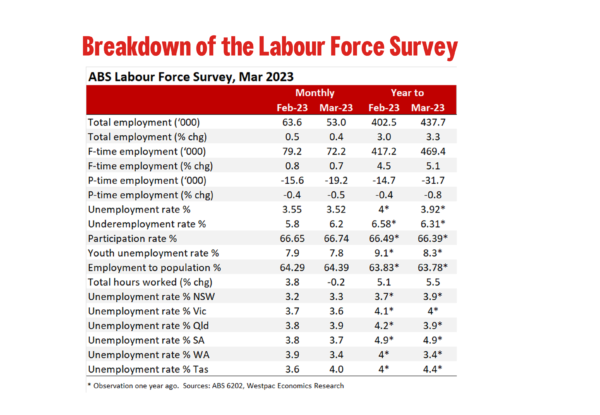

Total employment: +53.0k from +63.6k (revised from +64.6k); unemployment rate: 3.5% from 3.5% (unrevised 3.5%); participation rate: 66.7% from 66.7% (revised from 66.6%). The labour market continues to weather the headwinds facing the broader economy, remaining in robust health.

Total employment gained 53.0k or 0.4% in March following on from a 63.6k gain in February, shifting the three-month average change in employment from 13.3k/mth up to 35.4k/mth. The size of the lift in employment was also enough to lift the employment-to-population ratio to 64.4%, only 0.1ppt shy of the record high that was reached back in November 2022.

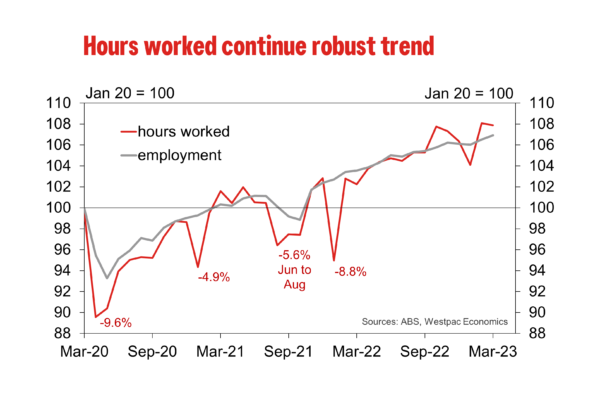

Seasonally adjusted monthly hours worked declined by 0.2% in March, but following on from the 3.8% surge in February – associated with a larger-than-usual number of people returning to work from summer holidays – the gains in hours worked still outstrip that of employment.

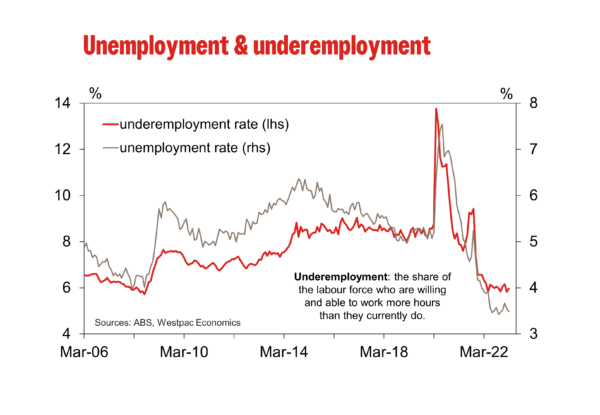

While the participation rate held flat at one decimal place (66.7%), it rose 0.9ppt at two decimal places, from 66.65% in February to 66.74% in March, just below November’s historic high of 66.8%. Underemployment – those who are employed and are willing and able to work more hours if offered to them – returned back to 6.2% in March after temporarily dipping in February.

Together, these results suggest that the supply side of the labour market – captured by the strength in labour force participation and individuals’ willingness to work more hours – will remain a supportive factor for the near-term. Indeed, the lift in participation saw the labour force grow by 51.4k, slightly lower than the gain in employment, resulting in the unemployment rate holding at 3.5%, near the cycle-low of 3.4% observed back in October 2022. At two decimal places, the unemployment rate fell by 0.03ppts from 3.55% to 3.52%.

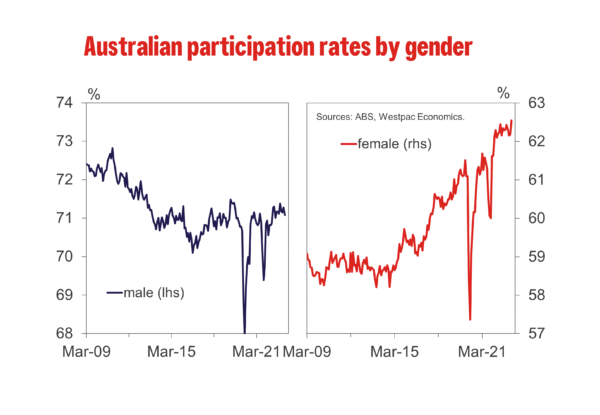

Underlying these results has been a continued outperformance by females in broader labour market outcomes. In March, female participation rose a record high of 62.5%, and with continued strength in employment gains – a lift of 56.3k for females while male employment was effectively flat at –3.3k – the female employment-to-population ratio also rose to a historical high of 60.4%.

As noted above, this reflects a strong supply-side story, with labour force growth for females (+55.6k) clearly outperforming that of males (–4.2k). Consequently, the downtrend in the female unemployment rate remains firmly entrenched, even falling to a fresh record low of 3.4%, while the male unemployment rate remains well off its cycle-low from October.

It is also interesting to note that employment lifted in all states except NSW, which reported a 0.5% decline in the month. Despite lifting 0.1ppts to 3.3%, the unemployment rate in NSW remains well below the national average. Qld also saw a lift in the unemployment rate (+0.1ppt to 3.9%), but declines were evident across Vic (3.6%), SA (3.7%) and WA (3.4%).

Overall, the March report presented a sound update on the labour market. Businesses’ appetite for new workers remains robust, in line with the growth in labour supply, but we continue to expect labour market outcomes will soften more clearly into the second half of this year.